HDB launches first flat sale whereby buyers can benefit from higher income ceilings, new grant

SINGAPORE – The first sales exercise of HDB flats whereby buyers can benefit from the higher income ceilings and Enhanced Central Provident Fund (CPF) Housing Grant was launched by Housing and Development Board (HDB) on Wednesday (11 September).

A day after Minister for National Development Lawrence Wong announced the new measures, HDB launched 4,089 flats for sale, comprising 3,373 Build-To-Order (BTO) flats and 716 re-offered balance flats (ROF).

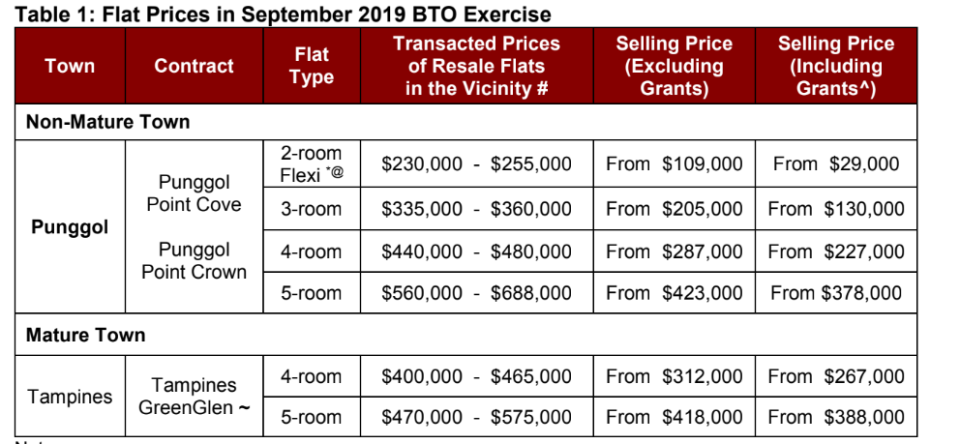

The 3,373 BTO flats on offer are spread across three projects: Punggol Point Cove, Punggol Point Crown and Tampines GreenGlen. They range from two-room Flexi to five-room flats.

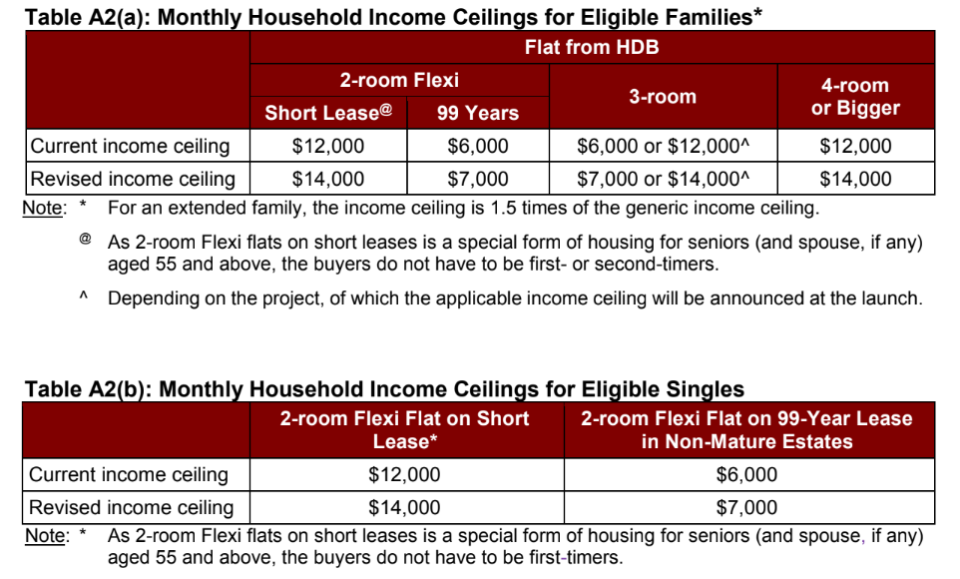

With effect from Wednesday, the monthly household income ceiling for eligible families buying flats from HDB has been raised from $12,000 to $14,000. For eligible singles, the income ceiling has been raised from $6,000 to $7,000.

EHG to replace current housing grants

HDB has also introduced an Enhanced CPF Housing Grant (EHG) to replace the Additional CPF Housing Grant and Special CPF Housing Grant, available to eligible first-timers buying new or resale flats, regardless of flat type and location.

Eligible first-timer families with a monthly household income of up to $9,000 will be able to enjoy the EHG of up to $80,000, when they buy a flat that can cover them and their spouses to the age of 95.

For those who do not meet this condition, the amount of EHG that they can enjoy will be pro-rated.

