9 undervalued stocks to watch in the MSCI Singapore Index: KGI

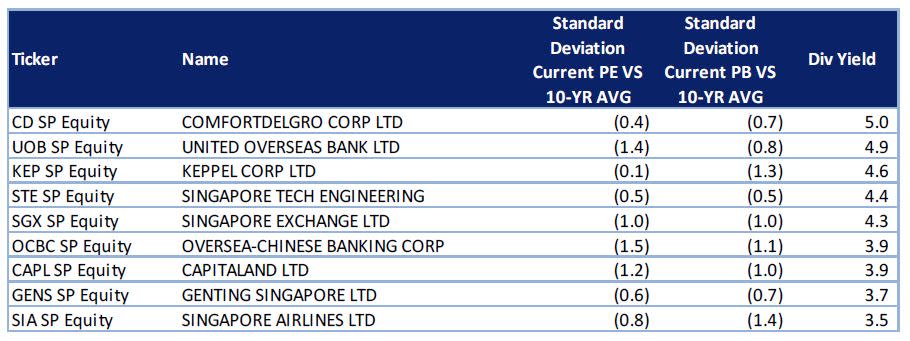

SINGAPORE (Dec 18): KGI Securities has highlighted nine stocks in the MSCI Singapore Index that are currently undervalued, even as they each offer a FY18 dividend yield of more than 3.5%.

According to KGI, the nine stocks – ComfortDelGro Corporation, United Overseas Bank (UOB), Keppel Corporation, Singapore Technologies Engineering (ST Engineering), Singapore Exchange (SGX), Oversea-Chinese Banking Corporation (OCBC), CapitaLand, Genting Singapore (GENS), and Singapore Airlines (SIA) – are trading below their 10-year price-to-earnings (P/E) and price-to-book (P/B) averages.

“We believe that they offer limited downside risks while paying an attractive dividend yield,” says analyst Joel Ng in a report on Tuesday.

Consisting 25 constituents, the MSCI Singapore Index is designed to measure the performance of the large- and mid-cap segments of the Singapore market. The index covers approximately 85% of the free float-adjusted market capitalisation of the Singapore equity universe.

“70% of MSCI Singapore stocks are trading below their 10-year P/B average while 60% are trading below their 10-year P/E average,” says Ng.

ComfortDelGro Corporation

All eyes are whether ride-hailing entrant Go-Jek will wage a price war against incumbent Grab, and how this renewed competition in the private hire car space will affect ComfortDelGro’s taxi business.

ComfortDelGro posted a 2% drop in earnings to $78.5 million for the 3Q ended September, mainly due to lower dividends received from its overseas subsidiary, Cabcharge Australia.

Revenue for the quarter grew 8.5% on-year to $967.9 million, driven by increased contributions from new acquisitions.

See: ComfortDelGro posts 2% lower 3Q earnings; to set up new US$100 mil global VC fund

As at 12pm on Tuesday, shares in ComfortDelGro are trading 2 cents lower at $2.12, some 15.5% lower than its 52-week high of $2.51 on Jun 5.

United Overseas Bank (UOB)

In 3Q18, UOB reported a 17% increase earnings to $1.04 billion, driven by double-digit growth in net interest income and lower allowances.

Net interest income rose 14% to $1.60 billion from healthy loan growth and a net interest margin uplift of two basis points to 1.81%. Total allowances more than halved to $95 million, largely due to high allowances provided for impaired loans from the oil and gas and shipping sectors in 3Q17.

As at 12pm on Tuesday, shares in UOB are trading 56 cents lower at $24.36, some 19.2% lower than its 52-week high of $30.14 on Apr 30.

Keppel Corporation

Keppel Corp saw its earnings sink by 15% to $226 million in the 3Q18 earnings ended September, mainly due to lower contributions from the investments and property divisions.

However, the conglomerate put in stronger performance in the infrastructure and O&M divisions, which registered a net profit of $2 million, after losses in the preceding three quarters.

