Asia's largest gaming expo opens in Macau

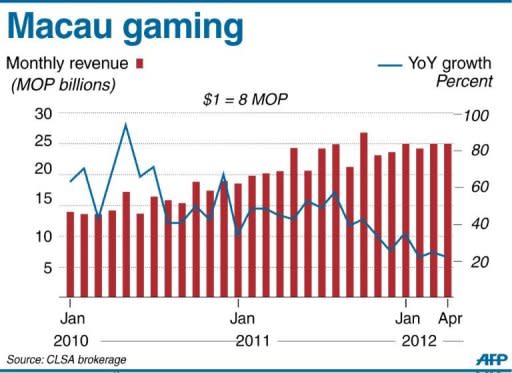

Casino industry leaders met in the world's richest gambling hub of Macau on Tuesday for the Global Gaming Expo Asia, a three-day feast of gambling innovations, at the glitzy Venetian Macau hotel. The largest gaming event in Asia, showcasing the industry's latest products, services and technologies, is taking place amid slowing Chinese economic growth and concern about a potential glut of gambling resorts in the region. The sector has boomed in Asia over the past 10 years, led by the former Portuguese colony of Macau which now generates five times the gambling revenue of Las Vegas thanks mainly to high-rolling Chinese VIPs. Singapore, the Philippines and Vietnam are staking their claims to regional market share, with several mega-resorts in the pipeline. Industry leaders said Asia's huge appetite for gambling would sustain the casino building boom despite the cooling Chinese economy, which is expected to grow by 7.5 percent this year from 9.2 percent in 2011. "This is the first time really since the opening of the expo that we have seen a downturn in economic growth" in China, said Frank Fahrenkopf, president of the American Gaming Association, which organised the event. "But we have to put it in perspective... 7.5 percent growth is still pretty good, so I would not expect in the immediate future a really negative impact." Gaming revenue growth in Macau has fallen from the stunning highs of the past two years, and the city's casino operators have watched their companies' shares tumble on the Hong Kong stock exchange since the end of April. Standard & Poor's ratings agency last week warned of "medium-term risks" for Asia-Pacific gaming companies, notably those in Macau and Singapore, from billions of dollars in new casino supply proposed over the next five years. It asked whether the Chinese gambling market could fill the huge integrated resorts -- all-in-one playgrounds of casinos, hotels and luxury retail space -- that are earmarked for construction from Macau to Manila Bay. Earnings growth would moderate over the next 12 months, while remaining "robust", the agency said. Shares in Galaxy Entertainment, Wynn Macau and Sands China have each fallen about 20 percent since the end of April, in a broadly weaker market. Galaxy chief financial officer Robert Drake said the "vital signs in Macau are very strong". "We're very pleased with the financial results this year ... it's more the macro effect coming out of Europe that's having an impact as far as the share price is concerned," he told AFP. Galaxy opened an integrated resort in Macau last year which generated revenue of HK$7.2 billion ($927 million) in the first quarter of 2012. Revenue for the group was more than 130 percent higher year-on-year. University of Macau professor Ricardo Sui said the dip in China's economic growth would not hurt the country's high-wealth big spenders, who account for more than 70 percent of Macau's gaming revenue. "This kind of slowdown will not have any significant impact on Chinese saving or their propensity to consume and travel, so for Macau it will not be that significant," he said. Hong Kong-based analyst Aaron Fischer, head of gaming research at CLSA brokerage, believes the new casinos planned for Asia, far from creating a glut, will drive demand to new heights. "Referencing to Las Vegas shows that the gaming industry is a supply-driven industry in which new casino opening is needed to drive increased critical mass into the casinos," he wrote in a report released last week. There are five integrated resorts on Macau's glittering Cotai Strip -- which has boomed since the city liberalised its gaming industry in 2002 -- and that number should more than double over the next decade, he said. Six firms are licensed to operate casinos in Macau, which was handed back to Beijing in 1999 and enjoys freedoms not allowed on the mainland. It is the only place in China where casinos are legal.