5 Clear Signs You Need a Credit Card

Credit cards get a bad rep. We blame them for everything: debt, inflation, gambling, alcoholism, Satan, cancer, and probably The Phantom Menace. When our children crack open history books 200 years from now, after their lunch of irradiated cockroaches and post-apocalyptic sewer sludge, “Hitler” and “Credit Card” will be in the same chapter. But for all that, credit cards do have their place. And as much as we dread Amex, there are times when a credit card becomes…dare I say it…a positive necessity. Here’s when:

"You want cash? As in the those paper things? What, do I look like an antique dealer?"

1. A Plane Delay Makes You Dial Suicide Prevention

Before I got a credit card, I used to have a breakdown every time my flight got canned. Unless I’d wadded emergency cash in my underwear (go ahead and rob me now), I sometimes couldn’t afford a hotel room.

Have you ever spent a night at LAX or Heathrow? Biblical passages about hell don’t even come close. And if you do make it to daybreak, don’t count on showing up for work; not unless your colleagues are fond of rumpled suits and cro-magnon behaviour.

A business man, or just about anyone in sales, can tell you the value of that plastic card. Travel often enough, and you will be in a situation where (1) you’ve run out of foreign currency, and (2) you urgently need a room. So if you have to fly around and close deals, always keep a credit card handy. A decent hotel room and night’s rest make all the difference in business.

"That's it, we're charging rent. Also, I think the one on the left has been dead for a week."

2. You Freak Out When Entertaining

I’m not just talking about dates; I’m talking about entertaining clients.

When I was working freelance, I didn’t have a corporate card or a company’s petty cash. Entertaining clients came out of my own pocket; something you can relate to if you’re self-employed. There were months when, to preserve my all-important cash flow, meetings were based on budget rather than location. Restaurants in town were too expensive, so clients were met in Jurong, Bedok, or places that make your GPS go “Lol! Wtf!”

Closing a deal requires your full attention. Don’t let yourself be distracted by the restaurant bill, or by how far away the next meeting is. A credit card takes your mind off all of that; and if you use it responsibly, the deals you close will more than make up for that monthly repayment.

"My good humour ended with my entertainment budget. Which was just after the salad."

3. You Need to Visit Stores For Everything

There are some purchases that make more sense online. Sites like E-Bay and Amazon are discount havens; compare their prices to brick & mortar (B&M) stores, and you’ll see a difference. Websites eliminate the middleman, which translates to lower costs.

Before I got my credit card (and subsequent E-Bay obsession), I bought everything in a store. Including boxed software, which has never been less than two versions behind. As a student, I didn’t have access to certain textbooks, because I relied entirely on Kinokuniya or the now defunct Borders to bring them in. A credit card would have put an end to all that, and saved me some valuable study time.

Not pictured or present: Oxygen

4. You Actually Use the Hotel Room Safe

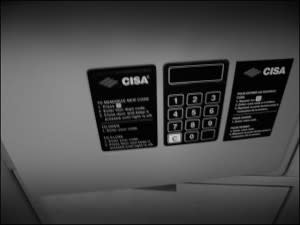

There is nothing, and I mean nothing, more pathetic than using the hotel room safe. Even hotels don’t take them seriously. The last one I used could only accept one combination, which was “000″ followed by dropping it on its corner.

But I didn’t have a credit card, and I put all my cash into it. Since it was only marginally harder to break open than a boiled egg, the money wasn’t stolen for one whole night.

In my defence: the other alternative was to walk in Kaohsiung alleys with bulging pockets, like a cow wandering around a steakhouse. While Singapore might be safe, other countries aren’t police states may not be. I could resort to alternatives like traveller’s cheques, but that’s an added inconvenience; a credit card is hassle free. I just walk into any shop in the world, and buy something. And if I’m robbed, I just limp to the nearest phone and have the card cancelled.

Safety, and convenience.

"…and to open, either enter the 8 digit security code, or slap it on the top."

5. Your Accounts Make People Ask “Who Gave the Monkey a Crayon”?

Credit card companies track purchases to near perfection. Because banks are notoriously picky, they’ll spot all the little buys you missed.

If you’re still in the “pen and a cheap notebook” school of accounting, it’s time for an upgrade. When you make and track purchases via credit cards, you’ve got a whole army of accountants working for you. Balding, bespectacled types whose idea of fun is Sudoku on a Sunday morning. Apart from saving you a few hours, their records can be used as evidence against fraud, to track your prime expenditures, and to draw attention to leaks in your budget.

It beats staring at your scribbling and saying “I spent most of the money on Doritos. I think.”

"About your accounting methods. It's not the level of…detail…that's the issue."

But Aren’t Credit Cards Dangerous?

Yeah, but so are Q-Tips if you shove them in too deep. As with most things, the golden rule applies: Don’t go too far and you’ll be fine. Credit cards have a lot of tangible benefits; not using them for fear of bankruptcy is like hand-sawing everything because power tools are dangerous.

Use sites like SmartCredit when picking a card. This aggregates information on all the cards, so you can be sure to pick one that fits.

Image Credits:

Meddygarnet, Obvio171, Rolling Okie, benoit.mortgat, UggBoy, Foxtongue, Wonderlane

How has NOT having a credit card ever inconvenienced you? Comment and let us know!

Get more Personal Finance tips and tricks on www.MoneySmart.sg

Click to Compare Singapore Home Loans, Car Insurance and Credit Cards on our other sites.

More From MoneySmart