Tubi CMO Says ‘Viewer First’ Content Strategy Fuels Streamer’s Massive Growth

Since debuting on Nielsen’s Gauge just over a year ago, Tubi has seen its share of total U.S. viewing time grow over 60% — faster than any other streamer.

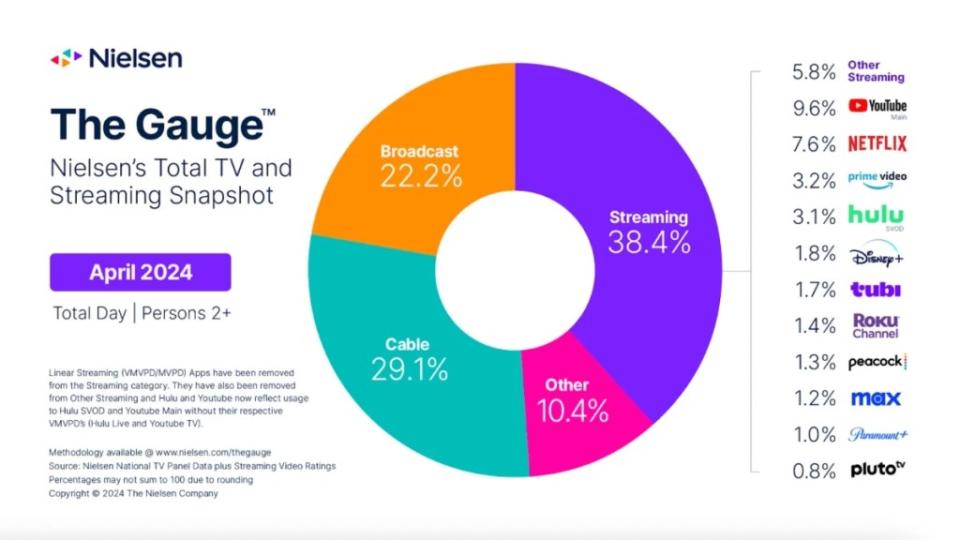

For the month of April, the free, ad-supported streamer accounted for 1.7% of streaming’s total 38.4% share of viewing, surpassing the Roku Channel (1.4%), Peacock (1.3%), Max (1.2%), Paramount+ (1%) and Pluto TV (0.8%) and coming in just shy of Disney+ (1.8%).

Tubi boasts nearly 80 million monthly active users — over 60% of which are considered cord cutters or cord nevers, and 40% of which are unreachable on most ad-supported streamers. More than 90% of viewers on Tubi are watching on-demand content.

Tubi chief marketing officer Nicole Parlapiano attributes the platform’s recent growth to three “core tenets” — removing the barrier of cost to make sure people have access to the content they love, offering a wide variety of content and “putting the viewer first” when deciding which content to greenlight.

“We spend a lot of time figuring out what people like, or what might be trending or what could be bubbling up to the top and programming around that,” Parlapiano told TheWrap. “I think being an ad-supported platform from the beginning, you have to be super responsive. We had a business for years that didn’t include originals, and was just really learning how to make a large library and a license and revenue share library work. So I think you’ll still continue to see those things.”

When it comes to Tubi’s future growth, Parlapiano is focusing on tapping into millennial, Gen Z and Gen Alpha audiences.

“We see increasing engagement across that demo…What they consider entertainment is different. These are individuals that are competing with time and a much broader competitive set — you look at social media, you look at gaming,” she said. “That is really where we’re focused on winning and where our growth will continue to compound. But we’re still staying true to doing the things that we know our viewers love and are working, and I think we’re just continuing to stay focused on that versus everything that’s going on in the competitive landscape.”

Check out the rest of TheWrap’s conversation with Parlapiano below.

How do you view competition from Pluto and major streaming players like Netflix, Disney+ and Prime Video?

