Thermal Coal Demand Underpinned By Uptick in Asian Consumption

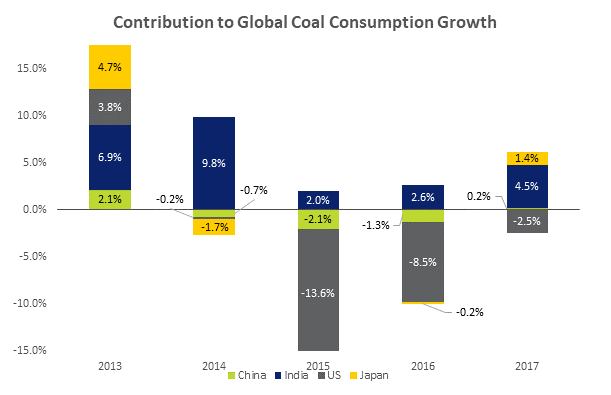

Statistics show that global coal consumption and production has picked up for the first time in 2017, after several years of declining growth, mainly driven by increased consumption from Asian countries, namely India (+4.5%), Japan (+1.2%) and China (+0.2%), according to a report from BP.

Despite tough rhetoric on environmental protection and pollution crackdown, China’s coal consumption picked up for the first time since 2013, increasing by 3.5 million tonnes of oil equivalent (Mtoe) or 0.2% to 1,892 million tonnes of oil equivalent. China alone contributed 51% of global coal consumption in 2017.

Indonesia’s coal industry is also supported domestically, driven by government efforts to increase investment spending in the coal and minerals sector to US$6.2 billion, in addition to its ambitious 10-year electricity procurement program, which aims to add 56 gigawatts (GW) of electricity capacity by 2027.

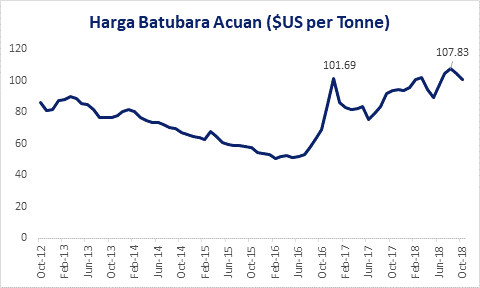

As of August 2018, Indonesia’s benchmark reference coal price, Harga Batubara Acuan (HBA), hit a six-year high at US$107.83 per metric tonne, increasing 28% YoY. The average HBA price as of Oct 2018 stands at US$100.89 per metric tonne, up 7% YoY.

Uptick in Coal Demand Despite Headwinds

In the last decade, Asia-Pacific countries have dominated the global coal market, both in terms of production and consumption, as developing countries favour coal as their main source of energy. Statistics from a report published by BP shows that in the last decade, coal contributed to at least 40% of total world power generation. In 2017, global coal consumption increased by 25 million tonnes of oil equivalent (mtoe) or 1%, its first uptick since three years of successive declines. This was largely driven by Asian countries, namely India (4.5%, 18 Mtoe), Japan (+1.2%) and China (+0.2%). India is projected to be the fastest-growing economy in South Asia with growth rates estimated at 7% in 2018 and 2019.

Indonesia’s Coal Price Surges on Government Efforts

Indonesia is ranked the fifth largest producer of coal in the world after India, Australia, US and China. The country joins the ranks of the largest coal-producing and exporting nations since 2005, as coal demand surges in the Asia Pacific region, led by China and India. Domestically, the coal industry is also supported by government efforts to increase investment spending in the coal and minerals sector, in addition to its ambitious 10-year electricity procurement program, which aims to add 56 gigawatts (GW) of electricity capacity by 2027. All of these factors have supported the rally in domestic coal prices.

As of August 2018, Indonesia’s benchmark reference coal price, Harga Batubara Acuan (HBA), hit a six-year high at US$107.83 per metric tonne, increasing 28% over a year ago. The average HBA price as of Oct 2018 stands at US$100.89 per tonne, up 28% year-on-year.

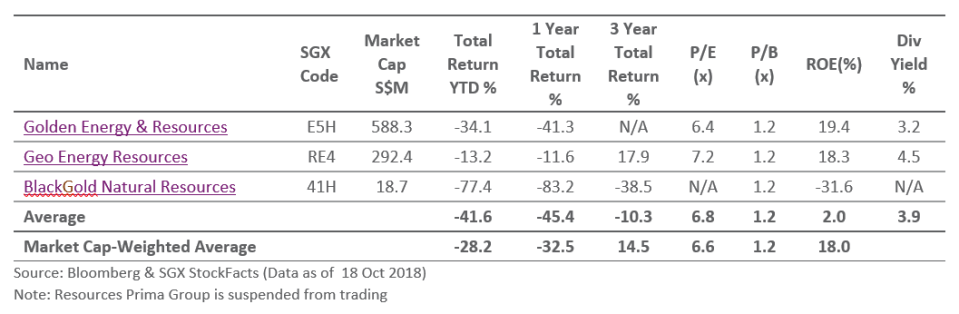

SGX’s Indonesia-based Coal Mining Stocks

SGX lists three coal mining stocks with a total market capitalisation of about S$900 million. Collectively, they average a dividend yield of 3.9% and a three-year total return of -10.3%. The table below details the three coal stocks, sorted by market capitalisation. Click on the stock name to view its profile in StockFacts.