E-Commerce Versus Bricks-and-Mortar – What can we expect from Singapore Retail REITs?

The headlines paint a dire picture; retail is dying with the advent of E-Commerce. We have seen major retail stores like Macy’s or Sears struggle. US retail Real Estate Investment Trusts (REITs) have no doubt suffered. Will the same fate await Singapore retail REITs? Our analysis tells us to expect a mixed bag. Despite signs of significant impact on demand and rents, we believe Singapore retail space is not oversaturated, and the REITs are more prepared to withstand the effects as they accommodate the necessary changes.

“Retailapocalypse” In The US?

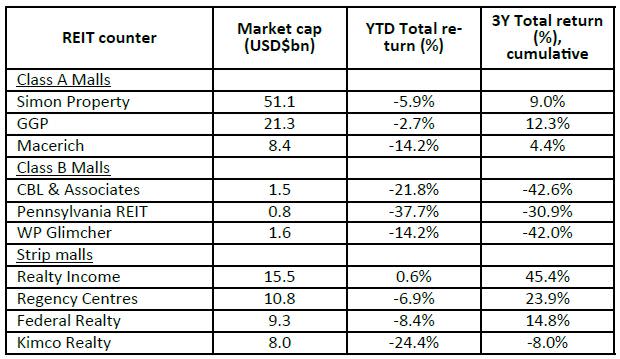

In the US, the biggest hits are taken by Class B malls. Overcapacity also had a part to play. Given E-Commerce will grow at a rate of four times compared to wider retail industry growth in the medium term (7 to 10 percent versus 2.5 percent, according to National Retail Federation), implied growth in demand for retail sales space will be cannibalised.

However, despite the headlines, plenty of retailers are not affected by E-Commerce, for example, discount retailers, personal care, and restaurants. Malls have evolved to cater more of such tenants to accommodate the need for shopper experience which e-commerce lacks, thus partially countering the threat. Also, the class of mall also should be considered as Class A malls are better insulated due to better capitalization and pricing power.

Table 1: US REIT Counters

Source: Bloomberg, PCM, July 2017

What Is In Store For Singapore?

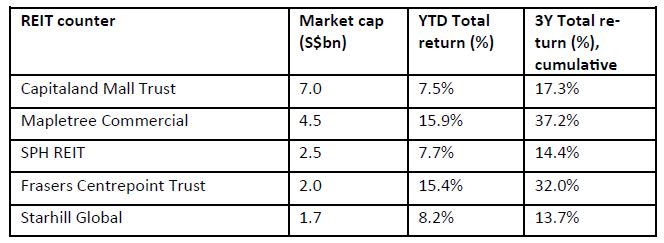

The performance of Singapore retail REITs in 2017 has been still resilient in 2017 so far. (See Table 2)

The question is whether this indicates that the fundamental situation is significantly different for Singapore retail REITs, or does this suggest that they could be prone to imminent weakness spreading from pessimism over US retail REITs?

Table 2: Singapore Retail REITs

Source: Bloomberg, PCM, July 2017

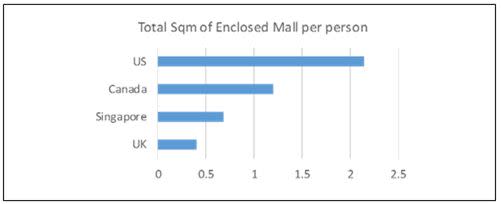

Not Much Space

Singapore retail floor space has grown at approximately half the rate that of US, and has a per capita mall space of a third of that in the US, with similar per capita income. Clearly, the US has been “over-malled” compared to rest of the world.

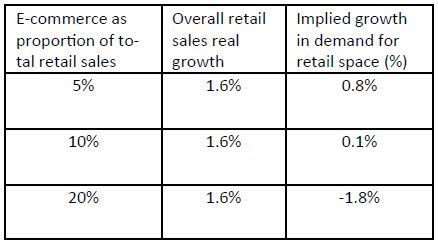

Does this mean Singapore have a better standing? Not necessarily. E-Commerce in Singapore is in a relatively nascent stage, contributing just 5 percent of total retail sales and is expected to be at mid-teens growth for next five years. Given the general retail sales growth of 1.6 percent, implied growth in demand for retail space would be sub-optimal, with a lower turning point for retail space demand turn negative due to cannibalisation.per capita income. Clearly, the US has been “over-malled” compared to rest of the world.

On the bright side, retail sales outlook should brighten due to trickle-down effects from stronger GDP growth; the expectation is for retail sales to rise 2 percent year-on-year, after falling for the last few years.

