Will Bitcoin replace Gold? Here’s what we think.

Over the last year, there has been a remarkable surge in the price of bitcoin. At the beginning of January 2017, the digital currency was trading at US$998. Thirteen months later, its price had increased by a factor of ten.

In the same period, gold prices have gone up by a comparatively insignificant 18%. Investors across the world are flocking to bitcoin and other digital currencies. Coinbase, a popular digital currency exchange headquartered in San Francisco, has over 13 million users.

Bitcoin is becoming increasingly mainstream in countries like Japan and Korea. In fact, Japan has amended its Payment Service Act to accommodate bitcoin. The digital currency can now be considered an asset as well as a payment method there.

However, Japanese authorities have stopped short of declaring bitcoin to be a legal currency. Korea stands at #3 in terms of bitcoin trading. Only the US and Japan have larger trading volumes.

Many analysts predict that bitcoin prices will continue to rise, with predictions reaching beyond US$300,000.

Does this mean that gold is losing its popularity? Will investors switch over to bitcoin investment in their quest for higher returns?

Difference between gold and bitcoin

Gold has been around for thousands of years. Bitcoin, on the other hand, was invented by the mysterious Satoshi Nakamoto, a mere nine years ago.

In fact, many cryptocurrency advocates believe the likes of bitcoin to be a “contemporary safe haven asset”. Benjamin Lu, an investment analyst for commodities at Phillip Futures, is less convinced.

To be sure, Lu notes that Bitcoin bears some semblance to a safe haven asset, during market uncertainties. Lu pointed out that bitcoin prices rose during both the euro debt crisis and Brexit. “This supplements market psychology assessment for bitcoin as a temporal safe haven.”

At the same time, cryptocurrencies also offer an alternate store of value in countries and governments that are troubled by economic instability.

However, Lu cautioned that bitcoin and other cryptocurrencies have a number of disadvantages. “Cryptocurrencies are relatively illiquid as large portfolio shifts have proven to be cumbersome. Bitcoin prices are also highly volatile as a 20% movement in a day is not uncommon for the digital currency.”

“As gold has a proven track record in the passage of time, digital currencies will need to develop a stronger following in time before its able to unseat the incumbent,” said Lu.

Another factor in favour of gold is that the metal has some practical use. According to the World Gold Council, a market development organisation for the gold industry, about 50% of the demand for the precious metal is from the jewellery sector. Additionally, gold is used in the fields of medicine, engineering, and electronics.

Till a few decades ago, the currencies issued by central banks were backed by gold. This created a constant stream of demand for the precious metal.

But in 1971, the US abandoned the gold standard and switched over to a system of fiat currency. Fiat currency is not backed by a physical commodity. It is instead a legal tender that is issued by a country’s government.

Does that mean that central banks around the world don’t hold gold anymore? On the contrary, they have thousands of tons of gold stored in their vaults.

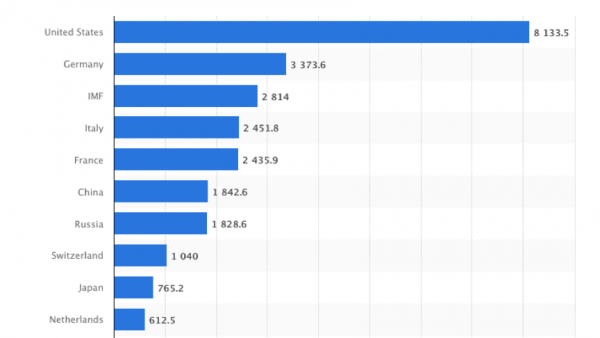

Gold reserves of the largest gold holding countries worldwide as on November 2017 (metric tons)

Source: Statista

Central banks around the world continue to build their gold reserves. In 2017, they added 371 tons to their stocks. Although that is 5% lower than the amount added in the previous year, it still represents the eighth consecutive year of net increases.

Why Gold remains in many investors’ portfolio

Lu notes that gold investment remains an essential risk diversifier for the investor’s portfolio for three reasons.

“The precious metal has a known reputation for being an effective sanctuary amidst turbulent market conditions as it allows for capital preservation. For instance, it has a tendency to spike when geopolitical tension is rife and also during difficult financial periods.”

Why is that? Investors rush to buy gold as they trust it in times of uncertainty. The increased demand can result in higher prices. This illustration prepared by Frank Holmes, the co-author of The Goldwatcher: Demystifying Gold Investing, illustrates this point very well:

Source: Forbes

The precious commodity is also effective as a hedge against inflation, says Lu. “Gold cushions the bearer against inflationary pressure. The precious metal has withstood the test of time against hyperinflation as a value store.”

Its third use lies in wealth management. “Gold’s price performance has been historically comparable against major financial asset classes. It’s long term returns have consistently outperformed bonds and soft commodities,” says Lu.

Outlook for gold prices

Will gold prices continue their upward trend in 2018? It’s difficult to make an accurate prediction about the future value of the precious metal. However, gold could get a boost if the stock market ends its bull run.

Share prices have been moving upwards for over eight years. Although there has been a market correction in February, many analysts think the stock valuations are still over-inflated. If the market enters a bear phase, investors may switch to gold. This could result in higher gold prices.

Phillip Futures’ Lu takes a more conservative stance on the commodity.

“We postulate for gold prices to stand firm through 2018 as investors will remain faithful to the precious metal. Geopolitical tensions and a persistent dollar weakness will continue to plague the markets. With the Federal Reserve being poised to tighten US monetary policy for up to 3 times this year and a softening for the precious metal can be expected during short intervals as prospect for a stronger dollar builds up.

“However, it is in our opinion that a bulging debt level along with growing trade deficit will continue to weigh in on the dollar. Thus gold prices will continue to be fundamentally relevant for much of 2018.”

So how should investors invest in gold

Investors can buy the precious metal in various ways:

Bullion dealing

Spot Gold Trading

Gold Futures or Options

“For investors who prefer tangible asset investments to be held in its material form, bullion dealing would be most suited for them,” said Lu. “For the others who prefer to avoid carrying cost, spot gold and trading on exchanges might have a stronger appeal as it allows for leveraged trading with only a marginal outlay required.”

Investors interested in spot gold trading can also trade using the MT5 platform, which offers automated trading through Expert Advisors (EA), and backtesting, where traders can test their strategies before placing a trade.

Don’t underestimate the relevance of gold

Gold’s value has remained relatively stable over thousands of years. An example provided by many financial advisors points out that at the time the Roman Empire was in existence, an ounce of gold could buy a toga. This was a wool garment measuring between 12 feet and 20 feet, which was worn by the ancient Romans. Today, an ounce of gold will get you a high-priced suit.

While this could be an apocryphal illustration about gold’s value, it does indicate that the precious metal’s value has been relatively stable for a very long time.

This article first appeared on ZUU online.

ZUU online is an Asia-based financial education online portal. Founded in Japan by Kazumasa Tomita, a former private banker at Nomura Securities, the portal seeks to fill the information gap between institutional research houses and the private investor.

(By ZUUonline)

Related Articles

- Phillip Futures on the growing success of MT5 in Singapore

- 5 Popular Forex Trading Strategies That Actually Work (even for beginners)