U.S. Senate committee chair exploring targeted tax relief to address coronavirus

WASHINGTON (Reuters) - The chairman of the U.S. Senate Finance Committee is exploring targeted tax relief to address economic fallout from the fast-spreading coronavirus, a spokesman said on Monday.

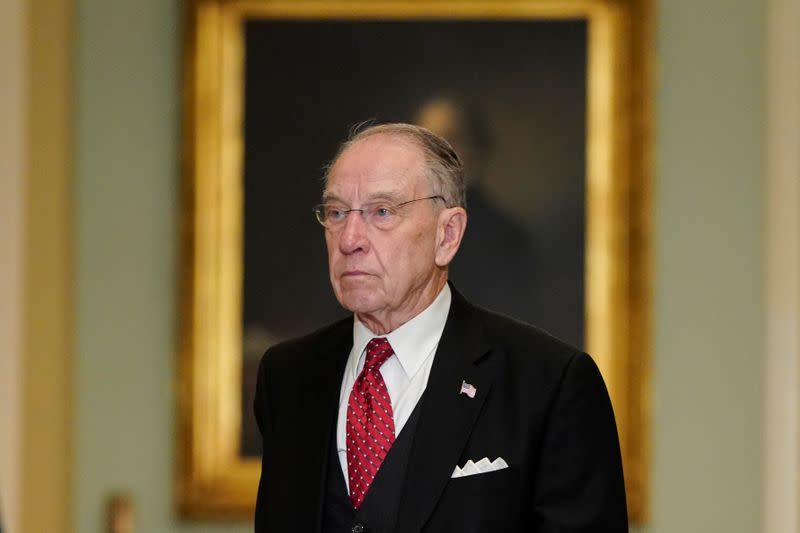

Senator Charles Grassley "is exploring the possibility of targeted tax relief measures that could provide a timely and effective response to the coronavirus. Several options within the committee’s jurisdiction are being considered," spokesman Michael Zona said.

Grassley has been in discussions with the White House, which is considering tax relief for travel and airline industries. Top Democrats in Congress on Sunday urged the White House to "prioritize the health and safety of American workers and their families over corporate interests."

Grassley, a Republican, declined to give reporters details of possible relief measures. "We haven't had any discussions on it, but I think that we ought to be ready for it, and I guess you'd say everything's on the table," he said outside the Senate.

Asked if a payroll tax cut was among possible options, Grassley repeated that everything was "on the table."

One camp in the White House, including President Donald Trump, backs an across-the-board payroll tax cut, said an economist advising the administration. But top White House economic adviser Larry Kudlow and others advocate specific tax credits, loans or direct subsidies to certain industries or hard-hit areas.

Grassley said it was possible Americans hospitalized for the coronavirus but lacking health insurance could get help with their costs from the Federal Emergency Management Agency, which usually helps with natural disasters. But he said he did not know whether legislation would be required.

(Reporting by David Shepardson; Editing by Dan Grebler and Tom Brown)