Has The Recent Industrial Incident Dented Union Gas Holdings’ Fundamentals?

During the end of June, one of the worst industrial accidents happened on an industrial facility affiliated with Union Gas Holdings (Union Gas) that had caused the death of one foreign national, and severely injuring two others.

According to a SGX filing, the company maintained that although the owner of the said facility, and supplier, Summit Gas Systems Pte Ltd (Summit) is a subsidiary of Union Energy Corporation Pte Ltd, but not part of the Group. On the day of the incident on 21 June 2019, the stock price of Union Gas fell from $0.25 to a low of $0.24 and has been trading at that price level since.

At a total market capitalisation value of $54.9 million, the stock is trading at a twelve-month historical price-to-earings (P/E) multiple of 8.6 times, and a twelve-month dividend yield of five percent.

Financial Performance Of Union Gas Holdings

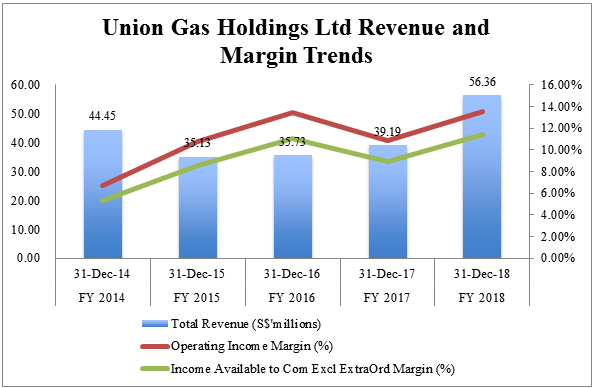

Source: SGX StockFacts, Company’s Financials

Looking at the latest reported financials of Union Gas for FY18, revenue rose 43.8 percent year-over-year to $56.4 million, while both operating income margin and net income available to common shareholders’ margin came in at 13.6 percent and 11.4 percent respectively. This compares to the 10.9 percent operating income margins, and 8.9 percent net income available to common shareholders’ margin in the previous year.

The increase in revenue was mainly due to three factors, namely, (i) an increase in revenue from the rental of bottled liquidfied petroleum gas (LPG) cylinders, and LPG-related accessories to mainly domestic households in Singapore arising from acquisition of assets from Semgas Supply Pte Ltd (Part of Union Energy Corporation Private Limited) and other dealers in 2018; (ii) revenue contribution from the sale of commercial LPG to supply to hawker centres arising from the acquisition of U-Gas on 31 May 2018; and (iii) an increase in revenue from the sale and distribution of diesel to retail customers at its fuel station located at its fuel station at Old Toh Tuck Road, and bulk sale of diesel to its commercial customers. The overall rise in total revenue is somewhat dampened by the decline in sales of commercial natural gas.

However, following the latest incident, there is an expectation that the company would incur some negative charges related to the industrial accident. At this time, the company is assessing if there is any material impact, operationally or financially, and will provide updates to shareholders accordingly.

Cash And Debt Position

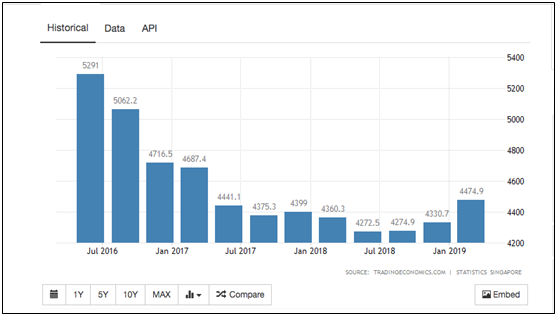

Source: SGX StockFacts, Company’s Financials

The Company’s latest cash and cash equivalents balance stood at $15.7 million, and it does not have any significant interest-bearing debt in its balance sheet. Meanwhile, cash flows from operating activities (CFO) stood at $8.4 million.

Peer Comparison

Valuation Comparisons | Union Gas Holdings | Sinorstar PEC |

Price-To-Book Value (P/BV) | 2.1 | 0.80 |

Price-To-Sales (P/S) | 0.98 | 0.23 |

Dividend Yield (%) | 5.0% | 2.6% |

Dividend Yield (%) – 5 Year Average | N/A | 4% |

Enterprise Value ($’million) | 40.4 | 289.8 |

Price-To-Cash Flows | 6.2 | 4.7 |

Price-To-Earnings (P/E) Ratio | 8.2 | 6.6 |

Net Cash/ (Debt) ($’million) | 15.7 | (167.1) |

Source: SGX StockFacts

While there are no close competitors for Union Gas, we took Singapore-listed Mainland Chinese company, Sinorstar PEC Limited (Sinostar) for comparison purposes as the latter has some business dealings in the LPG space.

Compared to Sinostar’s, we noted that Sinostar appears to be relatively cheaper in the various price multiples compared to Union Gas. However, Union Gas is in a net cash position, whilst Sinostar has a positive a net debt position of $167.1 million. Union Gas also offers a higher dividend yield.

Is Union Gas Worth Including In Your Portfolio?

While Union Gas fundamentals have improved over the years, namely in the area of operating cash flows, a net cash pile, rising trends in both revenue and profit margins, the latest industrial incident could put the company in a negative spotlight.

Although an associate by affiliation, Union Gas management may face potential liabilities in an event of fallout, which may be a long-term concern for the company.

Investors should be looking out for more updates from regarding potential charges/costs incurred from the industrial incident. Meanwhile, the fundamentals do look relatively attractive for potential inclusion to one’s investment watchlist, and possibly wait for more updates to come.