SI Research: 3 Blue-Chips We Wished We Had Bought A Year Ago

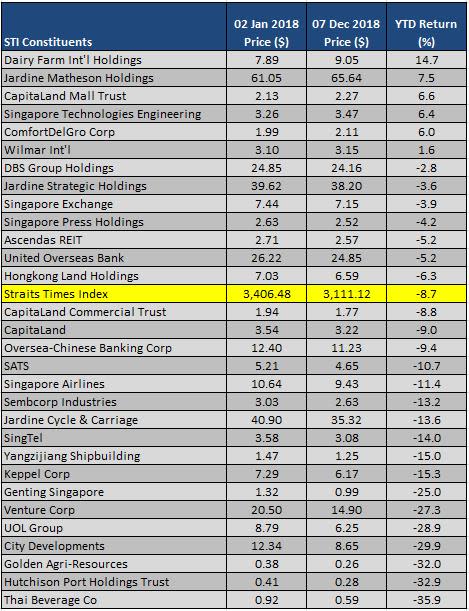

2018 has not been a strong year so to speak, clouded by the occasional pessimistic news surrounding the trade war between US and China. Despite registering a year-to-date (YTD) return of negative 8.7 percent, local benchmark Straits Times Index (STI) still managed to stand firm above the 3,000 psychological level as at 7 December 2018. This was in contrast to the negative 13.2 percent decline recorded by Hong Kong’s Hang Seng Index, while our western counterpart Dow Jones Industrial Average dipped marginally by 1.9 percent.

As 2018 is almost coming to an end, only six out of the 30 STI constituents bucked the trend to deliver positive returns during this eventful year. And with the luxury of hindsight, we identified three counters which topped the list of companies ranked in term of their YTD returns, namely Dairy Farm International Holdings, Jardine Matheson Holdings and CapitaLand Mall Trust respectively.

Source: Singapore Exchange, updated 7 December 2018

Dairy Farm International Holdings

Dairy Farm International Holdings (Dairy Farm) led the pack of outperformers with a YTD return of 14.7 percent.

Being in the business of fast-moving consumables, Dairy Farm is considered a fairly defensive stock in times of volatility. As at 30 June 2018, the group is a leading pan-Asian retailer with a strong store network operating over 7,400 outlets worldwide delivering total annual sales (inclusive of the group and its associates and joint ventures) exceeding US$21 billion in 2017.

The first half of 2018 saw strong sales achieved of US$5.9 billion, which was 7.7 percent higher than last year or 6 percent higher at constant rates of exchange. Although the food businesses in Southeast Asia remained challenging owing to higher rental and labour costs, this was more than offset by robust sales and profit growth from the health and beauty business in Hong Kong and Macau. Consequently, net profit grew 6 percent in 1H18 to US$224.9 million.

Operating cash flow for the period continued to be healthy with a net inflow of US$312.1 million compared with US$305.6 million year-on-year (y-o-y), as a result of improvements in working capital management.

Dairy Farm declared an interim dividend of US$0.065 for 1H18, the same amount as per what the group had distributed in 1H17. Assuming that Dairy Farm maintained its final dividend of US$0.145 this year, the total payout of US$0.21 would translate to a decent yield of 2.3 percent, based on its last closing price of US$9.05 as at 7 December 2018.

Jardine Matheson Holdings (JMH) took the second place among the group of outperformers this year with a YTD return of 7.5 percent.

JMH is a diversified Asian-based group with a broad portfolio of market-leading businesses ranging from motor vehicles and related operations, property investment and development, food retailing, restaurants, hospitality as well as financial services. The group holds 84 percent interest in Jardine Strategic, which in turn holds interests in Hongkong Land, Dairy Farm, Mandarin Oriental and Jardine Cycle and Carriage.

JMH had a good performance in 1H18 driven primarily by strong results from Astra and Jardine Cycle and Carriage, as revenue jumped 13.5 percent to US$21.3 billion. Although net profit was 57.3 percent lower at US$928 million, this was largely due to the absence of significant non-trading gains from the fair value change of investment properties. The group’s underlying profit for the first six months of 2018 actually rose 6 percent to US$792 million.

JMH declared an interim dividend of US$0.42 for 1H18, slightly higher y-o-y by 5 percent. Assuming the group maintained its final dividend payout of US$1.20, this would imply a dividend yield of around 2.5 percent based on JMH’s full year payout of US$1.62 and its last closing price of US$65.64 as at 7 December 2018. Furthermore, current price offers a 4.1 percent discount to the group’s net asset value of US$68.48 as at 30 June 2018.

CapitaLand Mall Trust (CMT) claimed the third position of delivering the highest YTD return in 2018 with a 6.6 percent return.

CMT was the very first Real Estate Investment Trust (REIT) listed on the Singapore Exchange in July 2002. The trust owns and invests in quality income producing assets primarily used for retail purposes, and its current portfolio comprises 15 shopping malls strategically located in the suburban areas and downtown core of Singapore.

CMT’s gross revenue for 9M18 rose 1.4 percent to $517.1 million, mainly due to higher gross revenue from the assets in its portfolio. Coupled with decreased property operating expenses attributable to lower utilities and marketing expenses, net property income climbed 2.8 percent to $369.1 million.

CMT distributed $0.0292 per unit for 3Q18. Based on an annualised full year payout of $0.1168 and the trust’s last close of $2.27 as at 7 December 2018, this worked out to be a yield of around 5.1 percent. While CMT’s yield seems to be slightly lower as compared to other listed retail REITs, this was more than compensated by the trust’s strong portfolio of quality shopping malls as well as the stability and sustainability of its distributions.