JPMorgan (JPM) Arm Acquires Minority Stake in Kraft Analytics

JPMorgan’s JPM Asset & Wealth Management segment has purchased a minority stake in Kraft Analytics Group, a sports-focused data analytics firm. The financial terms of the deal haven’t been revealed yet. The news was first reported by Wall Street Journal.

Foxborough, MA-based Kraft Analytics, owned by Robert Kraft, has more than 20 clients including the National Football League, teams in all five major American sports leagues and college athletic programs. The firm does data management, analytics and strategic consulting across sports and entertainment.

JPMorgan sees this as a lucrative partnership and expects to cash in on the huge growth potential in sports ownership for its wealthiest clients. The company intends to utilize tons of data that flows from legal sports betting, merchandise sale, fan behavior and mobile ticketing and concession sales, among others, to advise clients/owners in generating more profitable returns.

Mary Callahan Erdoes, CEO of Asset & Wealth Management segment, in a statement said, “Sports ownership is capital intensive, and specialized analytics are essential to the deal-making process. KAGR has the technology and the all-star team to help the industry make informed decisions.”

Of late, JPMorgan has been focusing on expanding its asset & wealth management operations. Last week, through its asset management division — J.P. Morgan Asset Management — it announced the acquisition of Campbell Global, LLC, a forest management and timberland investing company. With this, the bank will become a significant supporter of blooming forests around the world.

Further, earlier in the month, at an investors’ conference, Erdoes had noted about the division looking into possible add-on acquisitions. She also stated that there has been a major rise in deal activities across the industry. JPMorgan has looked into several possible deals and the lever for an acquisition is very high.

We believe that as low interest rates continue to hurt interest income, banks including JPMorgan, Bank of America BAC, Citigroup C and KeyCorp KEY have been diversifying operations and expanding fee income sources. So, the steps JPMorgan is taking is in the right direction and will support its financials.

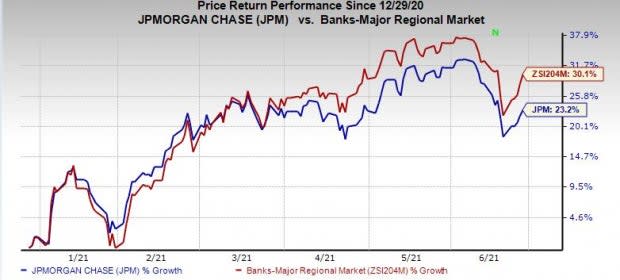

Shares of JPMorgan has rallied 23.2% over the past six months, underperforming the industry’s growth of 30.1%.

Image Source: Zacks Investment Research

Currently, JPMorgan carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bank of America Corporation (BAC) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Citigroup Inc. (C) : Free Stock Analysis Report

KeyCorp (KEY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research