Market In Focus: Filmart Aims To Reassert Regional Hub Status Amid Mixed Box Office And Shifting Streaming Landscape In Asia

After a successful return as a physical event last year, Hong Kong International Film & TV Market (Filmart, March 11-14) is taking place again this year against a complicated backdrop, both in terms of market realities and the shifting geopolitics of the region.

Although China’s box office has come roaring back, reaching $1.1BN (RMB8BN) over the recent Lunar New Year holiday, imported films are not sharing in the bonanza and mainland Chinese companies are not participating in international markets at the level they once did.

More from Deadline

Market In Focus: HKIFF Industry, CAA China Talk Building An Ecosystem For Emerging Filmmakers

Trinity CineAsia Acquires UK Rights To Edko Films' 'The Lyricist Wannabe'

Last year, Filmart benefitted from the last-minute lifting of China’s strict Covid restrictions, and the reopening of the mainland China-Hong Kong border, and happily welcomed back mainland Chinese participants, including buyers and sales agents, to the show.

However, in the intervening year, Chinese producers have not been hugely focused on exports, and while small contingents of Chinese buyers have been travelling to international markets including Cannes, Berlin and the American Film Market (AFM) in Los Angeles, they have mostly just been window shopping or re-establishing relationships with Western sales companies.

Meanwhile, box office in other territories across the region presents a mixed picture. Japan has also registered decent post-pandemic recovery, but again most of the spoils are going to local productions, in particular big anime franchises, rather than imported films. Both Korea and Hong Kong, dynamic theatrical markets before the pandemic, are lagging in recovery, and while Southeast Asia has some bright spots, including Indonesia and Vietnam, audiences in these markets are very young and lean towards local productions.

Questions are also swirling around the buying appetite of the region’s streaming platforms. While a recent pullback in local-language production among the global giants may open windows of opportunity for acquisitions, streamers across the region are focusing on profitability over customer acquisition.

And amidst all these market woes, Hong Kong itself has not fully recovered its sparkle as a regional events hub, one year after opening its borders, as it counters negative publicity ranging from declining political freedoms to capacity issues at its major airline, Cathay Pacific, and the recent press storm around footballer Lionel Messi not playing as promised at a friendly match in the city. After several decades of positioning itself as the gateway to China, the on-going economic malaise on the mainland is also not helping to burnish Hong Kong’s image.

But ironically, all these issues and on-going uncertainties may be working to Filmart’s advantage as many US and European sales agents are making the trip just to get a clearer picture of what exactly is going on. It’s not just Chinese buyers that are travelling less – buyers from other Asian territories, even the mature markets of Korea and Japan, have also been attending international markets in much smaller numbers – and Western sellers are keen to reestablish contacts across the region.

“China is not really buying at the moment but our members, both in the US and Europe, are very curious to come to Filmart to see who’s there and what the potential is in the rest of the region,” says Jean Prewitt, President & CEO, Independent Film & Television Alliance (IFTA), which is bringing a delegation of 11 companies including AGC Studios, The Exchange, Lakeshore, Palisades Park Pictures and Voltage Pictures to the market.

“The industry remains incredibly invested in Asia and the potential of Asia, and after the pandemic, really feels the need to renew their ties with countries throughout the region. They also want to get a better sense of what the marketplace wants and needs because audience demands and demographics are possibly very different to where we left off in 2019.”

Europe will also have strong presence at the market through a pavilion jointly hosted by European Film Promotion (EFP) and Unifrance, encompassing 20 French companies, including Charades, Federation Studios, Goodfellas and Mediawan Rights, and nine sellers from other European countries. The Italian Trade Commission (ICE) is also bringing a group of nine Italian sales agencies to the market.

Several of these companies say that it’s been five years since they last attended Filmart, so they feel it’s time to return and reconnect with the region. “Our industry has undergone dramatic transformations, pressing us all to adapt and scout for niches and fresh opportunities,” says Picture Tree International Co-Managing Director Yuan Rothbauer.

“The absence of engagement with the Chinese market since Covid has been particularly felt, which also made Filmart an ideal platform to reconnect not only with the majority of Chinese buyers but also with buyers from Southeast Asian countries.”

Attendance numbers are up on last year. Candas Yeung, associate director of service promotion at Filmart organizer, Hong Kong Trade Development Council (HKTDC), says that around 750 exhibitors and 7,500 visitors have signed up for this year’s Filmart, compared to around 700 exhibitors and 7,300 visitors in 2023 (although still behind the 880 exhibitors that signed up for Filmart’s last pre-pandemic show in 2019). Among the visitors, around 40% are from mainland China, 30% from Hong Kong and 30% from the rest of the world.

