Kering Beauté Acquires Creed

PARIS — Kering Beauté has made its first acquisition: Creed.

The French luxury house said Monday that it has purchased the totality of the high-end niche fragrance house that’s controlled by BlackRock Long Term Private Capital Europe and the current chairman Javier Ferrán.

More from WWD

All That Gel: Slicked-Back, Wet Hair, Headbands Rule at Milan Men's Fashion Week

Inside The Fragrance Foundation Circle of Champions 2022 Event

Financial terms of the all-cash transaction were not disclosed, but industry sources estimate it was for approximately $1.5 billion.

Creed will join other perfume brands in Kering Beauté’s stable that include Bottega Veneta, Balenciaga, Alexander McQueen, Pomellato and Qeelin.

Creed is the first niche fragrance brand to be owned by Kering, which announced early this year that it was creating an in-house beauty division.

The high-end luxury fragrance segment is a hot commodity these days, among the fastest growing in beauty. It’s been registering double-digit growth, plus high profitability and revenue recurrence.

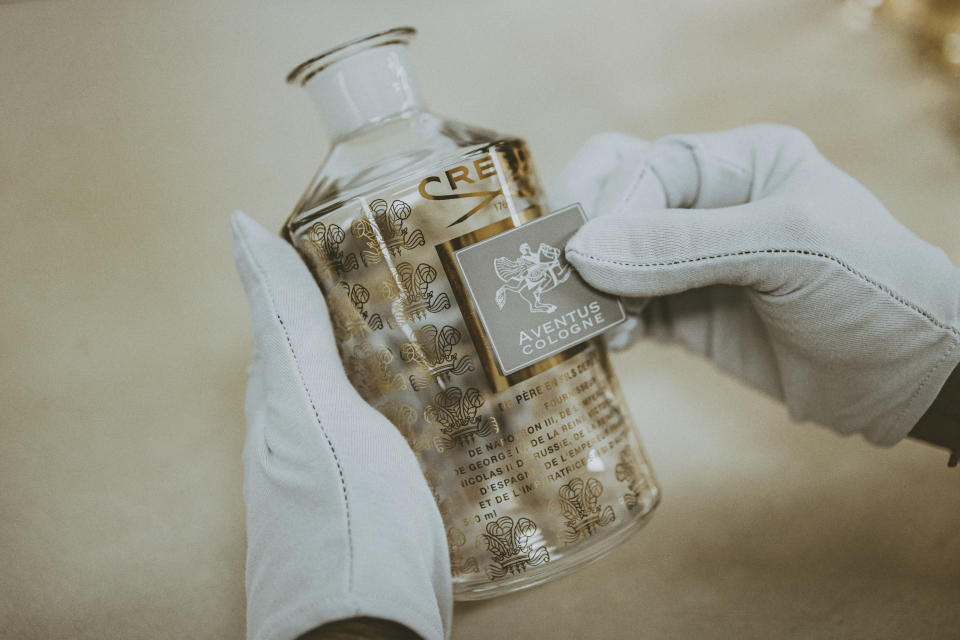

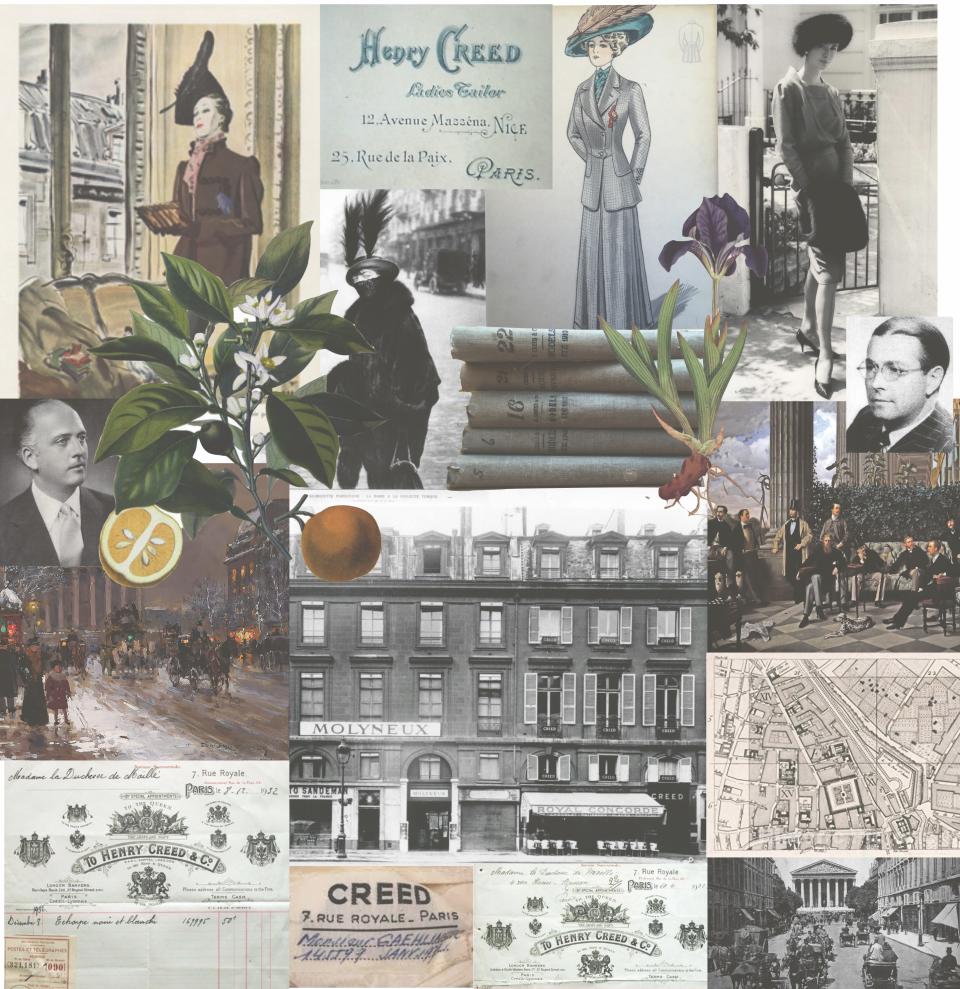

Creed dates back to 1760, when it was begun by James Henry Creed during the reign of King George III of England. Creed was first established as a tailor and later a fragrance house. Over the years, the Creed family produced more than 200 perfumes, including the cult bestselling men’s fragrance Aventus Cologne, Viking, Himalaya and Green Irish Tweed.

Based in Paris, with a factory in nearby Fontainebleau, Creed manufactures many of its own essences using a traditional infusion technique that enables Creed to maintain the quality and authenticity of its fragrances.

In a statement Kering called Creed is the largest global indie high-end fragrance-maker.

Creed was sold by the Creed family to BlackRock and Ferrán in early 2020, when industry sources estimated that Creed’s revenues were in excess of $200 million.

“The acquisition of Creed is a major step for Kering Beauté,” Kering said in a statement. “A perfect fit with its portfolio of renowned luxury brands, it immediately provides Kering Beauté with the required scale, an outstanding financial profile, as well as a platform, supporting the future development of other Kering Beauté fragrance franchises, by leveraging in particular Creed’s global distribution network.”

Kering Beauté said that while maintaining the heritage and high-end image of Creed, it will further unlock the brand’s potential in all markets, channels and categories, especially via its development in China and travel retail, as well as expand further in the feminine fragrance portfolio, body and home categories.

“The beauty category is a natural extension of Kering’s luxury universe, and the group is confident its expansion in this strategic segment will create lasting value for the group and its houses,” Kering said.

The deal is expected to close in the second half of this year.

