Someone died in this house; any takers?

“Murder homes” tend to be shunned by buyers and tenants.

In Singapore, property agents and home sellers are not bound by law to disclose if a death has taken place in a home. This may seem unfair to some, but experts say there are ways of finding out if the home you’re interested in buying has a dark past. We investigate.

By Romesh Navaratnarajah

32-year-old Singaporean Joy Foo (not her real name) lives in her dream home, a rented walk-up apartment in Little India.

“When I first visited the unit, it had a really nice feel to it, despite being dirty and unfurnished,” the television producer said.

“After moving in and chatting to the neighbours, it turns out the previous occupant was a Hindu priest, which might explain the good energy I felt when I first viewed the unit.”

Nightmare in Toa Payoh

Foo made it a point to find out about the property’s past because about 14 years ago, she suffered a nightmarish experience while she was living in her parents’ HDB flat in Toa Payoh.

Speaking to PropertyGuru, she recounted the incident: “I woke up in the middle of the night and from my bed, I could see a female ghost dressed in white outside my bedroom. I also saw a floating head with long hair outside my window grinning broadly and showing very sharp teeth.

“Not knowing what to do, I shut my eyes and stayed still until I could hear some signs of life outside. The next morning, I told my grandmother about what I had seen the night before and she insisted on telling my parents. Shortly after this incident, we moved out.”

Homes that are believed to be haunted, or that have seen murders or other crimes, are called stigmatised properties, and tend to be shunned by buyers and tenants.

Don’t ask, don’t tell

Some states in the US, such as Alaska, California and South Dakota require home sellers to reveal if murder or suicide had taken place on the premises. In Singapore, on the other hand, sellers are not required to disclose such facts.

When contacted, Sandra Han, Partner in the Real Estate Practice at RHTLaw Taylor Wessing, said: “The attitude in Singapore is still very much a ‘buyer beware’ one. Research these days is much easier with the Internet. If the buyer feels strongly about it, he or she may attempt to extract a warranty from the seller, but the buyer is highly unlikely to succeed.”

The lack of disclosure laws here has attracted criticism from a number of people. Foo believes that buyers have a right to know if the property they are viewing has a dark past, so they can make an informed decision on whether to proceed with the purchase.

“What they don’t know won’t kill them, but buying a home is a very big financial decision and I think buyers would appreciate having all the information,” she said.

Alan Cheong, Research Head at Savills Singapore, agrees. “If you can have laws pertaining to religious beliefs and religious harmony, and religion is something that the fundamental logic of science cannot prove, then something as ephemeral as a stigma should also be disclosed,” he said.

Just Google it

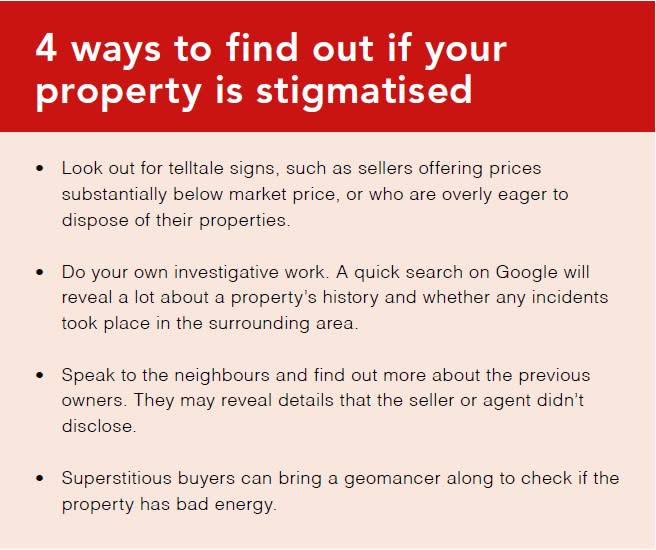

Cheong suggests that buyers can go online and search Google for information on incidents that happened in an area, then try to zoom in on a specific location.

But other analysts noted that it would be hard to determine which unit has seen death, since exact addresses are anonymised in media reports.

“Buyers would have to do the necessary background checks – such as checking with neighbours of the unit they are interested in,” said Dr Lee Nai Jia, Head of Southeast Asia Research at property consultancy Edmund Tie & Co.

Cheong also thinks the best source would be the neighbours, “particularly from the older generation”.

Lee added that buyers can look out for telltale signs, such as sellers offering prices substantially below market price, or who are overly eager to dispose of their properties.

Before you sign the sales agreement, do your homework and find out more about the property’s history.

Does it kill property values?

The question of whether the values of stigmatised properties are severely affected, though, is still a mystery. “Given that stigmatised properties are few and far between, and that the facts of the case tend to be incomplete or elusive, there is insufficient basis to conclude that stigmatised properties are heavily discounted, without having to resort to conjecture or anecdotal evidence,” said Lee.

However, Cheong believes the pool of potential buyers who would be interested in stigmatised properties is smaller, “limited to those who are not concerned by the past, or those who have the belief that living in premises with a torrid history would bring them better fortune”.

He added: “The fact that the market size is smaller would naturally translate to the price being lower.” He restrained from speculating about actual numbers. “How much lower, it is hard to tell, but my opinion is that it could run into double digit percentages.”

A big headache for agents

Marcus Sim, a property agent with PropNex Realty, revealed that selling a stigmatised property is a huge challenge for any seller and agent to undertake. “It involves a considerable amount of time and effort to market and eventually close the deal,” he said.

According to Sim, the amount of work involved in selling a stigmatised property depends on what took place in the home or the surrounding area. “There are varying degrees of stigmatised properties, ranging from estates plagued by loanshark vandalism to estates where a murder has taken place.”

In such situations, he first asks his client if there is an urgent need to sell the property. If so, he goes on to explain that such properties typically require a huge discount to entice buyers to even consider viewing the property.

Although this isn’t the best scenario for sellers, it does provide a good opportunity for property hunters to get a good discount, noted Sim.

“Unfortunately, such events don’t usually affect just one unit, but rather an entire cluster of surrounding units. And in most cases, sellers that are affected will have more room for negotiation in order to offload these properties,” he said.

Ah long flats

Sim has had some experience helping to sell stigmatised properties. He cited the case of a 3-room HDB flat in Clementi which had an asking price of $350,000.

“The block had several cases of loanshark activity going on. It was quite evident as the police had set up signboards to call for witnesses of these illegal activities in the estate. So invariably, every buyer who came to view the unit knew what was going on in the estate because these signboards were placed at the lift landings of that particular block.

“It was very hard to follow up with these potential buyers as most of them were put off by the signboards and lost all interest in the unit,” said Sim.

Nevertheless, after four months of marketing the unit, he finally found a buyer who was willing to offer around $330,000, slightly under valuation.

Even though the buyer knew about the block’s history, Sim said the sale went ahead because “the unit wasn’t the one affected by loanshark activity, and it had already been some time since the first few incidents occurred”.

This article was first published in the print version PropertyGuru News & Views. Download PDFs of full print issues or read more stories now! | |||