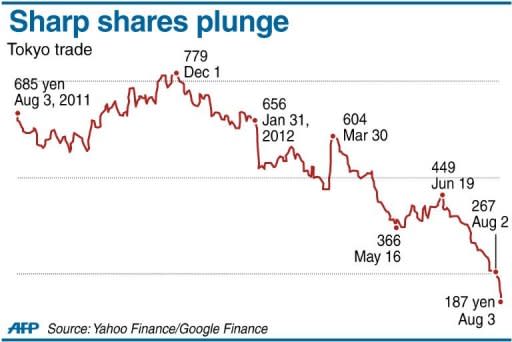

Sharp shares dive, more than $1 bn wiped off value

Shares in Japan's Sharp dived 30 percent to their lowest level in almost 40 years Friday, wiping more than a billion dollars off its value, after warning its annual loss would be bigger than first thought. The electronics giant slumped to 187 yen in Tokyo trade after saying Thursday it lost 138.4 billion yen ($1.77 billion) in the April-June quarter, nearly three times more than the same period last year. The share price was lowest since November 1974, according to Dow Jones Newswires. The firm's market capitalisation tumbled 88.8 billion yen ($1.1 billion). Sharp's stock recovered slightly by the closing bell Friday, ending down 28.08 percent at 192 yen. On Thursday, Sharp said it now expected a net loss of 250 billion yen for the fiscal year through March 2013, a huge increase from an earlier projection for a loss of 30 billion yen. It also said it would have to slash 5,000 jobs worldwide, its first cuts since 1950. Last year the firm posted a loss of 380 billion yen, blaming restructuring costs and delayed shipments of liquid crystal displays (LCD) used in mobile devices. The company, which has seen its mainstay television, LCDs and solar panel products struggle, said the job reductions were part of a bid to cut fixed costs by 100 billion yen to help its balance sheet. Sharp currently employs 57,000 people globally. Earlier this year the firm announced a tie-up with Taiwanese giant Hon Hai Precision in a bid to turn around its business with better efficiency. The Taiwanese firm, better known as Foxconn, which assembles Apple products in China, agreed to take a 10 percent stake in Sharp for about $800 million. "The domestic and Chinese demand for liquid crystal display televisions fell at a faster pace than expected," the company said of its poor results Thursday. "A tough business climate continued as the slower demand forced production adjustment at factories for large LCDs, while prices fell for finished products and electronic devices," it said. Rival Sony's shares also fell, down 6.95 percent at 897 yen after the maker of PlayStation game consoles and Bravia televisions Thursday reported a widening quarterly loss and chopped its full-year profit forecast. Japan's electronics giants have struggled to cope with a strong yen, falling prices, heavy labour costs and fierce competition from foreign rivals including South Korea's Samsung. Shigeo Sugawara, a senior investment manager at Sompo Japan Nipponkoa Asset Management, said Sharp's efforts to tackle its problems had failed to match investors hopes so far. "In part due to the strong yen and global economic uncertainty, the firm isn't making progress in structural reform as much as markets had expected," he said. The company also listed concerns for the future, including Japan's deflation and electricity supply, as the nation now uses only two of some 50 nuclear power reactors that used to provide one-third of the nation's energy. The government and utilities have not switched on most of the nuclear reactors due to public opposition after the crisis at the Fukushima Daiichi nuclear plant last year.