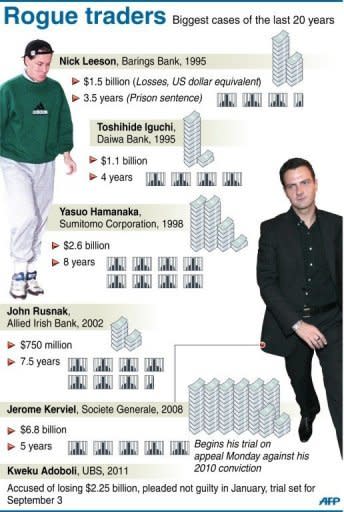

French rogue trader launches appeal, blames bank

French rogue trader Jerome Kerviel was back in court Monday arguing that he was a scapegoat and that Societe Generale must take responsibility for the billions of euros his gambles cost the bank. "I am not responsible for this loss," he said as his appeal hearing began against a 2010 conviction that gave him a three-year jail term and ordered him to pay back the 4.9 billion euros ($6 billion) he cost his former employer. "I always acted with the knowledge of my hierarchy," Kerviel, dressed in a dark blue suit and an open-necked white shirt, told the judge when asked why he was appealing his conviction over the losses incurred in 2008. Kerviel was for many a symbol of the excesses of the global financial system, which he has described as a "big banking orgy", and even became a cult hero in France. The 35-year-old from a small village in Brittany did not profit personally from his unauthorised 50 billion euros of uncovered bets on futures markets, which cost the bank 4.9 billion euros to unwind and which nearly ruined it. He has not served any jail time since his October 2010 conviction for breach of trust, forgery and entering false data into computers during the covert stock market deals. Kerviel, who faces up to five years in prison if the court upholds the conviction, has consistently argued that his superiors knew what he was doing and turned a blind eye as long as he was making them a profit. His lawyers have promised they will prove at the appeal hearing that Societe Generale knew that Kerviel was going far beyond his mandate with risky bets and that the bank could therefore not claim to be an innocent victim. French regulators fined the bank four million euros for failures in its internal risk management systems following the Kerviel scandal. Kerviel, who told the court he was currently unemployed and had no source of income, has admitted regularly exceeding trading limits and logging false transactions to cover his gambles, but says this was common practice. Societe Generale management has argued it knew nothing of what Kerviel was up to. The former head of the bank, Daniel Bouton, was due to appear at the appeal hearing on June 21. The hearing is set to last until June 28. The judge at the original trial said 140,000 jobs at Societe Generale had been endangered by Kerviel's actions. Two months ago, Kerviel changed his lawyer, hiring David Koubbi, who has launched two countersuits against the bank. One accuses the bank of manipulating secret recordings to make it appear that the trader's superiors were unaware of his activities. The other says that while Kerviel was ordered to repay the money he lost, the firm has already been repaid a third of the sum in the form of a tax write-off. Societe Generale, which said in 2010 that it would spare Kerviel from paying the full compensation, has hit back with two suits for malicious falsehood. Since the Kerviel case exploded, banks have insisted that internal safeguards have been reinforced to prevent a repeat, but fresh trading scandals continue to erupt. In 2011 a London-based trader was charged with fraud after losing Swiss bank UBS $2.25 billion, while US bank JPMorgan is recovering from more than $2 billion in derivatives trading losses, Those losses were blamed on another French trader, Bruno Michel Iksil, nicknamed the "London Whale" and "Voldemort" -- after Harry Potter's evil nemesis.