Get the Guru View: No one’s home

Vacancy rates in the Core Central Region have recovered somewhat since crossing the 10 percent mark, but remain elevated.

When examining the rental market, the vacancy rate is often overlooked. In this edition of the Guru View, we go into deeper detail into this statistic and explain why it is a key figure for landlords to look at.

By Chang Hui Chew

One of the biggest reasons why real estate in Singapore is such a popular topic is because of the potential to earn passive income to supplement one’s monthly salary. In general, there are two forms of returns for property investments – rental yield and capital gains.

Rental yield is what one earns from the rent paid by tenants after subtracting the costs of holding the property, while capital gains is the profit one makes after selling the property. In general, Singapore property is understood to provide low or no rental yields, with the exception of HDB rentals, but decent capital appreciation if the property owner has adequate holding power.

Unlike many other property markets here in Southeast Asia, Singapore real estate is not a market for nipping activity, i.e., buy and sell within a short time period to earn quick returns. As such, the key for those who wish to use property to grow their wealth is to have holding power. For those who rely on rents to offset or even entirely pay off their mortgage and other costs of holding like the monthly maintenance fee, a key statistic to pay attention to is the vacancy rate.

In this edition of the Guru View, we go into deeper detail on Singapore’s private residential vacancy rate, and examine the factors behind it.

What is the vacancy rate?

Essentially, the vacancy rate is the percentage of completed homes that are not occupied, either by the owner or by tenants. The state gathers this information by looking at whether or not the utilities for the unit are active, and publishes this on the Urban Redevelopment Authority’s (URA) website.

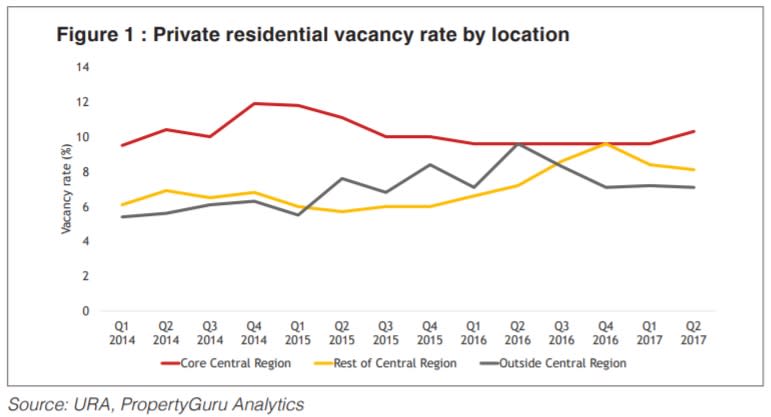

Figure 1 shows the trendline for the vacancy rate for private residential properties by location.

The vacancy rate for the Core Central Region (CCR) reached a high of 11.9 percent in Q4 2014, and remains relatively high at 10.3 percent as of Q2 2017. However, rates in the Rest of Central Region (RCR) and Outside Central Region (OCR) have not crossed the 10 percent mark over the period analysed. At the same time, both the OCR and RCR have come off their highs and stand at 7.1 percent and 8.1 percent respectively.

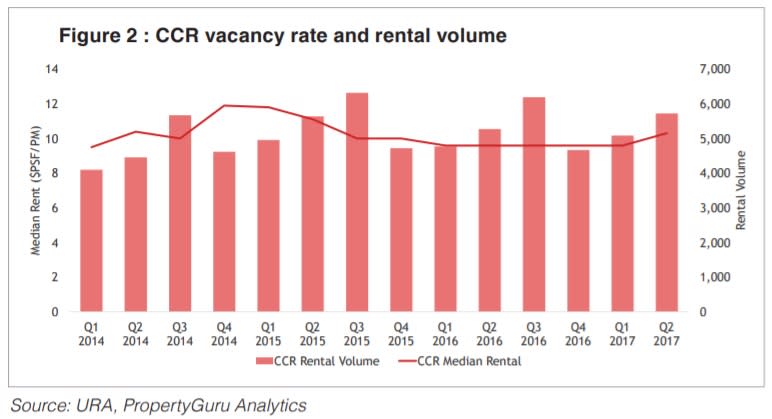

Rental volumes have not declined significantly despite vacancy rates going up. Figure 2 demonstrates the quarterly rental volume and vacancy rate in the CCR. All else being equal, when the rental volume increases, we should see the vacancy rate decline. However, this has not happened, particularly from 2015 onwards. For instance, in the first two quarters of 2017, both rental volume and vacancy rates have climbed at the same time.

