Foreign domestic workers contributed $11.1B to Singapore's economy in 2018: study

SINGAPORE — Foreign domestic workers (FDWs) contributed US$8.2 billion (S$11.1 billion) last year to the Singapore economy, or 2.4 per cent of the country’s gross domestic product, a study has found.

The study, commissioned by information services company Experian and Hong Kong charity Enrich, calculated the total economic contribution of 250,000 FDWs by combining their personal expenditure, real value of “paid” domestic work and value of freed-up time.

For instance, freeing mothers to re-enter the labour force added S$3.5 billion to the Singapore economy, including savings of S$675 in monthly childcare costs per household.

The study also found that FDWs contributed to the economies in their home countries through remittances. Singapore-based FDWs remitted a total of S$1.3 billion last year.

Domestic work has been “historically undervalued” and the research shows that it is a “key contributor to economic growth, and should be valued accordingly”, it stressed.

The significant economic contribution from FDWs to the Republic was partly reflected in the high proportion of such workers in Singapore households, with one in five hiring one FDW last year.

Singapore’s dependency on FDWs - higher than Malaysia and Hong Kong - has been increasing since 2010, the study noted.

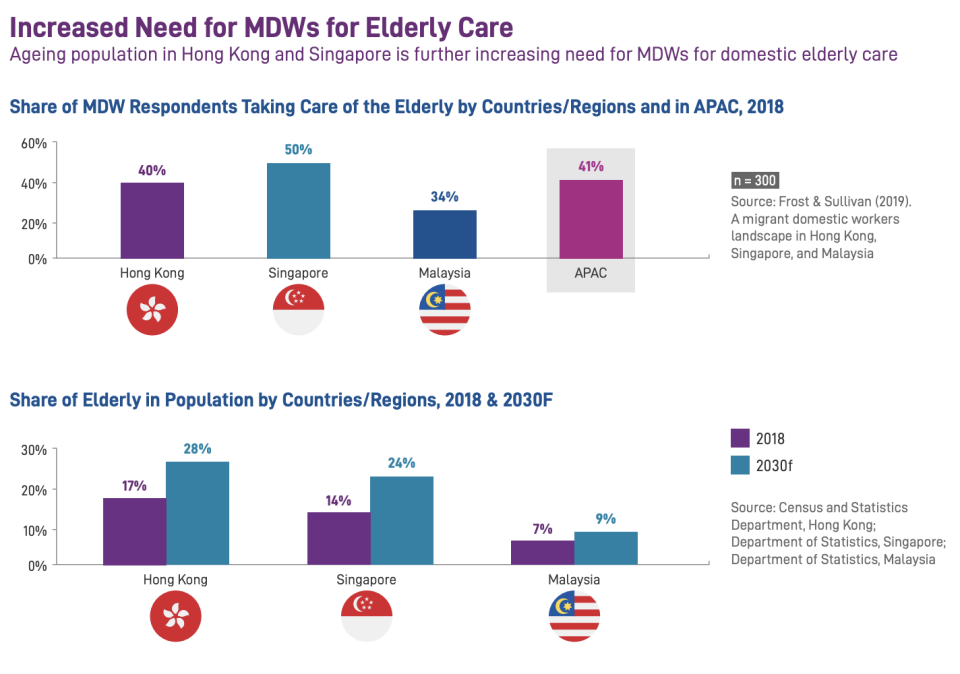

More Singapore-based FDWs also take care of the elderly (50 per cent), compared with those in Malaysia (34 per cent) and in Hong Kong (40 per cent).

Given Singapore’s greying population - with the share of the elderly residents expected to rise to 24 per cent by 2030 from 13.7 per cent last year -, the demand for FDWs who focus on elderly care is likely to grow further, the study added.

High proportion of FDWs in debt

While the workers contribute significantly to the regional economies, they are financially excluded and return home financially worse off, said the study.

One-third of Singapore-based FDWs are in debt, compared with 65 per cent in Malaysia and 83 per cent in Hong Kong.

The average size of debt among FDWs was found to be 4.5 times their monthly salaries.

High indebtedness is predominantly due to two factors: existing debts before coming to the country and loans raised against family emergencies.

The workers are further burdened with additional agency charges both in their home and recipient countries.

At the current repayment rates, the workers are likely to take an average of 28 months, 18 months and 19 months to clear their debts in Singapore, Malaysia and Hong Kong, respectively.

