How to Negotiate When Buying Your Property

In every real estate negotiation, I’ve left sellers with tears in their eyes. Mainly from laughter, when I strip off my shirt and make crying, begging noises. That’s why I let my property agents guide me in negotiations. They’ll pick roles for me, like “stand in that corner and try not to be heard.” I’m a bit sick of it, so I did some research on the fine art of house haggling:

“A little more about how my balding is unnoticeable, and you have your 5% off.”

Before Negotiating…

Negotiation takes preparation.

Before you start flinging numbers like T.T. Durai at a court hearing, brace for the cost. Figure out how much you have to bargain with. Take note of:

Cash Over Valuation (COV)

Excess from transfer of Option

Approval-in-Principle (AIP)

Cash Over Valuation (COV)

The cash over valuation (COV) refers to any cost in excess of the bank’s valuation.

For example, the seller of a resale flat may ascribe a value of $15,000 to his renovations. Your bank informs you that the only check issued will be a reality check, and that the estimate is off by $15,000. If you insist on accepting his price, you can go ahead and pay the extra yourself.

That $15,000 would be your COV, and your bank loan won’t cover it.

“Now stick a $15,000 label on it, and put it where the buyer will see. Trust me, it’ll work.”

Excess From Transfer of Option

Let say you’re desperate for the house, and buy from a house flipper. This will involve the house flipper transferring the Option to Purchase (OTP) to you. I’ve described this process in another article.

Besides paying the amount stated on the Option (to the original seller), you will have to pay an excess to the house flipper. Most house flippers aim to grab at least $10,000 – $20,000

Your bank loan will not cover this excess.

Approval in Principle

The approval in principle (AIP) is the loan amount a bank agrees to give you, should you buy a house within the given time. Most AIPs last for 90 days.

You should always get AIP before looking for a house. The AIP lets you know how much you have to bargain with. It also helps when securing a purchase; all things being equal, the seller’s agent will favour a buyer with AIP.

At present, Singapore’s banks do not charge fees for getting AIP (Check with the bank before getting one).

“Fine, since you insist, here’s your approval. Maybe next time you should wait for a real banker; I’ve only been the janitor here for 2 months.”

When getting the AIP, you should also check how much the loan repayments would cost for that particular bank. Use free sites like SmartLoans.sg to compare packages.

Once you have a clear idea of your loan quantum, follow through with this process:

Get two to three valuations on the house

Research surrounding property

Fix your maximum offer

Offer a starting bid 10% below valuation

Make counter-offers

1. Get Two to Three Valuations on the House

I have rigorous testing methods on deciding which valuation to trust.

You can drop by any bank for a free desktop valuation. Ask to speak to the home loans or mortgage banker, and bring the listing for the house.

The bank will give you a valuation based on district, recent sales in the area, and (sometimes) factors like capital gains projections. Valuations are inexact; you should consult at least two different banks.

If the difference in valuations is more than 5%, get a third opinion.

2. Research Surrounding Property

Call property agents selling houses in the same area, and check their prices.

Yes, I know you’re busy with work and all. Excuse me for advocating a few hours on the phone; it’s only a loan you’ll be paying for a large part of your life.

If you can be bothered, you’ll find two advantages: First, you’ll be informed of alternatives in the same area. Many buyers stumble upon better options while doing research.

Second, you’ll be prepared when bargaining. If the seller’s agent tells you houses in the area sell for $1.2 million, you can rebut with: “Oh yeah? Because I called Agent XYZ and her listing is just $1.1 million“.

3. Fix Your Maximum Offer

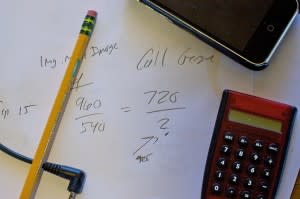

Somewhere, my old maths teacher is grinning.

Your maximum offer is not necessarily the maximum loan quantum on your AIP.

You don’t have to take the biggest loan you can get. Pick a loan amount with comfortable repayments; I suggest you take a loan in which repayments do not exceed 40% of your income. This is regardless of your official debt servicing ratio, which qualifies you for loans that take up to about 50% of your income.

As I mentioned before, visit loan comparison sites. And consult mortgage brokers, who will work out your projected monthly repayments.

Once you find a comfortable loan quantum, decide how much you’ll spend on excess costs like COV. Remember that COV is not covered by the loan, so it depends on how much you cash you have on hand.

Fix these two costs (the maximum loan amount, and the maximum excess you can pay) on your brain. Have a surgeon graft it onto your corneas if you have to. These two amounts constitute your maximum final offer, before you look for another house.

4. Offer a Starting Bid 10% Below Valuation

A good starting bid is around 10% below valuation, or 15% below the buyer’s asking price.

If you go any lower, the sellers may decide to filter you out. You can ask the property agent about the seller’s situation; someone looking for a fast sale might be willing to go lower. In which case, try going 15% below valuation.

“That’s a decent starting bid. Assuming you’re referring to that bicycle.”

5. Make Counter-Offers

You know how this works. The seller will offer you a counter-offer, prompting you to raise your bid.

Do so by increments of 3% – 5%, until you hit your maximum offer. Don’t get emotional; when you hit the maximum offer, just stop. If you end up eating baked beans and corn starch for the next 10 years, you won’t be happy about your purchase anyway; no matter how pretty it looks.

For more details on Singapore property, follow us on Facebook. We’ll let you know whenever we find good tips on property.

Image Credits:

mbrochh, jeremyfoo, nerdcoregirl, nicubunu.photo, cogdogblog, Thant Zin Myint

What’s your secret to negotiating property? Comment and let us know. The *legal* methods, please. We already know the one involving the ski mask and the fake kidnapping.

Get more Personal Finance tips and tricks on www.MoneySmart.sg

Click to Compare Singapore Home Loans, Car Insurance and Credit Cards on our other sites.

More From MoneySmart