SI Research: The Better Of Two Healthcare Giants

Annual healthcare expenditure more than doubled from around $4 billion in 2011 to $10 billion in 2016. Last year, Singapore’s budget for healthcare increased by 9.6 percent to $10.7 billion and this figure is projected to grow to $13 billion in 2020.

Ultimately, the higher expenditure will be funded by an increase in revenue, which could come in the form of new taxes or an increase in existing taxes.

The anticipated $3 billion increase in healthcare expenditure highlights the growing concern of the country’s aging population, which is further extended by technological growth that lengthens life expectancy.

Impact On Private Healthcare Sector

Since most of the government’s healthcare expenditure is channeled towards public healthcare services and facilities, it can be assumed that the higher expenditure would negatively impact the private healthcare sector and vice versa.

In developed countries such as Singapore, the standard of medical care offered by both public and private healthcare providers does not differ much. The main difference comes from the higher level of service and comfort.

As such, with an increase in public healthcare spending, which could translate into higher capacity and subsidies, patients might think twice before paying the hefty price tag for private healthcare services.

However, that would only be a concern if private healthcare providers are operating at low capacity. Amidst the growing healthcare demand, this would slow the growth of private healthcare providers but the negative impact would be less visible.

That said, should investors find a place in their portfolio for the two largest Singapore-listed healthcare stocks?

Raffles Medical Group

As a leading integrated private healthcare provider in Asia, Raffles Medical Group (RMG) operates medical facilities in 13 cities across Asia. The group, currently valued at over $1.9 billion, is also the only private medical provider in Singapore that owns and operates a fully integrated healthcare organisation.

Over the past year, RMG’s shares plunged around 28 percent to $1.08 as at time of writing. Accordingly, the price-to-earnings (P/E) ratio of the group’s shares fell from around 36 times in January 2017 to a current 27.5 times. There are many reasons which could possibly explain the decline, but only the investors who sold off RMG’s shares would have the right answer for that.

The group’s results for 9M17 were very much flat, which may very well be one of the reasons for the decline in share price. That however, could be due to the fact that “the hospital has been operating at full capacity in recent times”, according to the management. Thus, the timely opening of RafflesHospital Extension as well as the 700-bed RafflesHospital Chongqing and 400-bed RafflesHospital Shanghai which are targeted to be operational by 2H18 and 2H19 respectively, is expected to spark off a new growth phase for RMG.

It is also notable that the new hospitals are expected to incur startup losses in the next few years. However, the losses are expected to be minimal as the hospitals will be opened in phases and capacity would be increased alongside with demand.

IHH Healthcare

IHH Healthcare (IHH) is a leading international provider of premium healthcare services in regions specifically in Asia and Central & Eastern Europe, the Middle East and North Africa. The healthcare giant, dual-listed in Singapore and Malaysia, is one of the world’s largest listed healthcare operator with a market capitalisation of around $16 billion.

Over the past year, IHH’s shares fell slightly over four percent to $1.94 as at time of writing. However, the group’s shares are still valued at a relatively higher P/E ratio of 78.2 times, almost three times that of RMG.

IHH would seem to have done much better for 9M17, reporting a 32.6 percent increase in net profit to RM868.7 million. However, the group’s result included an RM554.5 million gain from the disposal of the group’s interest in Apollo Hospital Enterprise. Excluding the one-off gain, net profit would have fallen by over 50 percent to RM314.2 million, dragged down by exchange loss on net borrowings amounting to RM202.3 million.

On IHH’s expansion, the worst is over for the group’s new Gleneagles Hong Kong, which suffered much startup losses as all of its 500 beds were opened at one go.

Comparison

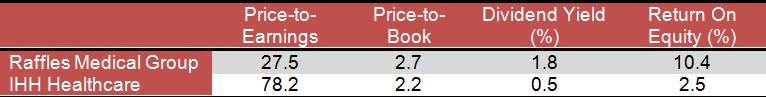

In order to identify which of the two healthcare stocks would be a better investment, we take a look at how their ratios compare.

(As at 11 January 2018)

P/E indicates the dollar amount that investors are willing to invest in a company in order to receive a dollar of the company’s earnings. Based on this ratio, between the two companies, investors are putting in almost two times more for every dollar of IHH’s earnings, which hardly makes sense unless IHH is able to grow three times faster than RMG.

In terms of price-to-book, IHH is slightly lower at 2.2 times. However, RMG would appear to be a safer choice as it sits in a net cash position of $40.6 million, while IHH has net debt of RM1 billion ($334.4 million). On top of that, RMG offers the higher dividend yield at 1.8 percent, making the highly-priced IHH even less attractive.

What is most impressive is that RMG managed to achieve a return on equity of 10.4 percent as compared to IHH’s 2.5 percent despite the latter recording a substantial one-off gain.

This comparison shows that RMG commands a lower level of risk while providing the likelihood of a higher return. As such, RMG might make a good choice of investment for investors looking for a share in the private healthcare sector.