Southeast Asia startup investments 2013: It’s all about e-commerce, fashion, and women

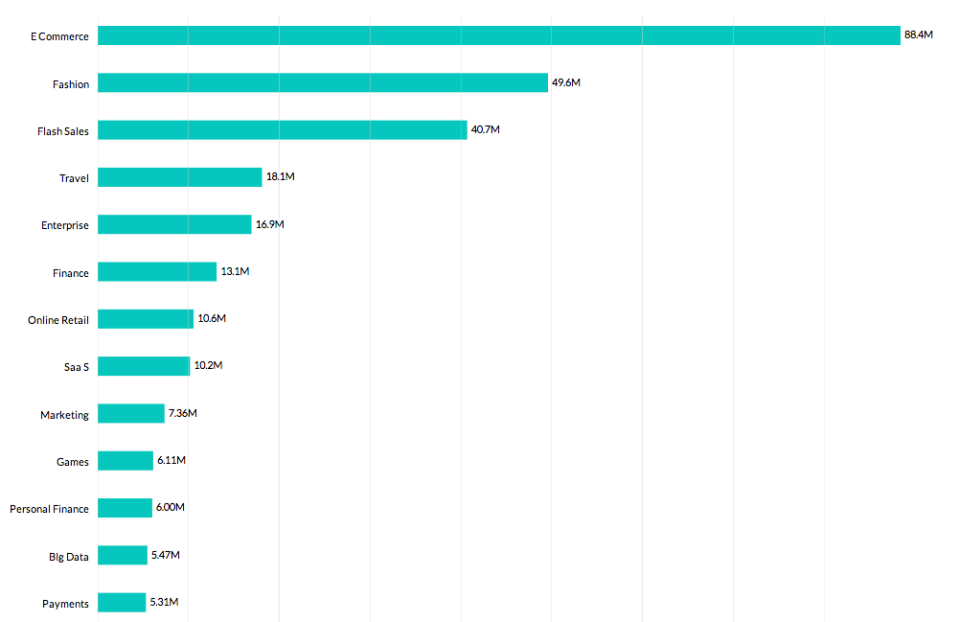

Click for full-sized version. Note that categories are not mutually exclusive, which means a deal can belong to multiple categories at the same time.

As the candle snuffed out on 2013, deals were still being announced even just before the arrival of Christmas.

While it has been a busy year for the startup scene in Southeast Asia, few attempts have been made to quantify the investment activity and take stock of what the numbers mean.

Tech in Asia is taking baby steps in that direction. On Techlist, our platform for connecting investors with startups, we’ve been tracking data from the seed stage right up to private equity investments in the web and mobile space.

All in all, we followed 151 deals in Southeast Asia, out of which 87, or 58 percent, had disclosed investment sums totalling $645 million. Here’s what we’ve found:

Tech in Asia is striving to make the data as representative of the ecosystem as possible. However, several limitations need to be addressed: |

1. E-commerce dominated, and the money is mostly going to fashion.

If you’ve been tracking the startup scene, you don’t need to crunch numbers to figure this out. Mobile commerce, in particular, has been a major theme in the tech scene in 2013, and given its initial successes, looks set to dominate headlines again in 2014.

But visualizing the data gives a better sense of the scale: Out of the $645 million plowed into internet companies, a massive $593 million, or 92 percent, has something to do with e-commerce.

Here, we’ve segmented e-commerce into several categories, including online retail, payments, C2C marketplaces, and flash sales. A deal can belong to multiple categories. The majority of e-commerce investments, it would seem, have gone into men’s and women’s fashion, with the latter dominating sales of course.

Online retail, which involves direct selling of goods to consumers, also form the majority of e-commerce funding, while flash sales are also taking in sizable chunks of money.

2. Rocket Internet’s total investments were about five times larger than the startup scene’s combined.

The figures above include money thrown into Rocket Internet, which accounted for $505 million of the investments into internet companies, while the rest came from venture capital firms, early stage funds, and angel investors. But even if we remove Rocket Internet, e-commerce is still huge, taking up $88.4 million out of $140 million, or 65.2 percent.

This hints at how capital-intensive and complicated e-commerce ventures are. Besides creating the front-end experience, startups are building infrastructure like logistics, payments, and inventory management tools. While a lot of it are in-house and closed systems (think Rocket Internet and RedMart), several startups including Anchanto in Singapore, Qwikwire in Philippines, and aCommerce in Thailand are catering to the rest of the market by offering infrastructure as a service.

Since much of the e-commerce investments have gone into infrastructure-building and early-stage online retail companies, we anticipate that funding for e-commerce companies will continue to dominate in 2014, as expansion of these startups beyond their indigenous markets will be expensive, and given that strategic investors like Rakuten and SingTel are still hungry for technology that will complement their consumer web ecosystem.

Because of the cost savings that can be gained with volume, we can expect to see consolidations in e-commerce that could match or exceed 2013’s acquisition activity – notable examples included iBuy’s purchase of multiple daily deals sites and SingPost’s $947,000 acquisition of e-commerce company EK Media.

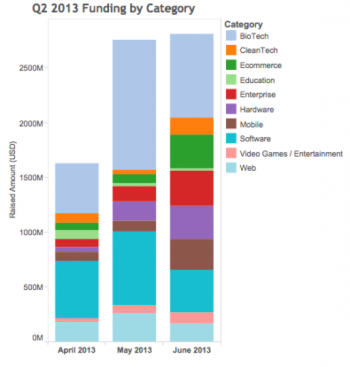

3. Besides being far smaller than the US, Southeast Asia’s startup ecosystem is also not as diverse.

While there’s a lot of hype about how Asia is the next great land of opportunity, it seems that venture capitalists and angels have mostly held back in Southeast Asia. China saw an average of $540 million per quarter in venture capital deals in 2013, while the United States received $9.2 billion in one quarter alone (more than ten times what internet companies in Southeast Asia got), with the majority going to Silicon Valley.

The investment scene in the United States is also relatively more diverse, with investments evenly distributed across sectors. Biotech is getting the most money in the United States, followed by software. E-commerce, enterprise, and hardware also dominated.

4. Hardware and Bitcoin made a tiny blip in 2013.

A couple of other investment areas have also gotten attention, though in small drips. Hardware startups have gotten at least $4.26 million, and many of them, like Pirate3D and Vibease, are doing so through crowdfunding via Kickstarter and Indiegogo. The success of these pioneering companies in the years to come could determine whether crowdfunding will become significant source of funding in Southeast Asia.

Bitcoin startups like itBit and GoCoin have attracted funding too, although with the currency experiencing some turbulence at the moment, we don’t know if the momentum will be sustained in 2014.

5. Other major investment themes

Looking at the rest of the field, travel startups have gotten at least $18.1 million in 2013, while enterprise software, financial services, and SaaS are the other themes that have received more than $10 million each.

Want to contribute to this project? Join Techlist or contact us for a discussion.

(Editing by Gwendolyn Regina Tan and Josh Horwitz)

The post Southeast Asia startup investments 2013: It’s all about e-commerce, fashion, and women appeared first on Tech in Asia.