Get the Guru View: Tightened supply for ECs in 2017

Crowd viewing a model of the Treasure Crest EC.

2016 was an interesting year for the EC market, with a number of projects doing extremely well due to its sound fundamentals. While the glut of units in the market has been reduced, more time is needed for the current supply to be absorbed.

By Chang Hui Chew

For this analyst, executive condominiums (ECs) are one of the most fascinating property classes in Singapore. A unique public-private hybrid, ECs allow homeowners to own a product that is similar in terms of amenities and lifestyle to private condominiums, but at a lower price point, and with the ability to use government grants for their purchase.

At the same time, homeowners face restrictions similar to that of HDB flat owners, which prevents them from renting out or selling their units immediately upon completion.

In this edition of the Guru View, we examine the performance of this public-private housing hybrid, and see what is likely to happen in the year ahead.

Stock and supply

2017 is going to be an interesting year for ECs. Together with the over 4,500 units completed in 2016, the end of this year should see over 7,400 units complete (refer to Figure 1). However, in the earlier half of this decade, the government was rather enthusiastic in releasing EC land sites, and developers in turn bid aggressively for the plots.

Coupled with a more restrictive mortgage servicing ratio (MSR) of 30 percent, part of the suite of cooling measures to curb inflating property prices, the EC market was in much of a state of oversupply from 2014.

In Q3 2014, EC vacancy rates rose to 16.2 percent, a record high (refer to Figure 2). In general, a vacancy rate above 10 percent is considered high. Since then, it has declined, albeit in part due to seasonal factors. The most recent reported vacancy rate for the property class is from Q3 2016, at 10.8 percent, a slight year-on-year increase from Q3 2015’s 10.5 percent.

To reduce the supply in the market, and to give current stock a chance to clear, the Singapore government has been reducing the number of EC land sites released. In 2016, only two EC sites were launched, with both subsequently won by Hoi Hup. In comparison, there were three EC land sales in 2015, which was already down from the seven sites that entered developers’ land banks in 2014.

The state has not put up any EC land on the confirmed list in the Government Land Sales (GLS) programme for H1 2017. There is only one EC site on the reserve list, located at Sumang Walk. This means that a developer would need to agree to a reserve price stipulated by the government, before it can be triggered for sale. This is another sign of the government moving to restrict the supply of ECs in the market.

Given that the Singapore government has reiterated that measures which enforce financial prudence, such as Total Debt Servicing Ratio (TDSR), are here to stay, it is definitely a good sign for the overall EC market that the supply of units has been tapered, to help bring some equilibrium into the situation.

Volumes and prices

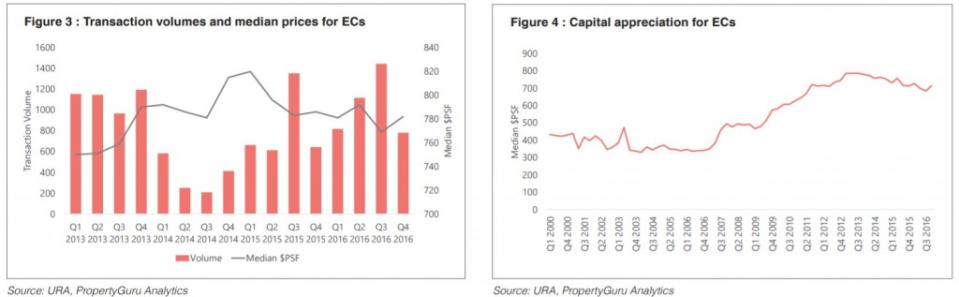

In 2014, transaction volumes for ECs dipped quite sharply on the back of cooling measures and overall weak sentiment in the real estate market.

When the government announced that it was raising the income ceiling for purchasers of ECs in 2015’s National Day Rally, volumes saw a surge – over 120 percent quarter-on-quarter, and an increase of 500 percent compared to the same period a year before (refer to Figure 3). While a number of launched EC projects, namely, Sol Acres, The Brownstone, Bellewaters and The Vales saw decent sales in that quarter, the market’s momentum did not carry over into the subsequent two quarters.

This suggests that there were a number of buyers who were sandwiched between ECs and private condos who took the opportunity to purchase a product that they felt was perhaps more financially prudent and affordable. At the same time, a number of savvy developers also took advantage of the revised income ceiling and ran promotions to entice buyers back into their showflats.