“The acquisition of Creed represents Kering Beauté’s first strategic initiative, and demonstrates our commitment to developing a strong position in the luxury beauty segment,” said François-Henri Pinault, chairman and chief executive officer of Kering, in a statement.

“I am thrilled that today our stories and values come together around this spirit of family entrepreneurship and excellence to accelerate our journey in beauty, and I am delighted that the brand is joining Kering’s collection of luxury houses,” he said.

“The House of Creed is recognized as one of the few leading global luxury fragrance brands, synonymous with exclusivity and creativity,” said Jean-François Palus, group managing director of Kering. “We are confident that this landmark acquisition will facilitate and amplify our development in fragrance. This is a milestone in the development of Kering Beauté, as we believe more than ever in the strong potential of our brands in beauty.”

After months of speculation, Kering in early February said it has begun taking its beauty business back in-house, and that it had appointed Raffaella Cornaggia as CEO of Kering Beauté, a new position in a new division.

She reports to Palus and has been charged with developing with a team an expertise in the beauty category for Bottega Veneta, Balenciaga, Alexander McQueen, Pomellato and Qeelin.

At the time, Kering said: “The creation of Kering Beauté will enable the group to support these brands in the development of the beauty category, which is a natural extension of their universe.”

Until then the buzz had been intensifying about whether Kering would make such a move and if so, what that might take, especially in regards to jewels in the crown, Gucci and Yves Saint Laurent, which are licensed to Coty Inc. and L’Oréal, respectively.

Kering is no stranger to beauty. Until the late 2000s, the group, then called PPR, took a more hands-on approach to fragrance and cosmetics. At the time, PPR’s Gucci Group had a beauty subsidiary named YSL Beauté, which included fragrance and beauty brands and licenses, such as Yves Saint Laurent, Stella McCartney, Boucheron and Ermenegildo Zegna, before it was sold to L’Oréal in 2008 for 1.15 billion euros.

Today, Gucci has a 50-year beauty license that is held by Coty and expected to expire in 2028. The Yves Saint Laurent license with L’Oréal is long term.

Among Kering’s other owned fashion and jewelry labels, Interparfums runs Boucheron’s business in perfume, while Lalique Group develops Brioni’s fragrance activity.

Industry experts believe it makes good strategic sense for Kering to sharpen its focus on beauty, especially as the group now has a stronger balance sheet and net cash position with which to carry out deals.

Industry sources have said Kering was interested in acquiring Byredo, which was snapped up by Puig in late May 2022, and Tom Ford, which was purchased by the Estée Lauder Cos. in December 2022, for instance.

Today, Kering Beauté is up against some formidable competitors. LVMH — which has 15 brands, including Parfums Cristian Dior and Guerlain, in its Perfumes and Cosmetics division — in March reorganized that branch, naming Stéphane Rinderknech as its chairman and CEO. There had been no one executive helming that division for decades.

According to WWD Beauty Inc’s Top 100 Ranking of beauty manufacturers, reflecting 2022 sales, LVMH placed sixth, Shiseido fifth, Procter & Gamble fourth, the Estée Lauder Cos. third, Unilever second and L’Oréal first.

Luxury goods companies, such as Puig, have over the past decade been taking back full control of the brands they own. That can pack a powerful punch, giving them more consistency, synergies and power.

There is something of an an arms race today to acquire and invest in niche fragrance brands. The category has been the biggest driver in the premium fragrance segment, which grew 9.1 percent to $57.36 billion and is forecast to rise another 7.9 percent between 2022 and 2023, and 6.7 percent between 2023 and 2024, according to Euromonitor International.

Last week, Advent International acquired Parfums de Marly and Initio Parfums Privés in a deal estimated by industry sources to be more than $700 million. Also this month, a majority stake in Sabé Masson, which began with solid fragrances, was sold to Boris Gratini et Hélène Ortola.

In May, Juliette Has a Gun raised a new round of funding with Cathay Capital, as did Perfumer H, with Natura & Co.’s venture capital fund Fable Investments.

Best of WWD