Top 5 Simple Ways to Build Your Wealth Slowly… But SURELY!

Much has been said when it comes to achieving wealth – elusive, unattainable, difficult…

What most people don’t know however, is that achieving wealth can be easy and all it takes are baby steps and some patience (the very thing that most people don’t have).

So here are the top 5 simple ways to build your wealth – baby steps that you can take every single day to reach your ultimate financial goal!

Cut Down Unnecessary Expenses

We hear about this all the time but… does it work?

We’d say yes, but not for everyone, and for a simple reason.

Managing money requires discipline, which most people don’t have, resulting in them spending more than they earn.

Our advice is, instead of saving what’s left after spending, spend what’s left after saving.

Just by putting aside at least 10% of your monthly income right away, you are already building your own savings by default. On top of that, it encourages you to plan your spending properly, so you can last through the month.

Start Small, Start Compounding!

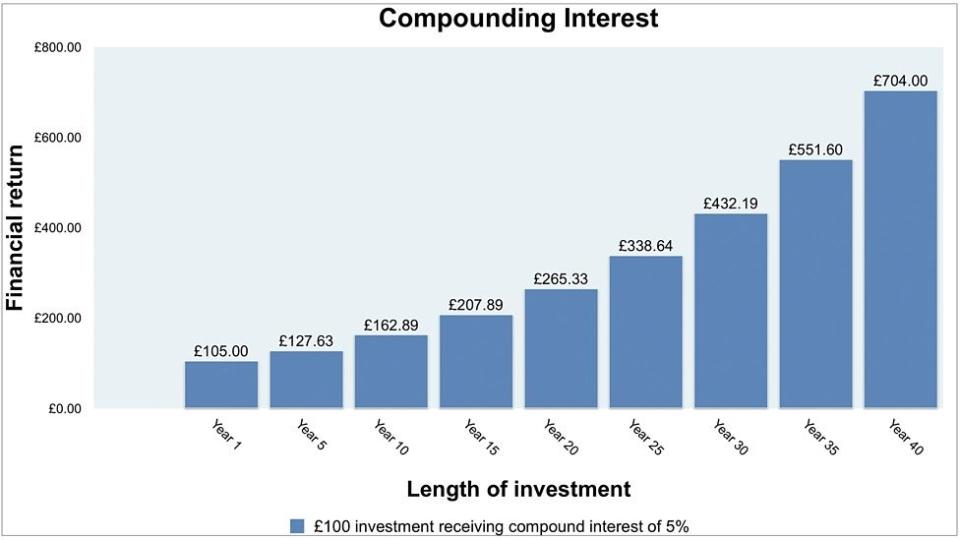

Compounding interest separates the wealthy from the broke.

Albert Einstein once said “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

One of the biggest investment myths out there is that it requires a huge sum of money or capital. Needless to say, this intimidate a lot of people and wealth would seem unattainable if they are not earning a 5-figure salary each month, or maybe even then.

What they don’t realize however, is that an army is built by adding one soldier at a time; as with their financial arsenal.

Pay Off Your Debt

Again; “Compound interest… He who understands it, earns it … he who doesn’t … pays it.”

Compounding investment returns increase our wealth, compounding interest from our debt shrinks it.

While you save and invest, it’s usually a good idea to pay down any debts you may have accumulated. Credit card debt, student debt, and even car loans can carry heavy interest rates that may drag you down. In fact, make it a priority to get rid of your debt as soon as possible.

Invest in Your Best Asset – YOU!

Investing in ourselves simply means spending more time educating ourselves and improving our skills.

No one can ever take away our knowledge, skills and wisdom. So, the more educated, skilled, and experienced we are, the more valuable opportunities we will get.

This include higher salaries and more career options down the road, both of which will help us build a stronger financial foundation.

Start early? Start young? No! Start NOW!

“I am too old for this. “

We’ve heard many renditions of this excuse.

But let’s face it – science hasn’t found a way to turn back time, so we are now at the youngest we will ever be and what better time to start than NOW when you are at your youngest?

And contrary to popular belief, we are never too young to start investing either.

Many youths see retirement or wealth building as something that comes later in life, which cause them to procrastinate. Little do they realise by procrastinating, they’re missing out on years’ worth of compounding.

Start now. Start compounding.

It is never too late or too early to start – The longer we wait, the more disadvantaged we are.

Source: https://www.bbc.co.uk

Charlie Munger once said the secret of success is to “take a simple idea and take it seriously.

”So, take these 5 simple ways seriously and we are bound to be on our way to success slowly… but SURELY.

If you wish to learn how to build your wealth systematically, and generate more cashflow for your family.

>>INTRODUCING “PASSIVE INCOME FOR FAMILIES” MASTERCLASS

(suitable for both beginners and experienced)

>>YOU WILL LEARN THE 3R SYSTEM TO INVESTING AND SYSTEMATICALLY BUILD THAT PASSIVE INCOME STREAM!

STEP ONE: USE THE 3R SYSTEM TO SELECT THE RIGHT SHARES

The 3Rs stand for:

Right business model

The share you are investing in must have a robust business model that can withstand time.

Right management

The company behind the shares must be run by an aligned and excellent management team.

Right price

The shares must be undervalued for you to make a profit from them.

STEP TWO: PLACE THE SHARES INTO A SAFE PORTFOLIO

After you have purchased the shares, it is critical for you to place them into an safe portfolio that you diversify and grow. Now it’s time for you to sit back and reap the results!

To find out more, register for our Masterclass Now!

Receive this FREE book with your tickets

Presented to you by

Disclaimer

This is not a get-rich-quick scheme. You be learning how to build an actual portfolio of publicly listed businesses that generate cashflow.

All forms of investments carry risks, including the risk of losing all of the invested amount. Such activities may not be suitable for everyone.

Value Investing College

Goldbell Towers, 47 Scotts Road #03-03

Singapore 228233