Over the last 12 months, we saw even more consumers return to showflats and volumes have picked up. Out of the 16 quarters examined for this article, Q3 2016 saw the highest volume of EC units moved, with Sim Lian’s project, Treasure Crest, topping the ranks.

When PropertyGuru reviewed Treasure Crest, we found that on a psf level, Sim Lian had priced the project competitively over other ECs in the area. A plethora of schools in the vicinity, an approximately 10-minute walk to Sengkang MRT station, as well as easy access to Cheng Lim LRT station, sweetened the value proposition for buyers as well.

Given the nature of Singapore’s property market, which remains one of the world’s priciest despite the imposition of cooling measures, buyers are incredibly price sensitive. Figure 3 demonstrates that a number of peaks in volume were coupled with troughs in prices, supporting the idea that it is pricing ultimately, that will sway buyers and lead them to open their cheque books.

However, buyers of ECs should note that they should not hold out too much hope that developers will reduce their prices in order to move units. In general, EC developers have rather tight margins, and it is hard for them to budge on pricing. What buyers should look out for are developers who bought the land at lacklustre prices, who are then able to pass on those cost savings.

Capital appreciation potential

Conventional wisdom behind the continued popularity of ECs is that one buys at a lower price point, but that will in time, catch up to the private market. After all, there are few actual differences in value propositions between mass market private condos in the suburbs and ECs, but the entry price points are rather different.

As such, we took a sample of older ECs across a number of districts to examine their capital appreciation (refer to Figure 4).

If one had bought at the absolute trough of the market over the period examined (Q2 2001), and sold at the peak (Q3 2013), you would be looking at a simple appreciation of 10.3 percent per annum, or a compound annual growth rate (CAGR) of 6.93 percent.

In contrast, if a homeowner had purchased at the start of the millennium in Q1 2000 (a relatively upbeat market) and sold the property in Q4 2016 when sentiment was far from bullish, he or she would be reaping a simple annual return of 3.9 percent, or a CAGR of 3.0 percent. Even if the homeowners did not manage to time the market properly, they would have still seen a good return on their investment.

Some older ECs, such as Bishan Loft, continue to see a good degree of popularity and interest, as well as rising prices, more than a decade after their completion. This is likely due to strong fundamentals, such as its location.

For those looking to use property to grow their wealth, ECs are a good option because of lower barriers to entry, while returns remain healthy. At the same time, savvy home buyers can also use the savings from purchasing an EC over a private condo and invest in non-property assets, diversifying their portfolio. What homeowners need to consider, however, is that unlike investing in private property, they need to hold the property for a longer period before reaping any returns, due to the Minimum Occupation Period (MOP).

Coming up in 2017

There are two likely EC launches in 2017. One is a site that Hoi Hup won in 2016, located along Yio Chu Kang Road and close to Hougang Avenue 9. The other is a site that Qingjian Realty was awarded in August 2015, located along Choa Chu Kang Avenue 5.

The Choa Chu Kang site is located about a six minutes’ drive or bus ride from Choa Chu Kang MRT station. Market sources suggest that the project will be named iNZ Residences, and will be launching sometime in the first half of the year. The bid price was $295.12 psf per plot ratio (psf ppr).

In contrast, Sim Lian had bid $361 psf ppr for the Wandervale site in 2014, which commanded a premium due to the location being within walking distance to Lot One Shoppers’ Mall and the MRT station. At launch, the guide price for a three-bedroom unit at Wandervale was approximately $765 psf, and it had cleared approximately 93 percent of its units by the end of 2016.

Meanwhile, Hoi Hup has indicated that the Yio Chu Kang site is likely going to be launched in the second half of 2017. When they won the bid, Hoi Hup revealed that they were likely to price the project at around $800 psf, as their estimated breakeven cost was above $700 psf. The project will be within walking distance to Rosyth School, which is likely to attract parents of younger children.

Hoi Hup also successfully won the Anchorvale Lane site in September 2016. However, given that developers have to wait 15 months between the award of the land tender and the sales launch for ECs, the launch is likely to be pushed to early 2018.

This article was first published in the print version PropertyGuru News & Views. Download PDFs of full print issues or read more stories now! | |||