SI Research: Would Food Empire Rise In World Cup Year?

The first earnings season of 2018 is running to a close. In general, results thus far have been rather well albeit within market expectations. Local blue chips like DBS Group Holdings and Venture Corporation that had been the top movers in the past year, saw their share prices coming down as earnings – though good – failed to excite.

Sentiments are that there are high expectations for local blue chips, signified by the unsustainable rise of the Straits Times Index. On 2 May 2018, the local benchmark rose to a new 10-year record high of 3641.65 points, but has since given back some gains to trade below 3,600 points.

Whether it is the rebound in the local property market, rising net interest margins for banks, or strong demand for electronic exports, local investors seemed to have already priced-in all the “obvious” catalysts. That led us to look for more obscure counters that have been much overlooked.

Globally, strong manufacturing activities will likely begin to normalise and spillover to other sectors. With higher income levels, we also expect the next phase of global growth to be spurred by consumer spending. As such, we look to Food Empire Holdings (Food Empire), a local stock touted to benefit most from the nearest-term catalyst – FIFA World Cup!

Impacted By Former Crisis

Food Empire is a producer of instant beverages, frozen convenience food, confectionery and snacks. Its products are sold and distributed across over 50 countries, in markets such as Russia, Ukraine, Kazakhstan, Central Asia, China, Indochina, the Middle East, Africa, Mongolia, Europe and the US.

Russia is its main market and revenue source, which accounted approximately 43 percent of FY17 revenue. As all football fans would know, Russia will be hosting the FIFA World Cup in June 2018, boding well for Russia’s domestic consumption and hence Food Empire. Who watches football without drinks or snacks?

Yet, the market has not always favoured Food Empire’s stock. In 2013, Food Empire’s share price took a beating, falling from around $0.70 to around $0.20 by 2015. The share price tumble was sparked off when Russia and Ukraine fell into military conflict, further exacerbated by the decline in oil price in 2014, which hurt the economy of oil-dependent Russia. The Russian-Ukraine conflict also saw a bout of US-led sanctions on Russia, contributing to the decline of the Russian Ruble.

However, in FY17, Food Empire has managed to return profitability back to around pre-crisis level. In fact, FY17 results of US$14.2 million in net profit on revenue of US$269.5 million have overtaken that of FY13 net profit of US$11.7 million on revenue of US$262.9 million. This is despite the fact that the group recorded a US$7.7 million full impairment on its Korean associate, Caffe Bene.

Now, with all the negative struggles over, Food Empire should report even better earnings in FY18. Investors’ interest has also returned to the stock, as it has recovered to pre-crisis level of $0.67 per share.

Poised To Benefit From World Cup Bounce

The arguement to go long on Food Empire is centred on the FIFA World Cup in Russia. For one, the World Cup brings a wave of euphoria to consumers coupled with the fact the hosting country would normally see an increase in inbound tourist arrivals.

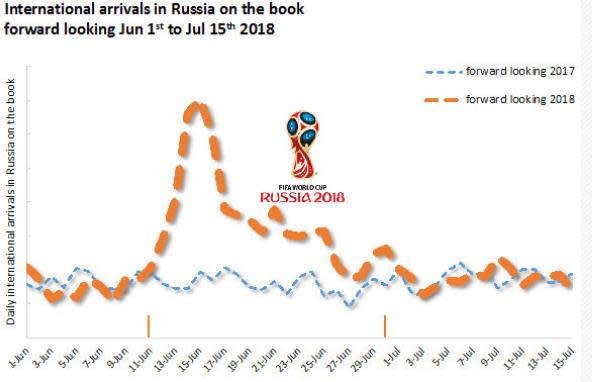

Indeed, booking data from travel intelligence ForwardKeys revealed, inbound tourists to Russia is set to see a big boost, thanks to the World Cup. Figures indicate that Russia is expecting tourists’ influx to more than double during the tournament period.

Citing yet another successful example of how the World Cup inspires higher consumer spending, Germany – the host of 2006 – saw an increase of US$2.6 billion in sales of food, drinks and memorabilia.

For Food Empire, the group’s dominance of 50 percent market share in the Russian instant coffee mix segment with its MacCoffee brand, means that it is set to benefit most since its products proliferate across the country and are offered at most food kiosks and open-air markets.

The indirect impact of the World Cup affecting Food Empire’s financial performance is the appreciation of the Russian Ruble. The influx of tourists to Russia and recovery of oil prices could lend support to the Russian currency which had been pulverised for the last three years. Given that more than 40 percent of Food Empire’s revenue is derived from Russia, the appreciation of the Russian Ruble would contribute significant margin expansion when converted into its reporting currency – the US Dollar.

Valuation

In its latest 1Q18 earnings release, Food Empire’s revenue increased 15.5 percent to US$72.5 million. Growth in the topline was contributed by higher sales volume in Indochina, Kazakhstan and Commonwealth Independent State markets.

Organically, Food Empire’s upstream projects which include its non-dairy creamer plant in Malaysia are also contributing more as utilisation rate reaches a rate of 80 percent in FY17 which is near full capacity. The Malaysian plant in particular, helped to drive growth in the group’s “Other Markets”, which saw contributions rise 14.9 percent to US$13.6 million in 1Q18.

Overall, Food Empire reported rather healthy growth, as 1Q18 net profit rose 14 percent to US$7.2 million. Trailing 12-months, Food Empire generated earnings-per-share (EPS) of about US$0.0281, translating to $0.037. At current share price of $0.67, Food Empire is trading at a price-to-earnings (PE) multiple of about 18.1 times.

Notwithstanding that, Food Empire is also backed by a net cash position of US$9.3 million or $12.4 million equivalent, translating to $0.023 per share. Correspondingly, net cash adjusted PE of 17.5 times, reflecting a rather undemanding valuation for the stock that has an imminent catalyst.

Year-to-date, the stock has traded flat, remaining at $0.67 since the beginning of the year. As such, investors could take this as a sign that the market has yet to fully appreciate the impacts of the World Cup on Food Empire. Hopefully, when Food Empire announces its 9M18 results, investors would be met with a pleasant earnings surprise.