What each bank is doing to help older and vulnerable people and NHS workers

Banks have set up dedicated phone lines for NHS staff and older people as they provide a raft of additional support for those most at risk during the coronavirus outbreak.

Older people can also send someone else to withdraw cash for them or give friends and family limited access to their account, while several banks have introduced the ability to cash cheques online.

The over-70s are more vulnerable than younger people to the worst effects of the virus. They have been advised to self-isolate as a precaution, but this has made it difficult for them to get access to banking.

The majority of banks are proactively contacting their most vulnerable customers to ensure they have all the help and support they need.

The industry has already taken steps, including offering mortgage repayment holidays and additional overdrafts to those who have been financially disadvantaged.

Here is what additional support is available for the most at risk. For what measures bank branches have in place see here. To find out out how to set up online banking for the first time, see here.

Barclays

Barclays said it has “identified customers that are especially vulnerable at this time and is working on initiatives to support these people”. The bank said it is paying special attention to NHS workers, financially vulnerable customers and the over-60s.

It is contacting customers it identifies as vulnerable or at risk of becoming vulnerable to ensure they can access their accounts. It also urged those who are facing hardship to get in touch.

It is prioritising NHS staff on its phone lines and is providing “virtual tea and teach” sessions to help older or vulnerable people who are not confident banking online.

It will allow a “trusted third party” access to an account on a one-off, temporary or permanent basis.

Lloyds Banking Group

Lloyds Banking Group, which owns Lloyds, Halifax and Bank of Scotland, has launched a new telephone service for the over-70s. It said its regular phone lines are “incredibly busy” and that the number of the new service is on letters sent to eligible customers.

It is also prioritising calls from NHS workers and has introduced a new system whereby a trusted person can make withdrawals on someone else's behalf, capped at £100. The individual will have to show ID in a branch and staff will then call the customer to confirm.

It urged its customers to bank digitally where possible.

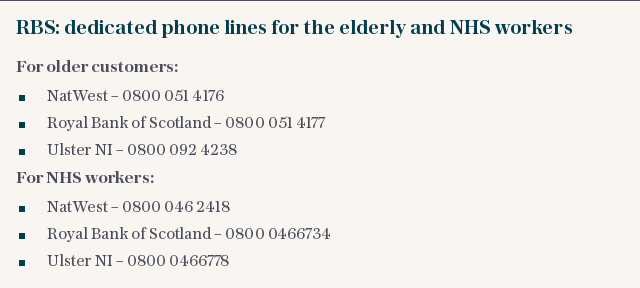

Royal Bank of Scotland

RBS said: “There are several ways we can support customers’ cash needs – and we are working to develop more options too. Customers can use ATMs, Post Offices and can call us or log into the mobile app to get a ‘GetCash’ code, which can be used to withdraw cash without a card.”

It has set up dedicated phone lines for NHS workers and the vulnerable across all of its brands – NatWest, RBS and Ulster Bank.

The numbers are listed in the box below.

Nationwide

Nationwide has determined five groups of people who could be vulnerable as a result of Covid-19. They are: people experiencing financial difficulty from a reduction in income; those unable to access their money; people experiencing disruption to travel or travel plans, those at increased risk of fraud or scams and those who have lost a loved one.

In addition to the cross-industry help for those in financial difficulty, Nationwide is introducing third-party account access and putting extra staff on its phone lines. There are also online tutorials for those who could be banking online for the first time.

The building society is also looking into how it can make registering the death of a loved one easier and is providing advice on how to avoid falling victim to scammers.

Santander

Branch staff are able to allow third parties access to customer accounts as long as the customer can confirm over the phone. These third parties will also be able to set up new payments, at the customer's instruction, although this is not done in branch.

If potentially vulnerable people do have to visit a branch, the bank said they should do so early in the day and staff will do their best to help.

Santander said: “We understand the stress and upheaval caused by the current situation and would like to reassure our vulnerable customers that we are ready to provide practical support to assist them with the banking needs.”

HSBC

A spokesman for HSBC said it is “dedicated to supporting elderly and vulnerable customers during this difficult time”.

Vulnerable customers may be referred to a specialist support team who can provide tailored assistance, including signposting to various charities.

The bank committed to finding solutions, including third-party access, for customers who are unable to bank online and said those people should get in touch.

TSB

TSB said its customers may be considered vulnerable if they have notified the bank of their mental or physical health difficulties or of difficult life events, including divorce or a serious illness. They would be flagged as vulnerable on the bank’s system with consent. TSB is also contacting older customers to offer them the same support.

The bank is in the process of contacting these customers, as well as those who it knows regularly use a branch. For those who are not confident using online service it said it would help customers give access to their friends and family.

The bank is also sending ATM cards to customers who currently only hold a passbook. Customers are encouraged to contact their local branch if they need help or support.

Metro Bank

Metro Bank said it is contacting all of its customers to inform them of support available.

It urged those who could be at risk and need to visit a branch to come at the start of the day and pointed out that the bank can be contacted by telephone.

The bank has introduced a new system whereby an individual can make a deposit of up to £1,000 a day on behalf of a customer. This will require a signed letter from the customer an the acting individual will be asked for ID.

Starling

The digital bank has launched a "connected card" for vulnerable customers. It can be given to a trusted person so that they can spend on the customer's behalf.

As always customers can do all of their banking from their mobile phone. It has also introduced a support scheme for those with an arranged overdraft who might struggle to meet repayments and is looking to offer the Government's business support loans to business customers.