When it comes to Pluto, I think the viewing experience is so different. Pluto really prioritizes the linear fast channels or that lean back experience similar to old school TV viewing, whereas 90% of our viewing is on VOD and so it’s high intent, high on-demand. People are coming in to watch something specific and they’re engaged. So I think the business model and the purpose of why you go to Pluto or Tubi are very different. Even though we’re both under the free umbrella, the product is different and I think the intent of what viewers are looking for is very different on both platforms. Ours mirrors more of what you would see on an SVOD.

In terms of competing with SVOD, I think we are the place when you don’t know what you want to watch and you’re looking for a different experience. The other SVODs really compete on their original titles to bring people in and prioritizing that. We know that’s super popular. I look at Tubi as a plus-one to whatever your SVOD of the month is. So I think it’s complimentary and not necessarily competitive. We’re seeing a lot more churn when it comes to any type of paid environment and I think our real challenge is just educating people on why should you go to Tubi and what can you find on Tubi that you can’t find anywhere else?

Where is Tubi at when it comes to the path to profitability?

The economics of the business are very different for us because we were ad supported. Our model was not ever really predicated upon making very big investments on original content. So I’ll say that we’re not at all in a position like the competition is when it comes to path to profitability. We are investing in our growth and it’s just about us pulling a few levers. We can be profitable when we want to be but that’s a little bit silly right now. Given the position that we’re in, we’re going to continue to invest in growth and you’ll see us invest in viewer experiences, you’ll see us make some content investments, but I think they will be moderate compared to the competition.

What have you been hearing from advertisers during upfront season? What are you doing to stand out from the competition as you fight for ad dollars?

We’re hearing ‘I did not know that you were that big.’ People have no idea, even though we’ve been rising on the Gauge, just how big the addressable ad audience is. So what we’ve been hearing overwhelmingly is I had no idea Tubi was that big, we should invest more with you. So I think we’re really focused on making sure that people are clear about our reach, our scale and our focus on audience. I think at the end of the day, because we’re ad supported, it’s not about the content. It’s about our relationship with our audience and our ability to deliver on that audience in a way that others cannot.

I remember in 2014 and 2015 when the social platforms just started to become pay to play and I was working at an agency. Even though the audiences were there, it took so long for dollars to migrate over into social. So the fact that other streamers are entering into ad supported as a good sign, because I think the ad dollars will migrate faster. We’re at the point where streaming does have the audience, there’s just a lag effect in people moving dollars from more established channels. So I think the others entering the market actually will only help us.

What do you think is the biggest challenge in the ad market right now and what is your recipe for success?

I think the biggest challenge for advertisers right now is impact. Reach is not an issue, there’s many places you can reach your audience. There’s trade offs in some areas, but I think the real challenge is finding the right message.

What I’m most excited about is working more closely with our clients on how we can solve brand problems through deeper integrations into content, or how we can help them distribute content that they have made. A lot of brands are in the business of making films and episodic series, and I think are feeling like their content is getting a little bit lost on YouTube and maybe they don’t want the film that they made, that they paid all this money for directors and storytelling, to be running next to viral cat ads. So we have done partnerships with clients like USAA, where either we’re figuring out how to distribute something they’ve made on Tubi that we know our viewers will love or we’re making something specific for them to live on Tubi.

We also just launched a new product that’s pretty cool for advertisers called Stubios. It’s a platform for emerging filmmakers where their fans have the greenlight power. So they come onto the Stubios platform, they have a project they want to make, their fans come and want to see the product made too. We help them produce and distribute the content on Tubi. Issa Rae has signed on to be a mentor for this program. So she’ll be mentoring the first class of Stubiorunners and it’s a really interesting opportunity for brands to align early on a project and be a part of someone’s journey as they make their first foray into Hollywood.