Figure 1: Square metre (Sqm) Per Capita

Source: Asia Consulting, PCA and Jones Lang LaSalle Research via the Property Institute

Table 3: Projected Cannibalisation Of Retail Space Demand

(Assuming 15 percent real growth in E-Commerce sales)

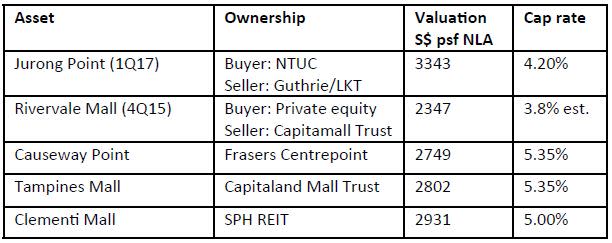

No Distress In Secondary Market

The transactions in the secondary market recently have hardly shown any signs of distress, unlike in US retail (especially Class B assets). Such valuation support is a key reason why retail S-REITs are not trading at distressed valuations. To take two recent examples (Table 4), this could probably be attributed to the strong finances of existing holders, as well as the quality of assets.

Table 4: Secondary Market Valuations Of Singapore Retail Assets

Source: PCM

Who Pays The Rent?

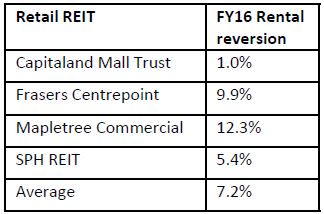

There is mixed evidence that E-Commerce has had a strong negative impact on rental rates in retail S-REITs. In other words, retail tenants are willing to pay an average rental 7.2 percent higher to renew leases compared to 3 years ago (retail leases are typically three years). This was in a 3-year period when E-Commerce in Singapore doubled their share of total retail sales to almost 5 percent.

Admittedly, the rental reversion trend has slowed significantly, particularly for CapitaLand Mall Trust, where rental reversion went from 6.3 percent in FY13 to 1 percent in FY16.

Table 5: Rental Reversions of Retail REITs

Source: PCM

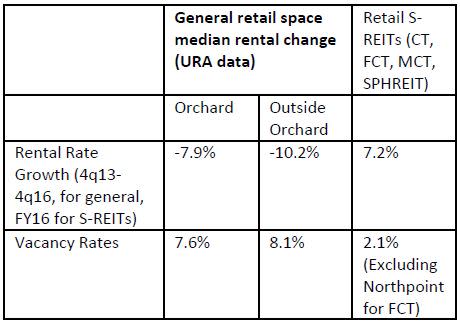

Looks Matter

REIT held malls perform better than the strata malls due to active management. (See table 6)

A big part of the reason for the discrepancy is that REIT-controlled malls are significantly more popular as they are better managed compared to strata malls, with coordinated retail concepts and mall promotions as the whole mall tends to be controlled by the REIT. In other words, asset quality should not just be seen in the hard asset, but also in the “software”.

Table 6: Rental Rate Growth and Vacancy Comparison Of Singapore REITs

Source: URA, PCM

Raising The Guards

Most retail S-REITs have rejigged their retail mix to

provide services that cannot be easily or fully replicated by E-Commerce. A key segment is in food and beverages (F&B), from where key retail S-REITs now collect at least 30 percent of their rental contributions.

F&B tenants typically pay relatively higher rents (mid-high teens $psf/mth) compared to most trade sectors, so this does not involve a significant tradeoff, though naturally there is a limit to how much further this can go. The retail S-REITs have also been cutting back on segments (for example Fashion and Electronics) which are affected by E-Commerce.

Table 7: F&B Contributions For REITs

Source: PCM, Companies

Valuations

Singapore retail REITs, generally trade poorer than average valuations on both price-to-book value and dividend yield basis compared to US REITs; We cannot say they are trading at distressed valuations. This is perhaps because there have been signs of a slowdown, but not distress, in the physical market (as we have seen above). It appears that CapitaLand Mall Trust and Starhill Global are more attractively-valued when compared to their historical trends. CapitaLand Mall Trust, in particular, might be taking the punishment for being a proxy for retail.

Table 8: Valuations of Singapore Retail REITs

Source: Bloomberg, PCM, July 2017

Last Words

Compared to US retail REITs, Singapore retail REITs will also be affected, but due to a differing market structure, the impact will not be similar. Cyclical recovery should ease some of the concerns, and despite a potential higher growth rate of E-Commerce, cannibalisation is likely to be less alarming.

Quality of asset is likely to prevail, as exemplified by Class A versus Class B malls in the US. Actively managed retail REITs should continue to see growth in income.

This is a guest post by Tan Teck Leng, a senior fund manager at Phillip Capital Management. Tan Teck Leng manages equity and asset allocation funds. His focus is investing in equities throughout Asia Pacific with particular expertise investing in the REITs asset class. Mr. Tan managed the 1st unit trust wholly investing in Singapore REITs and now manages several strategies investing in REITs in the Asia Pacific region. With 9 years of fund management experience, he is one of the few managers who hold special claim to being a specialist when it comes to investing in REITs.