SI Research: China Aviation Oil – Weak Oil Prices Bring Forth An Opportunity

Brent crude oil tumbled last month, triggered by the US government reporting an unexpected surge in the crude inventories coupled with increasing worries of demand slowdown amidst various trade conflicts. Closing at US$60.63 a barrel on 5 June 2019, brent crude oil has sunk by as much as 21 percent from its April peak. Nevertheless for investors who believe that oil prices are cyclical in nature and that the current sell-off is merely temporarily, we are closely looking at China Aviation Oil which allows investors a direct exposure to a likely oil price recovery.

About China Aviation Oil

China Aviation Oil (CAO) is the largest physical jet fuel trader in the Asia Pacific region and the key supplier of imported jet fuel to the civil aviation industry of China. As at December 2018, the group supplies jet fuel to over 17 international airports across mainland China including major gateways such as Beijing Capital International Airport and Shanghai Pudong International Airport, as well as to 51 international airports outside China in over 20 countries.

Source: Company’s Annual Reports

While the majority of the CAO’s top-line was derived from China accounting for 59.7 percent of its FY18 revenue, the group has been actively trying to strengthen its foothold in critical aviation markets such as Europe and the US in order to diversify its revenue streams and to drive further growth. After several years of operations in the US, CAO’s business in the US has gained traction now ranking among the top three suppliers at the Los Angeles Airport. Concurrently, CAO has also successfully gained access into the supply chain of several major European airports including Frankfurt and Amsterdam since joining the airport fuel supply consortium in late 2018. Today, the group’s sales to international airlines have expanded to almost on par with its sales to the Chinese airlines.

Financial Performances

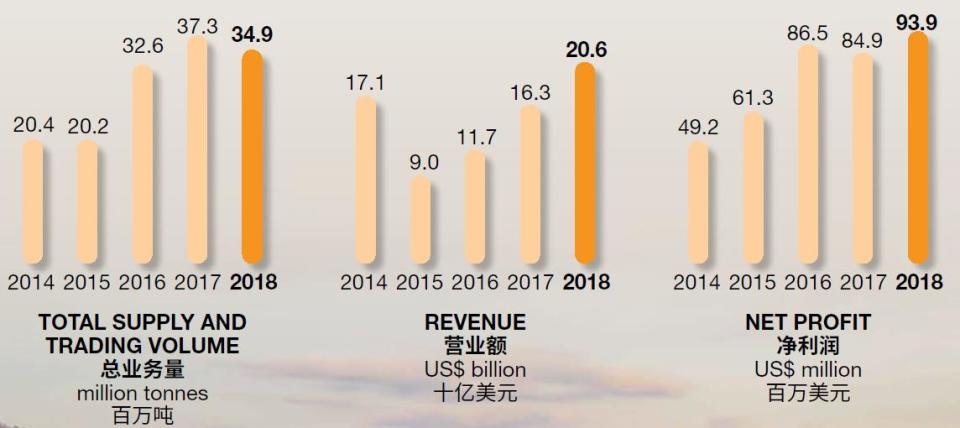

On the back of higher oil prices in the last few years, CAO’s total supply and trading volume grew at a compounded annual growth rate (CAGR) of 14.4 percent from 20.4 million tonnes in FY14 to 34.9 million tonnes in FY18. Correspondingly, revenue and net profit also increased at CAGR of 4.8 percent and 17.5 percent respectively over the same period. The group ended FY18 on a strong note achieving new record highs in both revenue and net profit.

Source: Company’s Annual Reports

Unfortunately, CAO did not manage to perform as well in the recent quarter as 1Q19 revenue slid 9.4 percent to US$3.7 billion pulled down by lower oil prices and a drop in trading volume. Consequently, net profit also dipped slightly by 2.1 percent to US$26.3 million.

In terms of financial strength, CAO’s balance sheet remained healthy with a net cash of US$379.2 million and zero borrowings as at 31 March 2019.

Shanghai Pudong International Airport

Shanghai Pudong International Airport Aviation Fuel Supply Company (SPIA) is the exclusive supplier of jet fuel and into-plane service provider at Shanghai Pudong International Airport (SPA), China’s second largest airport in terms of passenger traffic and the largest airport by refueling volumes.

According to statistics from the Civil Aviation Administration of China (CAAC), China is now the second largest civil aviation market in the world following the US, handling 610 million passenger trips in 2018. The International Air Transport Association (IATA) even went on to forecast that China could become the world’s largest civil aviation market by 2025.

As the local airport authority launched a series of expansion works to cater for the heavier traffic, SPA’s satellite terminal is slated to begin operations in September this year. Upon completion, SPA will then be able to handle 80 million passengers annually which currently served a total of 74 million passengers in 2018.

CAO owns a 33 percent stake in SPIA. As CAO’s key associate, it easily contributed more than 60 percent towards the group’s pre-tax profit. Hence, we see the completion of capacity expansion at SPA as a key catalyst that could potentially bring CAO to greater heights.

Opportune Moment For Entry

Along with the current weakness in crude oil prices, the share price of CAO has also corrected to $1.32 a share as at 17 June 2019. Although the bulk of the group’s earnings is reserved for working capital uses, CAO distributed 30 percent of its net profit in FY18 to shareholders which is equivalent to a dividend of $0.045 per share. This implies a yield of around 3.4 percent which is still not too shabby in our opinion. Furthermore, because of the unique business it is in, CAO possesses huge potential for capital appreciation given that it lies on the sweet spot to benefit from both a recovery in oil prices as well as the burgeoning aviation industry.