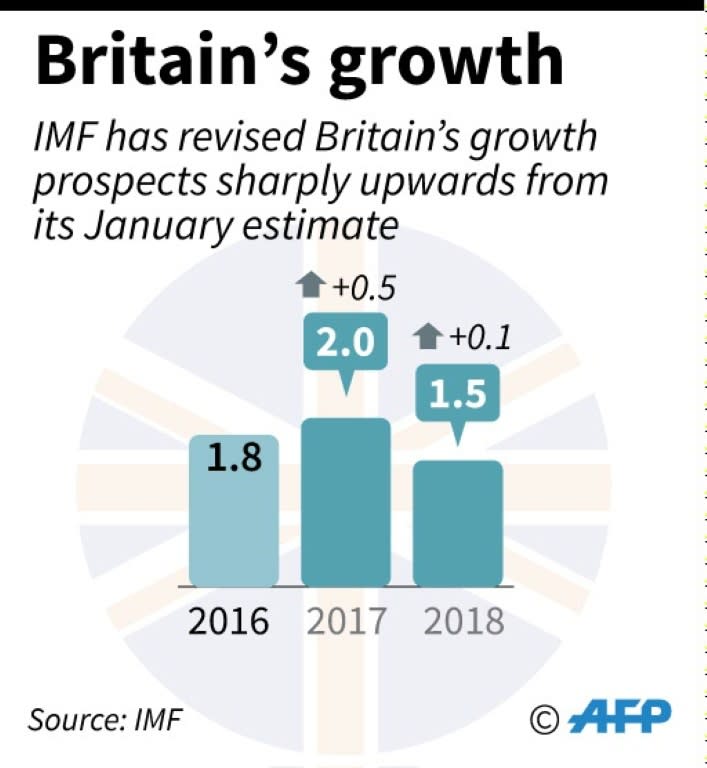

IMF raises UK growth forecast to 2.0% for 2017

The IMF on Tuesday raised significantly its forecast for 2017 British growth as the economy performs better than expected since the country voted last year to quit the European Union. In a boost for Prime Minister Theresa May, who Tuesday announced a snap general election, the IMF said Britain's economy is expected to grow by 2.0 percent this year, up from its 1.5-percent annual GDP estimate given in January. The International Monetary Fund lifted also its forecast for the UK's 2018 gross domestic product -- to 1.5 percent from January's estimate of 1.4 percent. But the Fund also noted risks ahead for the UK economy as it negotiates its exit from the EU. In its latest update, the IMF noted "the stronger-than-expected performance of the UK economy since the June Brexit vote, which points to a more gradual materialization than previously anticipated of the negative effects of the United Kingdom's decision to leave the European Union". It added: "These effects include reduced consumer purchasing power following the pound's depreciation and its gradual pass-through to prices and the impact of uncertainty on private investment." The Fund noted that while "highly uncertain, medium-term growth prospects have also diminished in the aftermath of the Brexit vote because of the expected increase in barriers to trade and migration, as well as a potential downsizing of the financial services sector amid possible barriers to cross-border financial activity". Britain is keen to establish trade links with the rest of the world as it prepares to leave the European Union, with May and finance minister Philip Hammond earlier this month leading delegations to the Middle East and India, respectively. Responding to the IMF update, Hammond said Britain was now forecast "to be the second fastest growing major advanced economy this year". - Rising inflation - On inflation, the IMF said "the pound's depreciation and the increase in energy prices are projected to push inflation up to 2.5 percent in 2017, before it gradually subsides to the Bank of England’s target of two percent in the next few years". The most recent official data showed that rising clothing and food prices kept British annual inflation at 2.3 percent -- the highest level in three and a half years in March. Inflation is rising in Britain also as a strong weakening of the pound since the Brexit vote starts to push up import costs. "Consumers' purchasing power is being ever more squeezed by rising inflation and muted earnings growth -- and the squeeze seems highly likely to deepen over the coming months," Howard Archer, chief UK economist at IHS Markit said in a note to clients Tuesday. Sterling rallied after Conservative party leader May called a snap election for June 8 as she seeks to bolster her position ahead of tough talks on Brexit. "The pound was the big winner from news that a UK general election is in the pipeline, as currency markets bet on the current government winning a greater majority," said Laith Khalaf, senior analyst at stockbroker Hargreaves Lansdown. "The rising pound helped heap pressure on the UK stock market, which was already on the back foot thanks to declining iron ore prices hitting the resources sector."