Should S’poreans Invest in Stocks or Property?

It’s one of the age old debates: Stocks or property? Chicken or egg? Is the world round or flat? “Uh, yeah, I’m pretty sure we know it’s round by now.” Yeah, but we were also pretty sure Bardot could sing. I’m not a trusting soul, and you shouldn’t be either. If you’re going to risk that hard earned capital, you’d better know what to expect. So, will it be stocks or property?

Are you just pretending to nod and understand? Because I’ve been comparing my grocery bills for the past hour.

Investing in Stocks

Around 2007, many Singaporean stock investors turned to property because of the now-defunct DPS (deferred payment scheme). The left the inaccurate impression that property investors and stock traders are the same breed.

In truth, it’s easier to move from stocks to property than vice versa.

But as measures to prevent house flipping kicked in, many of those pseudo-property dealers have returned to paper stocks. The main advantages of stock trading are:

Less capital required

Faster growth

Diversification is easier

Higher Liquidity

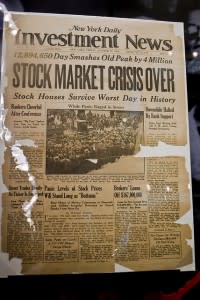

My news sources are a little old.

Less Capital Required

Stocks are easier to get into than property. Mind you, this is subjective: Compared to 10 lots of Google stock, a resale flat costs a pittance.

But you can choose to deal with lower priced stocks. Many investors start with a capital of $5000 – $10,000. You can even start with $2000, if you don’t mind standing the same chance as Frosty the Snowman during napalm testing. It’s a far cry from property investments, where even $350,000 is considered a comparatively small amount.

Stock trading also provides easy leverage. Simply put, it’s easier to borrow money for stocks than for housing.

Faster Growth

As an investment, residential property is prized for capital appreciation. In other words, investors count on the property growing in value; and that isn’t the kind of thing you time your hard boiled eggs to.

The property cycle is slow, compared to the frenzied movements of the stock market. Dealing with stocks, you can grow your money in a matter of days. If you’re lucky, you can grow it in hours. But property is a slow-and-steady investment, where you can expect to wait around five to 10 years before cashing in.

For that reason, stocks are often preferred by older investors. Don’t mean to be rude but some of them have, uh, less time.

“Wait, the market just turned. Change places.”

Diversification is Easier

Actually, you can diversify property investments easily; assuming your capital resembles the GDP of a small third world country. Most of us can afford to buy stocks in four or five different companies. But not many of us can afford multiple properties.

But let’s put capital aside: An important feature of stocks is they way they’re often “bundled”.

Exchange Traded Funds, for example, are a basket of different stocks. These are handled by a fund manager, so you don’t even need to pick the right assortment. Because the “baskets of goods” are assembled by experts, you don’t need the know-how to cherry-pick your investments.

Higher Liquidity

If things head south, you can liquidate your stock investments in minutes. It’s as simple as picking up the phone, calling your broker, and making crying sounds.

This doesn’t work with property. Once you’ve signed the loan for a house, you can’t call your bank and say: “Oh, I need money now, so is it okay if we just cancel?”

Even if you already own the property, how fast can your agent sell it? Even the best agents could take months. They need to advertise, show buyers around, and check valuations. After that, said buyers may take even longer to get their financing.

Investing in Property

“We’ve reached new limits. No I mean literally, we broke the budget limit again.”

Comparing property to stocks is like comparing a tank to a race car. It’s not as fast or glamorous, but it’s the final word in security.

Main advantages of property include:

Greater resilience to down markets

Cash-Generating Assets

Easier management

Greater Resilience to Down Markets

According to property investor Mr. Charlie Sng:

“You can see that when property prices drop, such as in April this year, the movement is very small. Less than one percent. If you check the history of property trends in Singapore, you will see that even drops of 3% – 5% are rare.

But stocks can easily fall 10% – 20% in a few days. You may make money faster in stocks, but you can lose faster also.”

Cash-Generating Assets

You can’t rent out your stocks. The only way stocks generate cash is through dividends (which are not always guaranteed), or by being sold.

With property, you can rent out rooms or apartments. In Singapore, it’s common for rental income to at least cover loan repayments. If you did your homework and picked a good location, your monthly rent can leave you with a surplus after home loan repayments.

But do note that commercial properties provide higher rental yields; residential properties are mostly kept for capital appreciation. For more on landlord issues, follow us on Facebook; we look into it periodically.

I didn’t lie what. There IS a cash generating asset in this area.

Easier Management

Stock trading is considered a high-stress investment method. Unless you have the temperament of a very bored rock, you’re more likely to end up in counselling than with a billion dollars.

Because of the rapid movements in the stock market, investors are constantly on their toes. Imagine stressing over your stock picks in the middle of the work day; can you handle that and still do good work?

Emotions aside, property requires less homework. You don’t need to start learning fundamental and technical analysis, or how to read candlesticks. A property investor can get rich without ever hearing names like Nisson and Demark.

In Conclusion…

When property is an option, it’s hard to recommend stocks instead. It’s best to try stock investments only if you understand the market and the nature of the stocks; otherwise, you’re trying to run a restaurant without knowing how to cook.

Stocks will always be a faster way to make money, but they’ll never be a layman’s game. Property offers fewer ways to go wrong; and because of the slow time frame, you’ll find it easier to think things through.

Image Credits:

kenteegardin, Aranha, epSos.de, photo_gratis,

Get more Personal Finance tips and tricks on www.MoneySmart.sg

Click to Compare Singapore Home Loans, Car Insurance and Credit Cards on our other sites.

More From MoneySmart