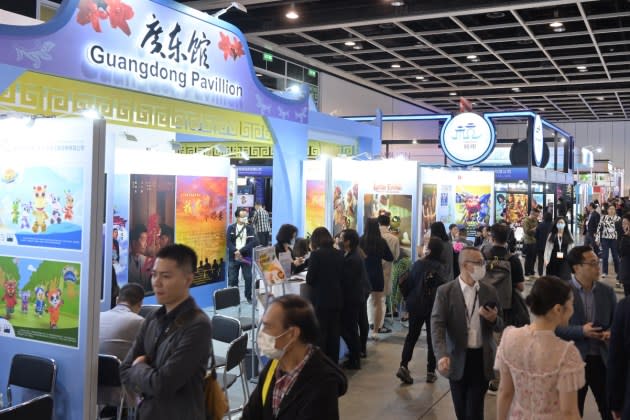

Major Hong Kong companies such as Edko Films, Emperor Motion Pictures, Media Asia, One Cool Group and Universe Entertainment will be unveiling new titles at the market (more on that soon). Chinese exhibitors will also be out in force including Alibaba, iQiyi, Tencent, CMC Pictures and Huace, along with a slew of pavilions hosting companies from Chinese provinces.

Other Asian pavilions include Korean Film Council (KOFIC) and Korea Creative Content Agency (KOCCA); Film Development Council of the Philippines (FDCP); Taiwan Creative Content Agency (TAICCA); a delegation of 26 Thai companies under an umbrella organised by Thailand’s Ministry of Culture; and a first-time presence from the buzzy Indonesian industry hosted by Indonesia’s Ministry of Tourism & Creative Economy.

Filmart’s Entertainment Pulse conference series will be attempting to answer many of the questions on attendees’ lips, with sessions on Europe-Asia co-production (following Create Hong Kong’s recent announcement of a European co-production fund); new technologies such as AI and Virtual Production; and a session on the streaming landscape with speakers including Viu’s Marianne Lee and CreAsia Studios’ Jessica Kam-Engle.

In keeping with the technology track, Filmart is working with Votion Studios to set up a Virtual Production studio on-site at the show, while Hong Kong Design Institute will announce the launch of a VP stage for training purposes located at Hong Kong’s Shaw Studios.

Filmart is also building out its online trading platform, which went live for two months in mid-February and currently features around 400 pieces of IP. “On the platform this year we will provide dedicated business referrals and connect our exhibitors with partners, investors and distribution channels,” says Yeung. “This exposure will not only attract potential buyers and investors, but also facilitate partnerships for co-production projects.”

However, what would really help Filmart regain its position as Asia’s premier film and TV market is for Chinese and other Asian buyers to attend the market in significant volumes and do some serious buying. Among Chinese buyers, it’s unclear whether it’s politics or market forces (or a combination of both) that is holding them back as China appears to have loosened its quota restrictions over the past year and has recently been experimenting with more open distribution models.

Currently, companies handling non-English-language product appear to be making more headway in the China market: “Lately we have started closing deals again to China after years of no deals,” says TrustNordisk Sales Director Nicolai Korsgaard. “The genres remain the same – action, animation and disaster movies.”

But fewer US indie movies are being distributed in China compared to what now feels like halcyon days before pandemic. IFTA’s Prewitt says: “Some independent films are going in, but people have been saying for a few years now that if you end up making a sale to China, that’s gravy, but you cannot build that into any financial model.”

If nothing else, this year’s Filmart should give sellers a clearer idea of whether that situation is ever going to change. It should also help Western companies build bridges with other markets in the region in the run-up to Cannes.

As usual, Filmart is taking place as part of Hong Kong Entertainment Expo, which is celebrating its 20th anniversary this year, and encompasses eight other events, including Hong Kong International Film Festival (March 28-April 8), HKIFF Industry Project Market (March 11-13), Asia Video Summit (March 13-14), Hong Kong Film Awards (April 14), and the Asian Film Awards (March 10), which are taking place at Hong Kong Palace Museum the night before Filmart opens and just a few hours before the Oscars.

Best of Deadline

Hollywood & Media Deaths In 2024: Photo Gallery & Obituaries

2024 Premiere Dates For New & Returning Series On Broadcast, Cable & Streaming

TV Cancellations Photo Gallery: Series Ending In 2024 & Beyond

Sign up for Deadline's Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.