3Q18 group revenue came in at $1.3 billion, 20% lower than the $1.6 billion registered a year ago.

As at 12pm on Tuesday, shares in Keppel Corp are trading 8 cents lower at $6.02, some 32.1% lower than its 52-week high of $8.86 on Jan 29.

Singapore Technologies Engineering (ST Engineering)

ST Engineering reported a 5.3% increase in 3Q18 earnings to $134.6 million, as revenue rose 1% to $1.63 billion on the back of higher contributions from the group’s Aerospace and Electronics sector.

Gross profit edged up by 1% to $342.6 million in 3Q18, despite higher cost of sales at $1.28 billion.

See: ST Engineering posts 5% increase in 3Q earnings to $135 mil

As at 12pm on Tuesday, shares in ST Engineering are trading 6 cents lower at $3.46, some 6.0% lower than its 52-week high of $3.68 on Apr 19.

Singapore Exchange (SGX)

SGX reported 1Q19 earnings of $91.1 million, 0.4% higher than a year ago, while earnings per share remained unchanged from a year ago at 8.5 cents.

Revenue for 1Q19 came in 2.2% higher at $208.9 million, compared to $204.5 million a year ago.

See: SGX reports flat 1Q earnings of $91.1 mil on slight rise in revenue

As at 12pm on Tuesday, shares in SGX are trading 11 cents lower at $7.13, some 16.0% lower than its 52-week high of $8.49 on Jan 23.

Oversea-Chinese Banking Corporation (OCBC)

OCBC reported earnings of $1.25 billion for 3Q18, an increase of 12% from a year ago, driven by a 23% rise in profit from banking operations.

Net interest income grew 9% to $1.51 billion in 3Q18, led by broad-based growth in customer loans of 10% and a 6 basis points rise in net interest margin (NIM) to 1.72%.

The increase in NIM was driven by improved margins in Singapore, Malaysia and Greater China, and a higher average loans-to-deposits ratio.

See: OCBC reports 12% rise in 3Q18 earnings to record $1.25 bil

As at 12pm on Tuesday, shares in OCBC are trading 21 cents lower at $11.13, some 20.3% lower than its 52-week high of $13.96 on May 2.

CapitaLand

CapitaLand reported a 13.6% increase in 3Q18 earnings to $362.2 million, even as revenue for the quarter dropped by 16.9% to $1.26 billion. The decline in revenue was mainly attributable to lower contributions from the group’s development projects in Singapore and China.

Gross profit rose 15.3% to $583.7 million during the quarter, as cost of sales decreased by 33%.

See: CapitaLand posts 14% increase in 3Q earnings to $362 mil on lower costs and expenses

As at 12pm on Tuesday, shares in CapitaLand are trading 2 cents lower at $3.13, some 19.1% lower than its 52-week high of $3.87 on Jan 30.

Genting Singapore (GENS)

Genting Singapore reported a 46% rise in 3Q18 earnings to $210.4 million ago on lower operating expenses, as revenue rose 1% to $639.1 million.

Operating profit rose 17% to $265.1 million as other operating expenses fell 97% to $1.2 million and other operating income rose 17% to $22.3 million.

See: Genting Singapore reports 46% rise in 3Q earnings to $210.4 mil on lower operating expenses

As at 12pm on Tuesday, shares in GENS are trading 1.5 cents lower at 98.5 cents, some 29.1% lower than its 52-week high of $1.39 on Jan 24.

Singapore Airlines (SIA)

SIA saw it earnings plunge 81% to $56.4 million in 2Q19, mainly due to a 40% jump in fuel prices.

Revenue for the quarter increased to $4.06 billion, as the flagship carrier reported a 4.2% increase in revenue on the back of passenger carriage growth.

See: Singapore Airlines 2Q earnings fall 81% to $56.4 mil on higher fuel prices

As at 12pm on Tuesday, shares in SIA are trading 6 cents lower at $9.39, some 20.2% lower than its 52-week high of $11.76 on May 28.