TechCrunch+ Roundup: FinOps for all, 15 investors who are taking pitches, Steve Blank on AI

Summer 2023 has been the hottest on record since 1880, but while early-stage founders were sweating over their pitch decks, the investors they hoped to connect with were playing pickleball in Jackson Hole or relaxing poolside with cocktails in Palm Springs.

“People tend to be out of the office longer than usual this time of year,” says Kittu Kolluri, founder and managing director of Neotribe Ventures.

Full TechCrunch+ articles are only available to members.

Use discount code TCPLUSROUNDUP to save 20% off a one- or two-year subscription.

“I suggest reaching out right before Labor Day to set up a meeting in September or wait and start your outreach altogether next month.”

With that in mind, here’s the latest edition of How to Pitch Me, a recurring column that gathers tips, insights and strategies from early-stage investors who are interested in making deals right now.

There’s a lot of actionable advice in here: If you’re wondering how much previous experience with AI investors are looking for, which questions to ask once you’re in the room, or just need a level set on CEO salaries, please read.

Thanks very much to everyone who participated:

Christine Hsieh, venture partner, Third Culture Capital

Marta Cruz, co-founder and managing partner, NXTP Ventures

Adam Struck, founder and managing partner, Struck Capital

Adam Nash, angel investor, CEO and co-founder, Daffy

Anshu Agarwal, general partner, Converge

Kittu Kolluri, founder and managing director, Neotribe Ventures

Jennifer Lee, partner, Edison Partners

Dave Zilberman, general partner, Norwest Venture Partners

Jake Jolis, partner, Matrix Ventures

Chad Cardenas, founder and CEO, The Syndicate Group (TSG)

Matthew Kinsella, managing director, Maverick Ventures

Ty Findley, co-founder and general partner, Ironspring Ventures

Kathleen Kaulins, principal, Plymouth Growth

Samarth Shekhar, EMEA regional manager, SixThirty Ventures

Zamir Shukho, founder and general Partner, Vibranium Venture Capital

Walter Thompson

Editorial Manager, TechCrunch+

Pitch Deck Teardown: Tanbii's $1.5M pre-seed deck

Image Credits: Tanbii (opens in a new window)

Less than a year after raising $1.5 million for biowaste-processing startup Mi Terro, founder Robert Luo landed a $1.5 million pre-seed funding round for Tanbii, a carbon-management platform.

Here's the winning deck he used:

Cover

Problem

Solution

Product

Value proposition

How it works

How Tanbii connects virtual and reality

Product features

Target audience

Future vision

Market size (TAM/SAM/SOM)

Partnerships

Competitive landscape

Go to market slide

Roadmap and business model

Team

Advisory

Contact and Closing

Embrace these FinOps best practices to ace your cloud strategy

Image Credits: Andriy Onufriyenko (opens in a new window) / Getty Images

The Dutch word gezellig literally means "cozy" or "pleasant," but because it's so highly adaptable, it can sometimes be hard to translate.

"FinOps" is similar: The harmonious synthesis of engineering and operations, this new practice seeks to optimize cloud costs and infrastructure.

However, “while most IT leaders genuinely believe that FinOps is the answer to cloud cost complexity, it’s clear there is still a lot left to learn," writes Kyle Campos, CTO at CloudBolt.

Get the TechCrunch+ Roundup newsletter in your inbox!

To receive the TechCrunch+ Roundup as an email each Tuesday and Friday, scroll down to find the “sign up for newsletters” section on this page, select “TechCrunch+ Roundup,” enter your email, and click “subscribe.”

Click here to subscribe

Will the power of data in the AI era leave startups at a disadvantage?

Image Credits: Nigel Sussman (opens in a new window)

AI-related startups scooped up $40 billion in venture funding in H1 2023, according to PitchBook.

"That’s almost a quarter of all the money invested in that time," notes Alex Wilhelm, who wondered whether "smaller startups are at an insurmountable disadvantage in the AI race," given the inherent advantages enjoyed by giants like Salesforce and Microsoft.

The technology's potential upside is on everyone's lips, "but I am also worried about who is going to make all the money," writes Alex.