Explaining the vacancy rate

There are a couple of reasons for this. The first is an increase in supply that has yet to be absorbed by the market. A glut of land sales and exuberant en blocs earlier this decade before the government reduced the number of land sales and implemented property cooling measures led to an excess of new projects that completed around 2015 and after. An increase in supply definitely played a part in the vacancy rate remaining high.

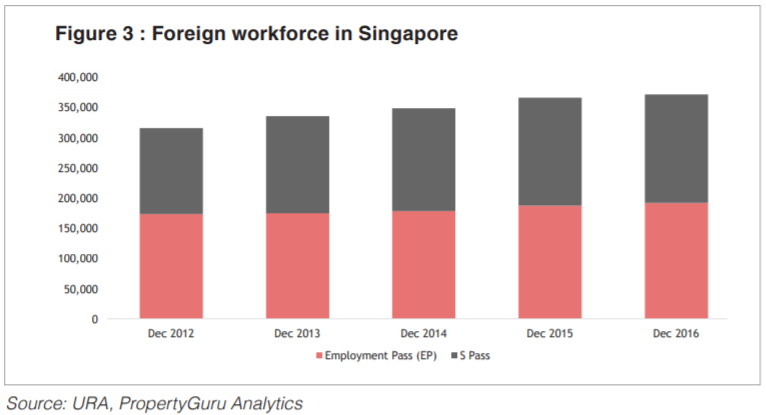

At the same time, rental demand has declined, which has made it difficult for the existing rental stock to be absorbed. Figure 3 indicates the skilled foreign workforce in Singapore, which has slowed in growth over the past years.

Private residential landlords are also facing additional pressures as expatriate salaries are localised, with housing allowances reduced or removed altogether. This has led foreign workers to shift from renting in the private market, to renting HDB flats. Last year saw a record number of HDB subletting approvals – 44,530 – compared to 41,531 in 2015, and 36,228 the year before.

Given these pressures, landlords have had to reduce rents.

Why this matters to landlords

Those looking to rent out their units should pay attention to the vacancy rate because it gives an indication of how difficult it is to rent out their units, and if the market favours tenants or landlords.

A higher vacancy rate suggests that it would take a longer time to tenant the unit, which should indicate to landlords that they will need to be responsible for the entire cost of ownership while the unit remains untenanted. Those considering investment properties and are likely to have cashflow issues if they are unable to tenant the unit within six months should reconsider if this is the time to enter the market.

At the same time, higher vacancy rates also indicate that the market favours tenants, and landlords should be prepared to offer concessions to rent out units. Common sweeteners that landlords can offer include shorter lease terms, offering to foot the cost for certain furnishings and appliances, and of course, reducing the rent.

In general, vacancy rates above seven percent are considered problematic.

Should landlords worry

Current landlords do have a cause for concern. The government is unlikely to increase the number of expatriates and foreign workers coming in, which negatively impacts rental demand. At the same time, a weaker economic outlook, especially in the banking and oil and gas sectors, might lead to tenants leaving the country, or seeking lower cost rentals as their belts tighten.

Given this, those who are currently holding on to investment properties should be prepared to offer concessions to keep the unit tenanted, or to attract fresh tenants. Alternately, landlords could re-think their rental strategy and sublet into individual room rentals rather than renting out the unit entirely to provide themselves with more options.

This article was first published in the print version PropertyGuru News & Views. Download PDFs of full print issues or read more stories now! | |||