Bloomberg Q&A: How Chinese Stocks Got a Huge Boost From New York

China’s domestic stocks just won a significant seal of approval from MSCI Inc. The New York-based provider of financial tools agreed to include the shares in its major emerging-market indexes, accepting them after three rejections.

The move is a stamp of financial credibility and opens China to more global investment because the indexes can influence trillions of dollars held in pensions and mutual funds.

1. What’s the importance of this?

MSCI is the world’s biggest compiler of indexes, with roughly $11 trillion in assets estimated to be benchmarked to its products. MSCI’s China approval is expected to send billions of dollars flowing into the world’s second-biggest equity market as global money managers buy shares and much more over time.

Still, the symbolism of adding the mainland to the global financial community is arguably even more important.

2. So what happened?

China’s A shares will make up 0.7 percent of the benchmark MSCI Emerging Markets Index, with 222 large-cap stocks being added to the gauge, MSCI said. That will happen in two steps, the first in May 2018 and the second next August.

The weighting could increase if the country enacts further reforms, according to MSCI, which also said it might add mid-cap companies in the future.

3. Why was China rejected before and did it address concerns?

Control. Specifically, the control that China’s government has over its financial markets. MSCI previously pointed to limits on some money investors can repatriate from China as a hurdle, as well as accessibility issues for foreigners.

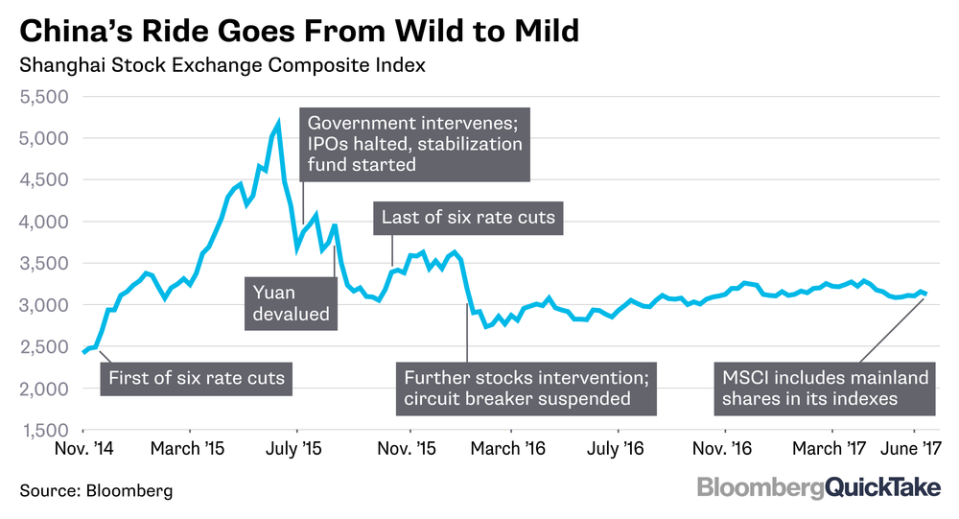

The prevalence of long-term trading halts in individual stocks — a tactic allowed by authorities to limit losses amid the 2015 stock rout — also scared money managers.

Explaining the reasons for voting “yes” this time round, MSCI said that the opening of the Shenzhen exchange link in December had improved market access for global asset managers.

China’s exchanges have also loosened pre-approval rights on financial products linked to A shares, MSCI said, and the index company is addressing the concern about trading halts by making companies that have suspended their shares for more than 50 days in the past 12 months ineligible for inclusion.

4. So investors are about to own a lot more Chinese stocks?

Not at first. The 0.7 percent allocation of yuan-denominated A shares is less than in the previous, rejected proposals. And it’s important to remember that investors tracking MSCI’s gauges already own a lot of Chinese shares — just not the domestic ones.

Chinese companies listed in Hong Kong already account for six of the ten largest companies by weighting on the MSCI Emerging Markets Index as of the end of last month, and eight of the 10 biggest by market value.

5. There’s a political aspect, too?

The inclusion of China’s $6.9 trillion stock market (about a ninth of the worldwide equity value) was seen as merited and could help power the growth of domestic companies in the years ahead.

It also represents a victory for President Xi Jinping, whose policy of “a socialist market economy with Chinese characteristics” has seen authorities in Beijing keep relatively tight control over the mainland’s capital markets while also winning international approval.

6. What’s next?

Funds that wish to perfectly mirror the rebalanced index will need to buy 222 mainland-listed stocks including distiller Kweichow Moutai Co. and appliance maker Midea Group Co. All the firms are large-cap companies that can be bought using Hong Kong’s links with exchanges in Shenzhen and Shanghai.