4 Ways You Are Using Your Credit Card Points Wrong

What drives customers to credit cards? A 2017 JD Powers survey reports that 50% of respondents suggested that the primary reason they acquired their card is for cashback while another 37% based their decision on rewards programme. But if we’re all signing up for credit cards to maximize our points, rebates and miles, are we all following up on that? Or are we improvising along the way? Although the concept of credit card points as “free money” makes it easy to overlook your own credit card strategies, consumers can leave money on the table by failing to take advantage of every benefit offered by their credit cards. Here are a few ways credit card users are using their points wrong—and what they can do to fix it.

1. Ignoring Your Credit Card’s Own Policies

Do you know how many points you get for specific purchases on your card—or do you use it absentmindedly, letting points accrue automatically? A lot of credit cards in Singapore tend to offer a "multiplier" rewards where you can receive 4x to 10x more points per S$1 spent on a specific category of expenditures like online shopping, groceries or dining. Therefore, it is possible to use 2 to 3 credit cards to truly maximise the amount of rewards you can earn by rotating through them depending on how you are spending your money.

For example, you could use a card like Citi Cash Back Card that provides 8% rebate on groceries and dining to earn rewards on food purchases, while using a different card like HSBC Revolution Card to earn higher rewards on shopping and entertainment. However, if you use only one card of those cards for every thing, you may be leaving more points on the table than you imagined. For those who want to concentrate their rewards and spending only on one card, it may be worthwhile to consider a flat-rate card like DBS Altitude Card that provide the same amount of rewards on every dollar you spend regardless of the spending category.

2. Minimizing the Value of Your Points by Opting for Cash

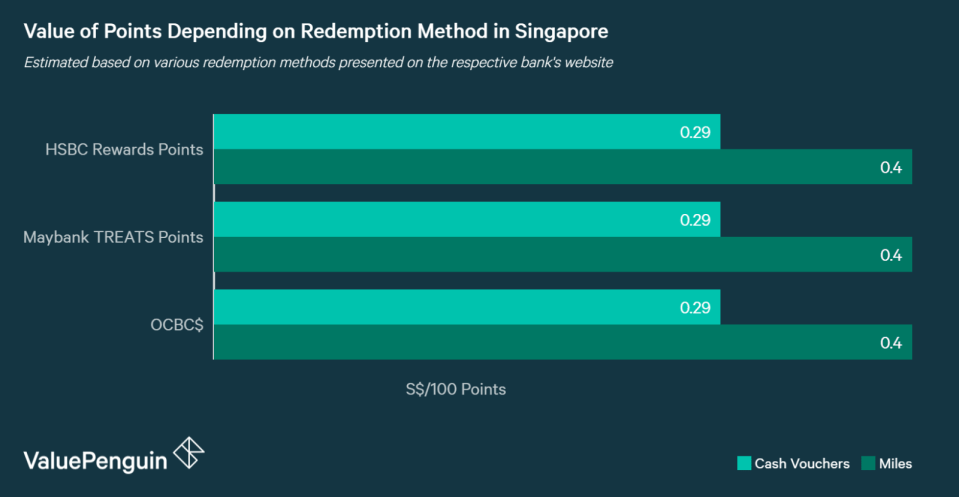

Many rewards credit cards in Singapore tend to offer some form of points redemption mechanism that allows customers to convert their points into different things like cash vouchers or miles. However, you should carefully choose how to redeem your points because it can have a meaningful impact on the value of your rewards points. In general, you can often stretch your dollar by opting to redeem your points for credit card miles rewards. For example, the average conversion rate of a point across banks was about S$0.29 per 100 points for cash vouchers (including vouchers for specific merchants), while travel related redemptions (i.e. miles and vacation vouchers) were worth about S$0.40 per 100 points (assuming that 1 mile is worth S$0.01), a difference of 33%. Miles can also be worth even more when redeemed for long haul flights or business class tickets.

Unless cash back rewards are your chief priority, you should think twice before using your credit card points to justify using your points for a random shopping spree or online purchases. In many cases, a credit card will reward you with more miles than the cash equivalent of those same miles, a trend we also observed in rewards credit cards in the US where airlines have also struck deals with banks to attract more customers.

3. Paying with Cash or Debit Cards

Paying with cash or debit card can be a great thing when trying to manage a budget. But if debt management isn't a problem for you, there’s no reason you can’t put big purchases on a card. This is especially important in Singapore, where both credit card rewards and credit card fees charged to merchants tend to be higher than most other countries in the world. For example, top cards in Singapore tend to yield more than 3% to 5% in rewards, while top cards in the US yield around 2%. Since you mostly pay the same price regardless of your mode of payment, you would be leaving a lot of money on the table by paying with cash instead of a credit card.

4. Signing Up for a Credit Card Just for the Bonuses

With most credit card users reporting that rewards programs are high on their list of priorities for credit cards, it can be easy to get caught up in the mania of choosing those credit card programs that offer the most value upon signing up. However, credit card churning can be a very dangerous and counter-productive exercise unless done extremely carefully. Some expert credit card churners are adept at maintaining a high credit score while utilizing a variety of registration bonuses, but requires a relatively high level of monthly spending spread across multiple cards, a strategy that is difficult for many to replicate.

When you sign up for a credit card, you should make sure to include a number of variables in your research: whether there are minimum spending requirements to worry about, how much annual fee you are going to have to incur, and whether you can afford to meet these requirements without leaving an unpaid balance at the end of the month.

Using Credit Card Points the Right Way

With the above in mind, how should most consumers utilize their points? It starts with planning. Understanding your individual goals as they relate to your credit card use will give you a leg up. Study your own credit cards and understand where you’ll find the greatest impact in your purchases (for example, do you get more points for grocery purchases?) and redemption (will you have opportunities redeem your miles to travel?). Even “free money” should not be treated lightly.

The article 4 Ways You Are Using Your Credit Card Points Wrong originally appeared on ValuePenguin.

ValuePenguin helps you find the most relevant information to optimise your personal finances. Like us on our Facebook page to keep up to date with our latest news and articles.

More From ValuePenguin: