1MDB scandal: Well done with Ambank, now go after auditors - Pua

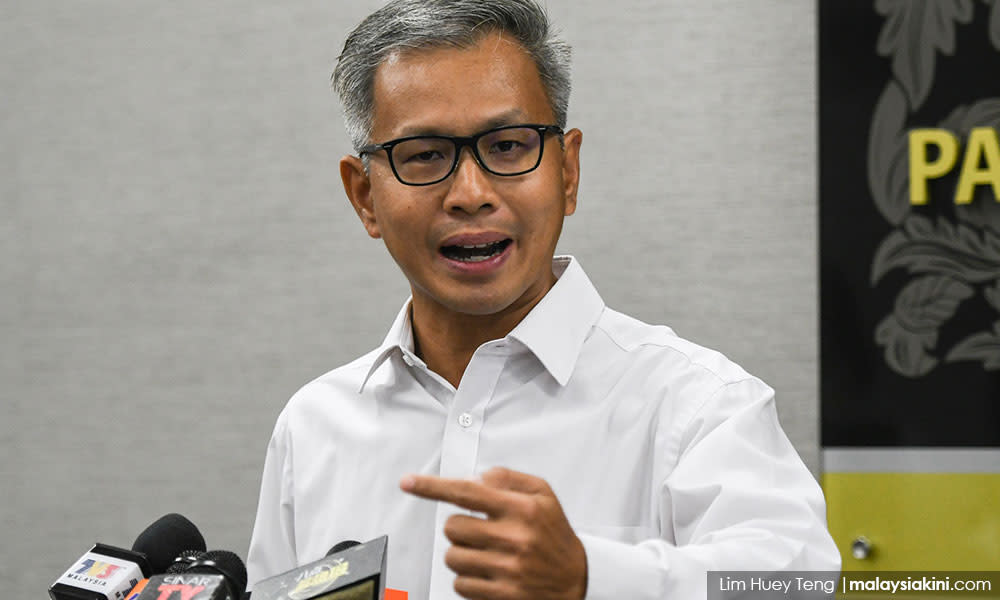

A top opposition figure said the Finance Ministry had "done well" to secure RM2.83 billion from Ambank over the 1MDB scandal but must now train their sights on accounting giants KPMG and Deloitte.

Damansara MP Tony Pua said the previous Pakatan Harapan administration had prepared claim documents against the two firms over their role in the 1MDB scandal just prior to the change of government on March 1 last year.

The government needs to finish the job, he said, either through courts or settlements.

"I call upon the Finance Ministry to now set their focus on the claims against the former 1MDB auditors, KPMG and Deloitte Malaysia. Like the Ambank case, the claim documents against both entities were completed by the professionals more than a year ago.

"However, unlike the degree of forthcoming cooperation shown by Ambank, these international auditors have failed to demonstrate any remorse and have refused to acknowledge any degree of culpability in the RM50 billion scandal despite clear evidence of their failure to carry out their audit responsibilities in a competent and diligent manner," he added.

For much of the past 10 years, Pua was 1MDB's chief critic. He later played an instrumental role in the efforts to recover 1MDB assets as the political secretary to the finance minister between May 2018 and February 2020.

In 2015, Pua filed complaints against KPMG and Deloitte with the Malaysian Institute of Accountants (MIA). The hearing is ongoing.

Pua accused KPMG of failing to consider material disclosures of the transactions involving 1MDB's US$1 billion investment in PetroSaudi International Limited in 2009 and 2010.

This investment was later proven to be a sham, where US$700 million was siphoned off by fugitive businessperson Low Taek Jho, or better known as Jho Low, through a company called Good Star Limited.

READ MORE: DOJ traces three phases of money-laundering through 1MDB

In his complaint to the MIA, Pua alleged that KPMG signed off on 1MDB's 2010 financial audit within three weeks after replacing Ernst & Young in September that year.

As for Deloitte, Pua accused the company of intentionally or negligently failing to conduct the necessary due diligence and audit of 1MDB's cash flow and liquidity risk.

Deloitte quit as auditors in 2016 after the US Department of Justice revealed findings of its probe on 1MDB.

Past and present figures from both KPMG and Deloitte have filed suits in order to reverse findings by the MIA that they were involved in "unprofessional conduct".

Meanwhile, Pua said he was "happy" that the Harapan administration's efforts to reclaim losses caused by the 1MDB scandal was bearing fruit, in part due to the cooperation granted by Ambank's senior management, unlike the aforementioned audit firms.

"I believe that the settlement of RM2.83 billion, which amounted to nearly 30 percent of the bank's market capitalisation is a fair sum, given the level of cooperation provided to the government," he said.

Pua also paid tribute to the many lawyers and accountants who were involved in preparing the comprehensive claims against all the parties who were directly or indirectly culpable for the billions of ringgit lost or misappropriated.

"These claim documents were completed in the final weeks before the betrayal against the people's mandate for Harapan by unprincipled members of Parliament to form a new government," he said.

In a related development, AMMB Holdings Bhd - the parent company of Ambank - said the group has strengthened and enhanced its processes to meet current regulatory standards.

"To this end, the AMMB Group has decided to resolve these historical matters to allow the group to focus fully on its business," said the company.

The firm will not be paying any dividends for the year ending March 31, 2021, but claimed to remain highly liquid.