I’m really excited about that because melds the aspects of social and people wanting to participate in how things get made and how decisions get made and seeing underdogs of the industry win. We are currently in talks with brands, whether they are part of the pre-production phase or whether they’re a part of the finished film or series. It’s a great way to align on a deeper initiative that builds a lot of brand love than say commercial ads. So I’m super excited about just experimenting with different ways to bring storytelling and brands and individuals that are creative and influential and charting their own course on platforms like Wattpad or TikTok into the TV home.

In Jan. 2023, Tubi struck a deal with Warner Bros. Discovery to license content such as “Westworld” and “Cake Boss.” What has been the impact of that partnership?

I think from a perception standpoint, those are really recognizable, iconic shows. So the partnership definitely helps with perception, but I think these shows are going to audiences that have never seen them before…. I think being able to bring some of these shows to a much wider audience and grow their fandom is beneficial to both Tubi and any of our licensing partners.

I think the worst thing in entertainment is the fact that people make things and no one watches it, or they don’t get to see it because it’s stuck behind a paywall. New isn’t necessarily newly released, new is to people who have never seen it before. The definition of new is changing now that we have streaming and you can now access shows that are eight years old or 10 years old or 20 years old whereas that was impossible years ago. So I think that nostalgia viewing and net new audiences are two trends that were keeping a close eye on.

How important is sports to Tubi’s strategy?

Obviously, sports has high engagement. High engagement means people are more likely to hear your message and listen to your message and its more likely for it to land.

We have a variety of live sports whether it be G League, Liga MX, Concacaf. We have a DAZN partnership that is going to bring content like women’s soccer. Luckily with Fox Sports, we are able to exploit some of those relationships – Concacaf is a co-Fox Tubi thing – but I think we’re really thinking about the intersection of culture and sports. I think for a lot of these sports to grow and get viewership, it’s really focusing on the athletes and getting people to lock into the athletes stories and then want to watch the live sports.

We did our first sports docu-follow called “Shattered Glass” in February and it follows three WNBA stars. This was before all the conversation about pay and disparity that was discourse in May with the latest freshman class of the WNBA, but we tackled this issue in February by following these women and their stories and how they have to play overseas and what it does to their bodies and a lot of them are parents and what is that like? It became top of mind for everybody that these women should be getting paid more. So I think we’re going to continue to look for stories that we feel like our viewers will love and that continue to bolster some of these sports that are growing and emerging and specifically popular with younger demographics.

Do you think the FAST streaming market is getting too overcrowded? What’s next for FAST?

There’s not that much truly free competition in the market right now and I think that people have kind of settled into what the differences are. The folks that are using all the different ones know what they’re going there for. So I don’t see it being too crowded and essentially you’re competing with all free entertainment, which like I said, there’s games that are free, social media is purely free, YouTube is free. So I do think they will be more popular because we have a generation that is not used to paying for entertainment, they’re just not. It can become more popular, but delivering an experience that doesn’t feel like it’s free and feels like you should be paying for it because it’s so good is really what’s going to stand out. We have no shortage of content, we have no shortage of entertainment. I think that the next chapter is really going to be figuring out who is going to innovate on the viewer experience and make it so that people can find what they’re looking for faster.

Everything’s so fragmented right now. There’s a lot of viewer frustration of not being able to find what they want to watch or have to Google where’s this show available because its been so content forward. So I do think there’ll be a shift towards us really focusing on what is our point of differentiation of our or brand but also how are we solving problems for viewers and advertisers and how are we innovating on the current experience? I think there’s so much that can be done in the ads space that isn’t just taking your TV commercials and putting them onto streaming. There is so much more innovation. We’ve only yet scratched the surface on what we can deliver on there and so that’s what I’m excited to see.

The past strategy was all about the war for content and as we can see the growth is not going to be predicated upon the content. Leading with a great product and viewer and advertiser experience and making it feel like it’s not free has always been in our DNA and I think that we’ll continue to win.

The post Tubi CMO Says ‘Viewer First’ Content Strategy Fuels Streamer’s Massive Growth appeared first on TheWrap.