Singapore Budget 2018: GST to rise to 9 per cent sometime in 2021-2025

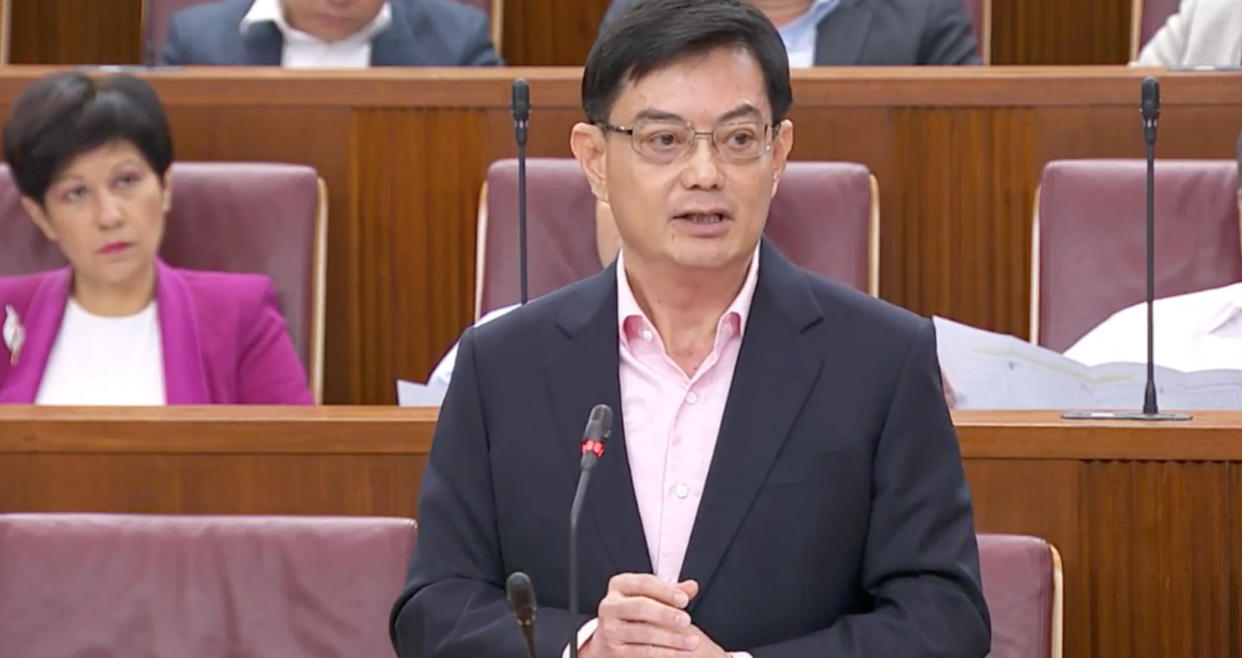

The Goods and Services Tax (GST) will be raised to 9 per cent from 7 per cent sometime from 2021 to 2025, Finance Minister Heng Swee Keat announced on Monday (19 February).

The exact timing of the GST increase will depend on Singapore’s economy, expenditure growth and existing taxes, Heng said in his Budget 2018 speech in Parliament. The planned increase in the GST will be the first since 2007.

Heng said that the GST revision takes into account Singapore’s long-term needs as spending increases in all sectors, such as in healthcare, infrastructure and security.

“As the government has stated before, we have ensured that we have sufficient resources to meet our spending needs till 2020. This is a result of careful and prudent planning. But in the next decade, between 2021 and 2030, if we do not take measures early, we will not have enough revenues to meet our growing needs. We expect our spending needs to continue growing across all sectors, with some rising faster and more than others,” Heng said.

With an aging population, healthcare spending in areas ranging from hospitals to subsidies is forecast to surge over the next decade, having already increased from $3.9 billion in financial year 2011 to $10.2 billion in financial year 2018. Healthcare spending is expected to rise from 2.2 per cent of gross domestic product to almost 3 per cent over the next decade, overtaking spending on education.

In addition, the government has to commit to “massive investments” to enhance Singapore’s infrastructure, Heng said. These include boosting the railway network, redeveloping parts of Singapore such as in Jurong and Woodlands, and building new flats.

With the rise in major terrorism threats, Singapore also has to spend more in security. With the level of threats is at its highest in years, the country has to invest in areas ranging from security officers to technology, Heng said.

At the start of his speech, Heng outlined a range of long-term challenges that Singapore faces including a shrinking resident workforce amid an aging population.

“We must be prepared for the challenges of an aging society…Also, our resident workforce will shrink, tightening our labour market and slowing economic growth further unless we remain dynamic in our outlook by increasing productivity in the way we work and supplementing our workforce with a calibrated inflow of workers from broad,” Heng said.

The revision in the GST has been widely anticipated by Singapore-based economists for several months, with nine out of 10 economists projecting such a move in a Reuters poll released last week.

DBS Senior Economist Irvin Seah, who first forecast the measure in November 2017, said in a report that the hike was “inevitable” amid a challenging fiscal position for Singapore, which had registered three consecutive years of deficit in the primary balance.

The GST was previously revised upward on 1 July 2007 from 5 per cent to 7 per cent.