Older HDB resale flats depreciate slower than private condos: study

The rate of price decline for older HDB flats was 3.0 percent, compared to older freehold and leasehold private units which depreciated by over 10 and 30 percent respectively.

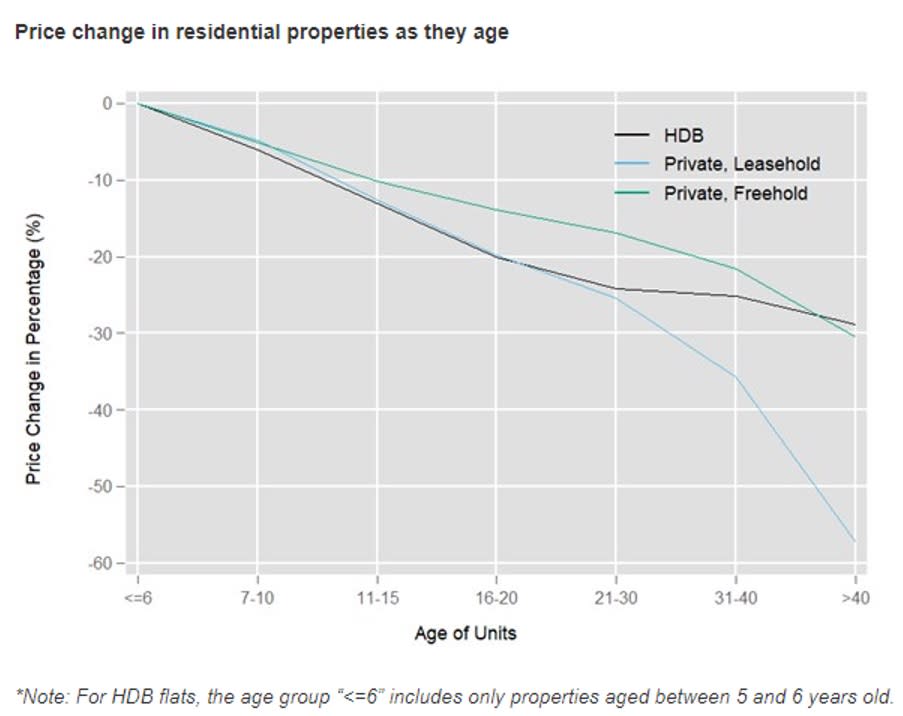

Prices of HDB resale flats depreciated slower than private non-landed homes (leasehold or freehold) when they reach 30 years and above, according to a study from the National University of Singapore (NUS).

During the first 10 years, the rate of price decline of the three kinds of properties were roughly similar, with HDB resale flats recording a slightly faster rate of depreciation by 1.0 percent compared to the other two types of homes.

After a decade, private freehold houses generally depreciated at a slower rate versus the other two, which saw a similar rate of decline until 20 years.

But when the properties are 21 years and above, the rate of price decline for HDB flats hits 3.0 percent. In comparison, that for freehold private homes and leasehold private residences depreciated by over 10 percent and more than 30 percent respectively.

Source: NUS

NUS associate professor Sing Tien Foo, who is one of the study’s authors, thinks HDB resale flats that are 30 years and above depreciate at a slower rate than the other two kinds of homes due to schemes introduced by the authorities.

“The increasing aging effects of private properties above 30 years old is probably due to lack of maintenance of the building and its surroundings. HDB flats enjoy the benefits of upgrading efforts such as the Singapore government’s Home Improvement Programme (HIP) that help reduce the aging effects more effectively than private properties.

“The problem seems more serious for leasehold private property owners who face both aging and lease decaying effects as aging can hasten economic obsoleteness of older buildings,” he noted.

Aside from the government’s programmes, maximum subsidy grants of $50,000 for first-time buyers of HDB resale flats further allays the price depreciation, added co-author professor Sumit Agarwal.

Other researchers include NUS Business School finance professor Low Tuck Kwong and PhD student Zhang Xiaoyu of the Department of Real Estate at the NUS School of Design and Environment.

The study analysed resale transaction prices of HDB flats and private non-landed homes, either leasehold or freehold, from 1997 to 2017. In particular, the research covered 72,006 freehold homes, 68,407 99-year leasehold residences and 477,665 HDB flats.

Find HDB flats for sale or read our HDB guides. Can you afford an HDB flat? Check your affordability now.

Romesh Navaratnarajah, Senior Editor at PropertyGuru, edited this story. To contact him about this or other stories, email romesh@propertyguru.com.sg