3 Great Stocks for Your Roth IRA

A Roth IRA is funded with after-tax earnings, but any cash you pull out of the account after retirement is tax-free income. So, it makes sense to put dividend-paying stocks into your Roth IRA, thus turning dividends into a tax-free stream of retirement income to help supplement your Social Security payments.

To this end, high-yielders Duke Energy Corp (NYSE: DUK), ONEOK Inc (NYSE: OKE), and Tanger Factory Outlets Centers Inc. (NYSE: SKT) are all great stocks to add to your Roth IRA wish list today. Here's a quick rundown on each.

1. Low risk, nice yield

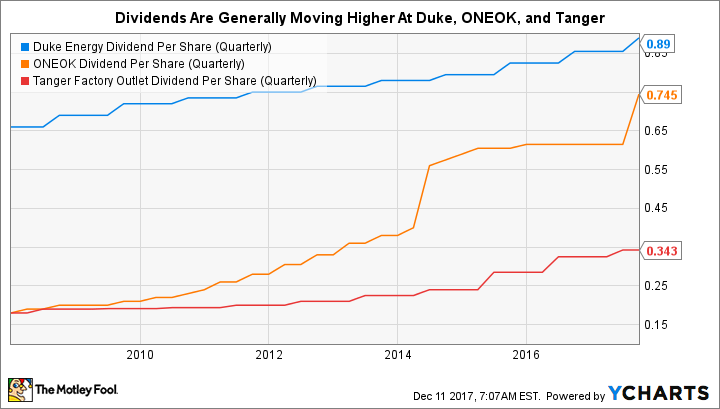

Duke Energy is one of the largest electric and natural gas utilities in the U.S. It currently offers investors a 4% yield, around twice what the broader market is offering. Dividend growth is expected to track along with earnings growth in the 4% to 6% range over the next few years.

That may not sound like much, but it bests the historical rate of inflation growth (around 3%), keeping your purchasing power growing over time.

High yields and Roth IRAs go very well together. Image source: Getty Images

Backing up Duke's earnings and dividend growth is capital expenditure-rate dynamic at its regulated utility business. As a regulated utility, the rates Duke can charge customers must be approved by the government. Generally speaking, the more the company spends on its regulated assets the larger the increases it can pass on to customers. It intends to spend $30 billion on its regulated assets over the next few years. It has another $7 billion or so of spending planned at other businesses (like renewable merchant power and pipelines) that could further enhance its growth prospects.

The best part is that Duke is a simple, predictable company. Slow and steady progress wins the race. For example, it's paid dividends for over 90 consecutive years. And, here's another nice boring fact, its beta is a tiny 0.26. That means its volatility relative to the S&P 500 Index is very low. If you want a decent yield, steady dividend growth, and low volatility, get to know Duke.

2. Pipelines without the partnership

If you are an income investor you have likely come across midstream limited partnerships.

These entities are designed to pass income through to unitholders, with many of the top names offering mid-to-high single digit yields. The problem is that LPs don't play nicely with tax-advantaged retirement accounts. Which is why ONEOK, and its 5.6% yield, is such an interesting opportunity -- it's a high-yield midstream company that isn't a partnership.

ONEOK has increased its dividend for 15 consecutive years and owns a diversified collection of largely fee-based midstream assets. It also has a strong history of dividend growth, with an annualized dividend growth rate over the past decade of around 16%. The current target is more modest at around 10%, but that's still three times the historical rate of inflation growth.

DUK Dividend Per Share (Quarterly) data by YCharts

Backing that growth up are spending plans that could reach $3.5 billion over the next few years. The company has a strong history of expanding through project expansions. Having spent around $9 billion on organic growth projects between 2006 and 2016.

The more fee-based assets it has in service, the more it can pay out to shareholders. There's more to know about this company, including its efforts to reduce leverage, but if you want to include a high yield midstream investment in your Roth, this is a good way to do it.

3. Retail isn't dead yet

Everyone claims 'retail is dying' these days. But as much suffering as there is, retail isn't a dying business. After all, even internet giant Amazon is opening physical stores -- and let's not forget its purchase of Whole Foods. If you believe that people will still go to physical stores for the foreseeable future, then you'll want to take a close look at Tanger and its 5.2% yield.

Tanger owns 44 outlet centers in the United States and Canada. It doesn't count department stores like struggling Sears and J.C. Penney as tenants, and its outlet focus is all about providing consumers with year-round deals -- something that's always in fashion. Rents at its outdoor malls, meanwhile, are lower than at enclosed malls, which retailers find attractive.

The real estate investment trust (REIT) posted 1.7% net operating income growth through the first nine months of 2017. That's the lowest level since the tail end of the 2007 to 2009 recession, but it is growing.

With a new mall opened in October 2017 and an expansion at another mall completed a month after that, more growth is on tap for Tanger in 2018. That's despite the fact that management expects the near-term to be less robust than the recent past.

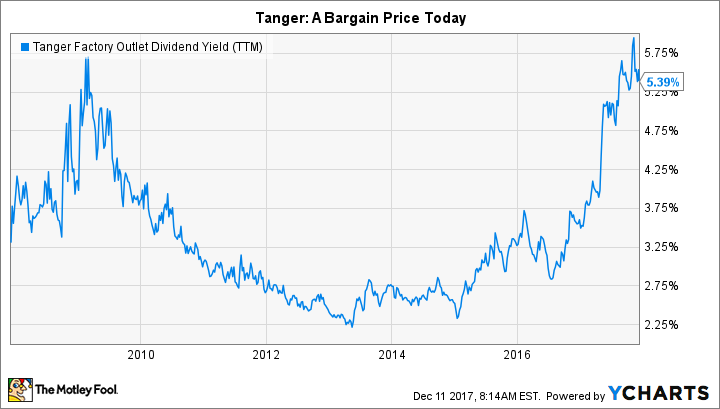

SKT Dividend Yield (TTM) data by YCharts

Solidifying its 5.2% yield is 24 years worth of annual dividend increases. The compound annual growth rate over the past decade was around 6.5%.

But here's the best part: the FFO payout ratio was just 55% in 2016.

That means there's a huge margin of safety for the dividend, even if retail is a tough market for a little while. The high yields in the REIT space partly come from the fact that REITs don't pay taxes on the dividends they pay -- tax savings that gets passed on to shareholders. But if you put a REIT in a Roth IRA, you can turn those dividends into tax-free income.

I would expect slower-than-normal dividend growth at Tanger over the near term as the retail sector adjusts to a new normal. But Tanger is worth a deep dive, particularly since its yield hasn't been this high since the last recession -- suggesting it's on sale today.

Avoiding the tax bite

The big story about Roth IRAs is that they help you avoid taxes in retirement. That makes them a great home for income-producing securities like Duke, ONEOK, and Tanger. All three offer impressive yields relative to the market and strong stories backing their historical dividend growth and future dividend prospects. If you are looking to create some tax-free income in your Roth account, now is a good time to do a deep dive on this trio.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Reuben Gregg Brewer owns shares of Tanger Factory Outlet Centers. The Motley Fool owns shares of and recommends Amazon and ONEOK. The Motley Fool recommends Tanger Factory Outlet Centers. The Motley Fool has a disclosure policy.