Paramount Eclipses Warner Bros. Discovery With Most In-Demand Licensed Titles on Netflix

Netflix has had success with licensing content recently from other networks. Seen as a complement to its original programming and as a way to drive audience engagement with the catalog by its CEO, these shows often find a renewed appeal following the move.

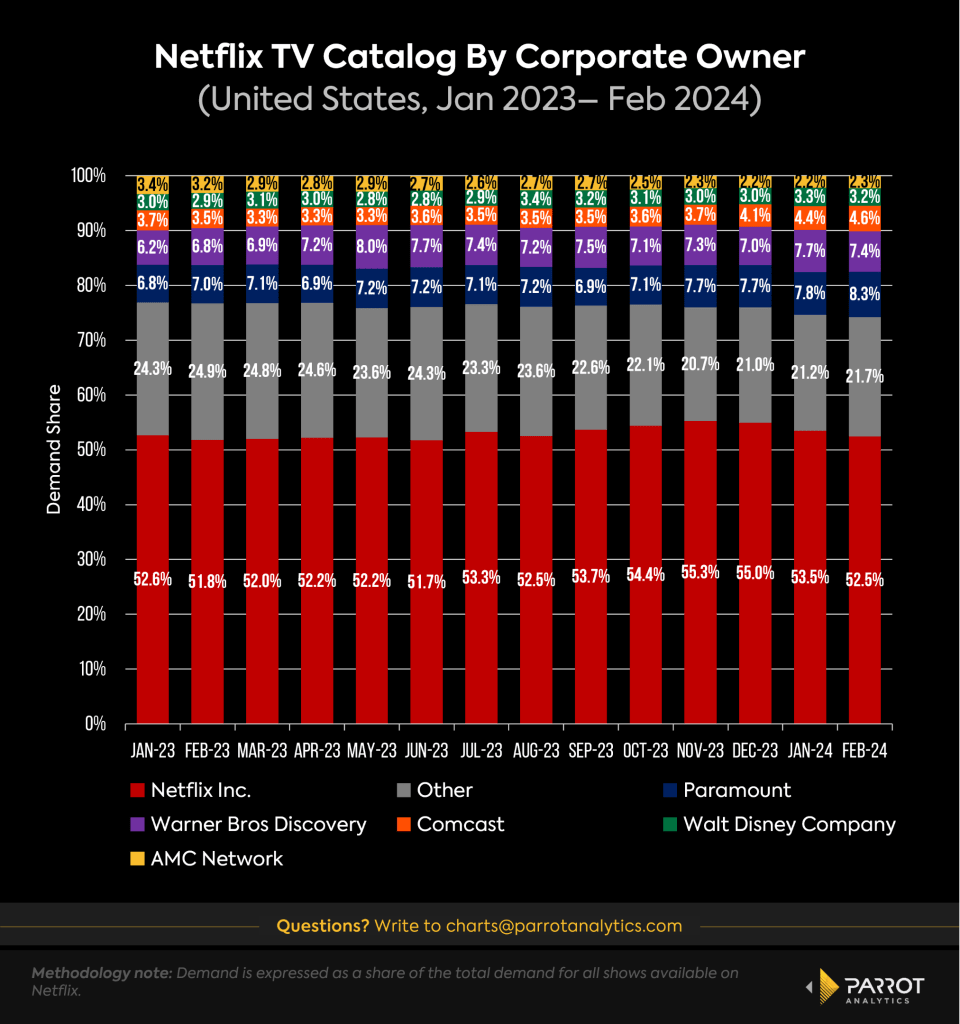

In the past year, licensed content accounted for nearly half of Netflix’s TV catalog demand. The platform’s largest supplier of licensed titles is Paramount, which generates 8.3% of its catalog demand despite being only 1.8% of the TV catalog.

This demand share has seen a marked increase since the last quarter of 2023, when Netflix licensed many shows, among them CBS’s ”Young Sheldon.” However, most of Paramount’s titles on Netflix are Nickelodeon shows. The original animated “Avatar: The Last Airbender” and “The Legend of Korra” have both seen increases in demand as interest has spilled over from the recent Netflix live-action adaptation.

Until October 2023, Warner Bros. Discovery was the primary source of licensed TV content for Netflix, when the demand share for WBD shows was higher than Paramount’s. This share was only slightly affected by the Netflix-WBD deal signed that brought several HBO shows to Netflix in the U.S. for the first time through 2023, rising to 7.5% in September, when HBO’s WWII shows “Band of Brothers” and “The Pacific” became available on Netflix.