Ask Sophie: What’s the wait time for EB-2 and EB-1 green card categories for those born in India?

Image Credits: Bryce Durbin/TechCrunch

Dear Sophie,

Back in 2018, the Cato Institute estimated it would take 151 years for a person born in India to get a green card in the EB-2 category.

How has that changed in the wake of the pandemic, the Great Resignation, and the tech layoffs? How has the EB-1 category changed?

— Living in Limbo

That 30-slide deck won’t cut it anymore

Image Credits: Nuthawut Somsuk (opens in a new window) / Getty Images

Despite the downturn, a recent report from DocSend shows a 16% year-over-year increase in the number of pitch decks founders are sharing with investors.

“Pre-seed founders have responded to the investor pullback by creating shorter decks,” says Justin Izzo, the company’s research lead. “They are rearranging the opening slides in ways I hadn’t seen before.”

The average length of a pitch deck has shrunk by nearly 16% over the last year, which “means you have to be very intentional about what to include,” writes Haje Jan Kamps.

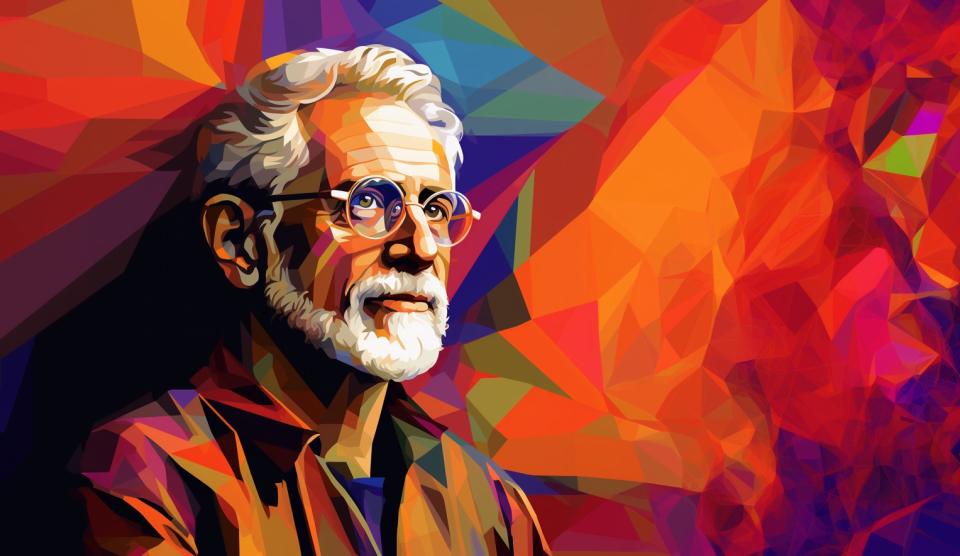

Steve Blank: AI will revolutionize the ‘lean startup’

Steve Blank as illustrated by MidJourney

Known as the progenitor of the lean startup movement, entrepreneur/educator Steve Blank says generative AI is far more than a typical hype cycle.

Thanks to the “dumb money" investors are slapping down and the tech's labor-saving potential, "it’s probably increased productivity by 50%, and that’s if you’re using it poorly," he told TechCrunch+.

“It dawned on me that we’re going to take this whole lean startup pipeline, and if not by the end of this year, certainly in the foreseeable future, that machines will be doing this a lot better than human beings,” Blank said.

7 founders explain what fusion power needs to go mainstream

Image Credits: Bryce Durbin / TechCrunch

Previously, climate reporter Tim De Chant interviewed several CEOs and founders of fusion startups to learn more about the challenges facing an industry that could literally transform human civilization.

For part two, he asked seven entrepreneurs about what it will take to make this tech commercially viable:

Kieran Furlong, co-founder and CEO, Realta Fusion

Robin Langtry, co-founder and CEO, Avalanche Energy

Christofer Mowry, CEO, Type One Energy

Benj Conway, co-founder and president, Zap Energy

Taka Nagao, co-founder and CEO, Kyoto Fusioneering

Greg Twinney, CEO, General Fusion

Thomas Forner, co-founder and CEO, Focused Energy