Captain’s Log, Oct 20: Intel Capital names 2 APAC startups in latest investment

PanenID is one of the winners of Australia’s Investing in Women initiative, MAS sets new rule for VC managers, while SoftBank already prepares next fund

China’s Horizon Robotics at the Intel Capital CEO Showcase event. Image Credit: Intel Capital

Horizon Robotics, Leapmind raises investments from Intel Capital

Intel Corporation’s global investment organisation Intel Capital today announced new investment of “more than” US$60 million in 15 startups. Of the startups in the list, China’s Horizon Robotics and Japan’s LeapMind were the only startups originating from Asia Pacific.

Beijing-based Horizon Robotics describes its service as integrated and open embedded artificial intelligence solutions of high performance, low power and low cost. It envisions smart devices such as autonomous vehicles and smart cameras to be equipped with “brains,” becoming intelligent entities that have the ability for perception, understanding and decision-making for safety, convenience, and fun.

Tokyo-based LeapMind makes learning with deep neural networks “small and compact” for easy use in any environment. With the goal to achieve “deep learning of things” (DoT), the company aims to improve the accuracy of neural network models and is researching and developing innovative algorithms to reduce the computational complexity of deep learning and original chip architectures for use in small computing environments.

As part of its “transition into a data company”, Intel invests in startups working in the different facets of data life-cycle, from analysing, capturing, managing, to securing data. The new portfolio companies are working in fields such as artificial intelligence, 3D medical visualisation, robots for retail, and cybersecurity inspired by the human immune system.

To date, Intel Capital said it has invested more than US$566 million to its portfolio companies.

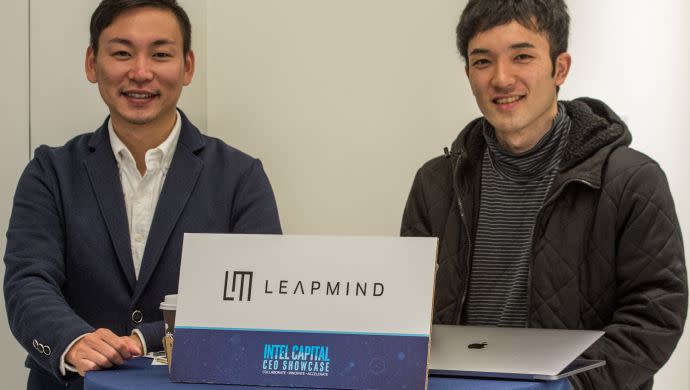

Japan’s LeapMind at the Intel Capital CEO Showcase event. Image Credit: Intel Capital

Indonesian agritech startup Panen ID gets US$25,000 Investing in Women initiative

Indonesian online marketplace for agricultural products Panen ID has been named as one of the four women-led businesses to receive US$25,000 investment from Investing in Women, a programme by the Australian Government that aims to empower small businesses led and founded by women.

Investing in Women is working together with investment firms Patamar Capital and Kinara Indonesia, who has been running an impact accelerator programme for women entrepreneurs.

The winners of Investing in Women are all participants of the accelerator programme.

Apart from PanenID, the other winners are working in the F&B industry. Ladang Lima produces gluten-free, cassava-based food products; Healthy Sunshine produces healthy snacks from organic fruits and vegetables; while Rahsa Nusantara produces traditional herbal drinks such as bir plethok and jamu in a modern and sustainable packaging.

Kinara Indonesia also named the other eight companies participating in the accelerator programme, which includes agritech startups such as Sayurbox and Eragano.

The winners of the Investing in Women programme. Image Credit: Investing in Women

MAS to simplify rules for VC fund managers in facilitating capital access for startups

The Monetary Authority of Singapore (MAS) today announced a simplified regulatory regime for managers of venture capital funds (VC managers).

Set to come into “immediate effect”, the new regulation follows a public consultation on the proposal earlier this year with industry players. It aims to simplify and shorten authorisation process for VC managers.

MAS will no longer require VC managers to have directors and representatives with at least five years of relevant experience in fund management, and they will also not be subjected to capital requirements and business conduct rules that currently apply to other fund managers.

Instead, the central bank will focus primarily on existing fit and proper and anti-money laundering safeguards under the Securities and Futures Act.

SoftBank to prepare follow-on funding to its SoftBank Vision Fund

Japanese telco giant SoftBank Group is preparing to raise a follow-on to its US$100+ billion SoftBank Vision Fund, according to Nikkei report.

Expected to be launched within the next two to three years, the second fund will also target companies working in the field of AI and IoT.

“The Vision Fund was just the first step, JPY10 trillion (US$88 billion) is simply not enough … We will briskly expand the scale. Vision Funds 2, 3 and 4 will be established every two to three years,” SoftBank Group Chairman and CEO Masayoshi Son said.

The post Captain’s Log, Oct 20: Intel Capital names 2 APAC startups in latest investment appeared first on e27.