Although the availability of HBO shows on Netflix generated considerable media attention, the majority of WBD content on Netflix comes from The CW and Cartoon Network. Available on the platform for almost a decade, “The Flash” is the most in-demand CW show on Netflix, followed by “Supernatural” and “Riverdale.” CN, on the other hand, helps Netflix to boost its kids’ catalog with shows like “Ben 10,” “Sonic Boom” and “The Powerpuff Girls.” WBD demand share is also impressive when compared to how many titles are available on the platform. WBD-owned networks are responsible for 1.7% of the number of shows available on Netflix.

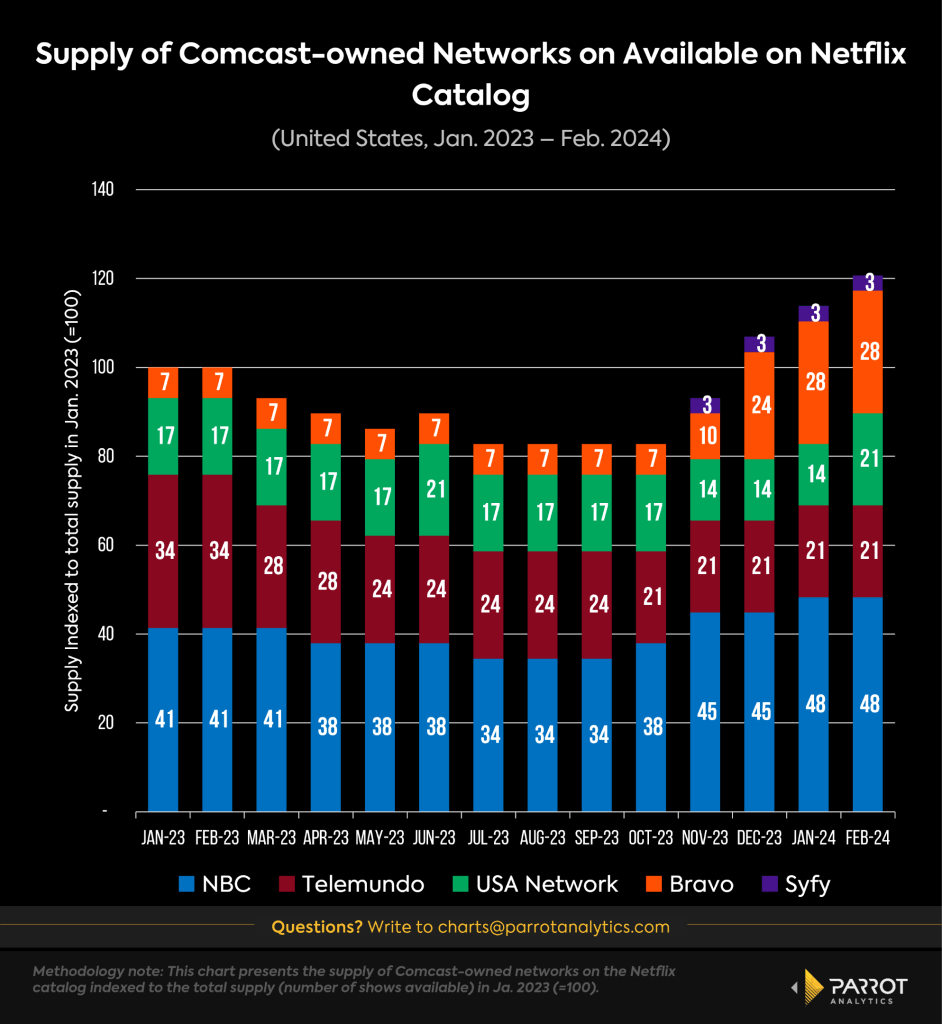

Comcast is another growing contributor, with its demand share growing from 3.5% in mid-2023 to 4.6% in February 2024. Comcast’s licensed content includes not only popular, highly-rewatchable sitcoms like “Seinfeld,” and “Community,” which are a great tool for Netflix’s subscriber retention between season releases of hit shows, but also Bravo’s reality TV.

The number of Bravo titles available in Netflix’s catalog more than doubled between November and December 2023. The new batch of licensed Bravo content includes “Top Chef” and “Project Runway,” both shows that saw an increase in demand following December. Another example of a Comcast show that found a second life on Netflix is “Suits,” which blew up on the streaming charts during the strike-related content drought in Summer 2023.

Both sides of the negotiating table can benefit from the licensing deal. The revival of interest in a show after licensing generates an effect similar to when a new season is released. With the show being made available on a platform with a wider reach, audiences that missed the show in its first run now have access to it.

Daniel Quinaud is a senior data analyst at Parrot Analytics, a WrapPRO partner. For more from Parrot Analytics, visit the Data and Analysis Hub.

The post Paramount Eclipses Warner Bros. Discovery With Most In-Demand Licensed Titles on Netflix appeared first on TheWrap.