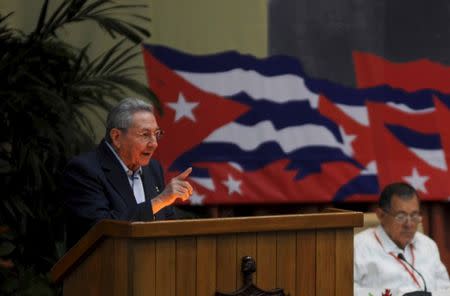

Explainer: The state of Raul Castro's economic reforms in Cuba

By Marc Frank

HAVANA (Reuters) - President Raul Castro’s efforts to modernize Cuba's Soviet-style centrally planned economy have borne mixed results, with some initiatives moving forward, others stalled and still others either scuttled or yet to begin.

The effort can best be viewed as building on policy changes Cuba initiated after the fall of the Soviet Union, for example allowing foreign investment and some mom-and-pop businesses.

Late former President Fidel Castro termed these changes "concessions to the enemy" while Raul Castro has cast them in a more positive light and said they are an indispensable part of Cuba’s future.

The ruling Communist Party says the process has been harder than expected and most of the reforms, which were first adopted at a Party congress in 2011 and then ratified in 2016, are still a work in progress.

Some of the changes that are under way, for example the development of a private sector, have been subject to constant tinkering and increasing complaints about both growing social inequality and tighter regulation.

While the 2011 reform plan prohibited the accumulation of private property, the 2016 version added a ban on “accumulation of wealth.”

Following are highlights of the most important economic changes to date:

AGRICULTURE

The government began leasing fallow state-owned land to prospective farmers in 2008. Since then the length, size and terms of leases have improved, although farmers must agree to cultivate certain crops or raise livestock for sale to the state.

Currently 151,000 people hold leases covering 1.2 million hectares (3 million acres) of land, similar to five years ago.

A sweeping agriculture reform began in 2010 and included loosening regulations on farmers to favor market forces and prices. The market reforms were reversed and the state dominated system restored in 2015 on the grounds that speculation was inflating prices.

SMALL BUSINESS

Regulations around small businesses were liberalized in 2010 as part of an effort to cut bloated state payrolls. Entrepreneurs were still categorized as self-employed rather than as business owners, however they were authorized for the first time since 1968 to hire non-family labor.

Simultaneously the state began shedding small service outlets such as barber shops and snack shops in favor of arrangements where employees would lease the premises. A pilot program authorizing non-agricultural cooperatives began in 2013.

There are 580,000 self-employed license holders, including cab drivers, tradesmen and the employees of thousands of private eateries, bed and breakfasts, and construction contractors. The private sector includes 429 cooperatives, many of them former state establishments.

STATE COMPANIES

The government began reorganizing and merging thousands of companies in 2011, even as it moved them out of the direct control of government ministries. The government aimed to make the companies more autonomous and competitive and said it would regulate and tax businesses, not manage them.

There have been numerous adjustments to regulations aimed at giving the companies, which account for some 70 percent of Cuba's economic activity, more authority over day-to-day operations, as well as how they handle excess production after meeting their production quotas and after-tax profit.

However, the government still exercises strict control through levers such as centralized planning and a monopoly on foreign trade.

PRIVATE PROPERTY

The government authorized the buying and selling of homes and cars in 2011 after a ban dating from soon after the 1959 revolution. Owners were also authorized to rent their premises. However, citizens remain restricted to ownership of one home and a vacation home and the sale of new cars, which are all imported, remains in state hands at a mark-up of on average 800 percent of the factory price.

TAXES

In 2012 Cuba adopted its first comprehensive tax code since all personal taxes were abolished after the revolution. Levies on income, property, inheritance, and fallow farmland were among those included, in addition to various contributions and fees, for example to social security.

The taxes are being gradually implemented. The majority of state workers still do not pay income tax. The self-employed, farmers and workers making more than 2,500 pesos per month, the equivalent of just over $100 and three times the average wage, do.

FOREIGN INVESTMENT

A new foreign investment law in 2014 opened up most of the economy, cut taxes by around 50 percent and provided greater flexibility in terms of majority ownership by foreign investors in ventures partnering with the state, compared with a previous law adopted in the 1990s.

In 2017 the country signed new ventures valued at more than $2 billion, around twice the amount signed during any previous year.

A China-style special development zone also opened at Mariel, just west of Havana, with further tax and customs breaks and where most projects are fully owned by investors.

(Reporting by Marc Frank; Editing by Frances Kerry)