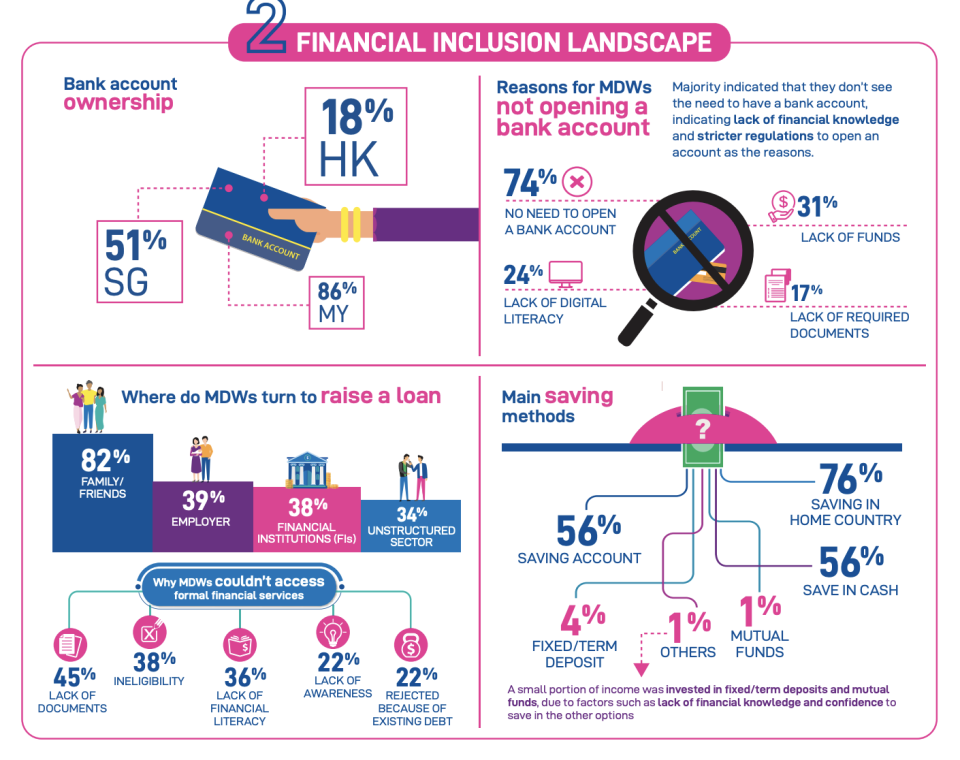

Across the region, the workers relied mainly on family and friends to get loans as they do not have access to formal financial services. The main reasons cited include ineligibility, lack of knowledge about financial services or low confidence in dealing with financial institutions.

In Singapore, 28,000 FDWs took loans from licensed moneylenders in the first half of last year, more than doubled from 12,000 in 2017 and a surge from 1,500 in 2016.

New loan caps were introduced by the Singapore government in November last year to tighten moneylending rules, with foreigners only allowed to borrow a maximum of $1,500 if their annual income falls below $10,000.

Lacking access to bank accounts

Almost half of Singapore-based FDWs do not have access to a bank account, compared with 86 per cent of those in Malaysia.

Tighter regulations in both Singapore and Hong Kong have resulted in workers keeping their salaries in cash or some of them entrusting their employers to safe-keep salaries, said the report.

However, it noted that this is changing in Singapore, with the Ministry of Manpower prohibiting employers from safekeeping their workers’ money from 1 January, and offering free bank accounts with no minimum deposit from mid last year.

Across the region, the main reason cited by workers for not opening a bank account is because they do not see the need or benefit of having them.

The study called for measures including financial literacy training and better access to financial services given that many FDWs turn to the “unstructured” sector, such as loan sharks, to borrow money instead of financial institutions, placing themselves at higher risk.

The report, conducted by market research firm Frost & Sullivan late last year, surveyed 300 FDWs across Singapore, Malaysia, and Hong Kong, and drew upon official data in the region.

Of the 100 Singapore-based FDWs surveyed, 50 were from the Philippines, 40 from Indonesia and 10 from Bangladesh.

Related stories:

Plight of abused foreign domestic workers who seek justice and shelter in Singapore

Parliament: Not beneficial to foreign domestic workers to be brought in for short-term help

Singapore’s foreign domestic workers vulnerable to forced labour, report finds

Eldercare workers in Singapore paid the lowest among 5 Asia Pacific economies: study