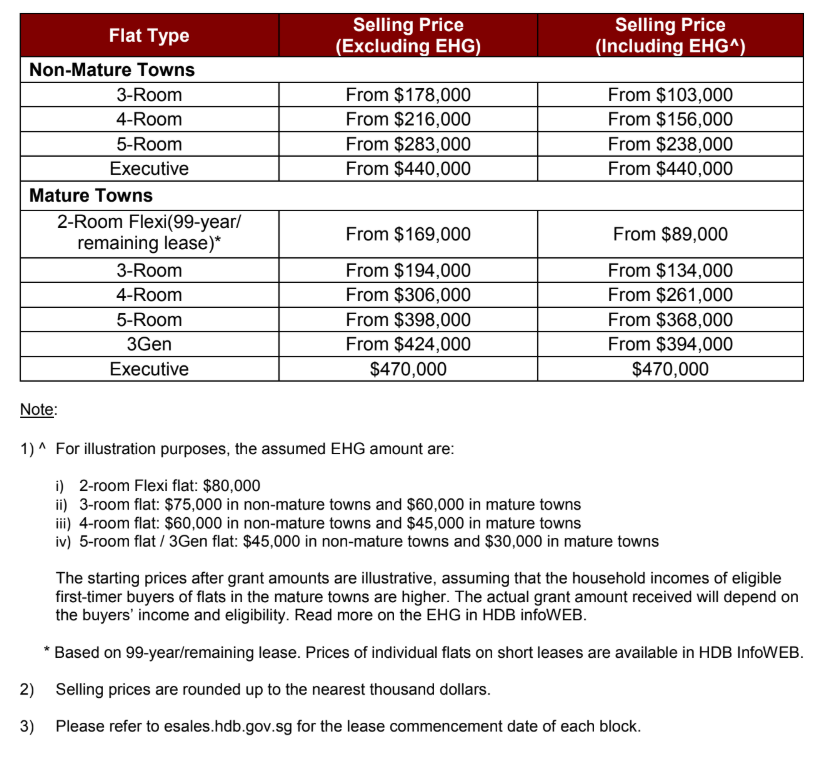

With the enhancements, those buying a five-room flat in non-mature towns or a flat in the mature towns can receive more housing grants. The flat prices in this sales launch, and the indicative prices after factoring in the EHG, are shown in the table below.

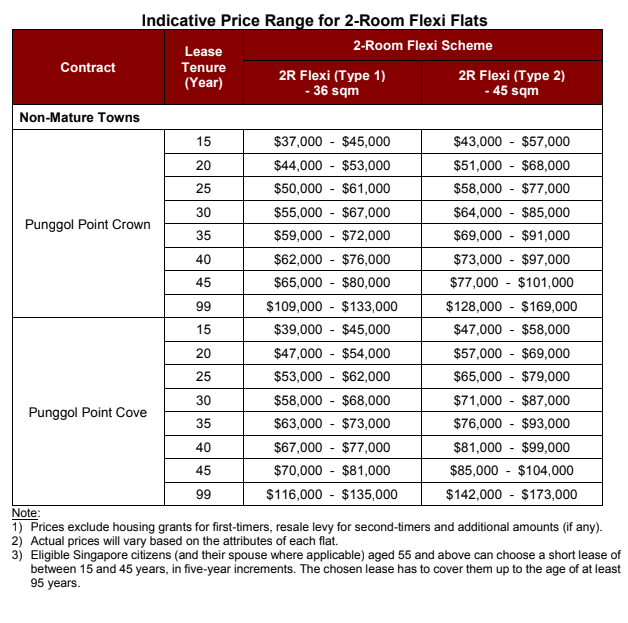

In addition, two-room Flexi flats on short leases are priced taking into account the different leases, as shown in the table below.

716 ROF flats across various towns/estates

In addition to the BTO flats, HDB will re-offer 716 flats which have remained unselected from the November 2018 Sale of Balance Flats exercise.

They comprise 268 two-room Flexi units, 202 three-room units, 90 four-room units, 49 five-room units, 104 3Gen units and three Executive flats across various towns and estates.

About 12 per cent of these flats are completed. The selling prices of these flats are as below:

HDB will set aside at least 95 per cent of the flat supply for first-timer families and up to 5 per cent for second-timer families. The elderly may apply if they meet the eligibility conditions to buy a two-room Flexi flat on short lease.

Application period from 11 to 17 Sept

Application for the flats offered in the September 2019 BTO and ROF exercises can be made online on HDB InfoWEB from 11 to 17 September. Applicants can apply for a flat under either the BTO or ROF exercise, but not both.

If they apply for a BTO flat, they must select only one flat type in one town or estate. If they apply for a ROF flat, they do not have to indicate flat type and town or estate, as ROF applicants book a flat from the available units according to their balloted queue position, subject to eligibility and ethnic quota.

Those who wish to take up an HDB housing loan for their flat purchase need to produce a valid HDB Loan Eligibility letter when they book a flat. Young couples who are eligible for deferment of income assessment do not need to do so.

There will be another sales exercise in November, when HDB will offer about 4,500 BTO flats in Ang Mo Kio, Tampines and Tengah. In February 2020, it will offer about 3,000 BTO flats in Sembawang and Toa Payoh.

Related story:

HDB unveils higher grants and household income caps for buyers