SI Research: GuocoLand – A Late Bloomer Playing Catch-Up

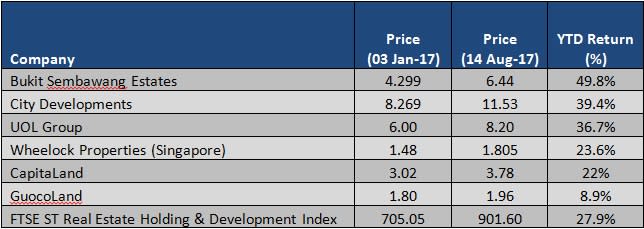

According to market updates released by the Singapore Exchange in June 2017, the Real Estate Management and Development sector is one of the best performing sectors in 1H17 apart from banking. Since beginning this year, the FTSE ST Real Estate Holding and Development Index had advanced by 27.9 percent to 901.6 as at 14 August 2017. On top of that, upbeat news last month on how all 531 units of Hundred Palms executive condominium at Yio Chu Kang Road were sold out within a single day further bolstered investors’ conviction that an earlier-than-expected property rebound has already begun.

While share prices of established property developers the likes of City Development, UOL Group and CapitaLand are all posting robust year-to-date (YTD) returns in the region of double-digit growth, GuocoLand has only been able to deliver a less-than-impressive YTD return of merely 8.9 percent. What are the reasons that could have contributed to this laggard’s disappointing performance? Or is there any overlooked value waiting to be discovered as GuocoLand starts to play catch-up to its peers?

Source: Singapore Exchange, updated 14 August 2017

About GuocoLand

GuocoLand is a premier regional property company whose principal business activities are property development, property investment, hotel operations as well as property management. Over the last 27 years, the group has successfully developed and sold 34 residential projects with more than 9,000 units in Singapore.

As at 30 June 2016, GuocoLand’s total assets amounted to $7.9 billion with a portfolio comprising residential, hospitality, commercial, retail and integrated developments spanning across the Asian region. GuocoLand’s core geographical markets are mainly focused in Singapore and China which contributed 61.5 percent and 25.7 percent to the group’s FY16 revenue respectively, while the rest is made up of revenue from Malaysia and Vietnam at 12.4 percent and 0.4 percent.

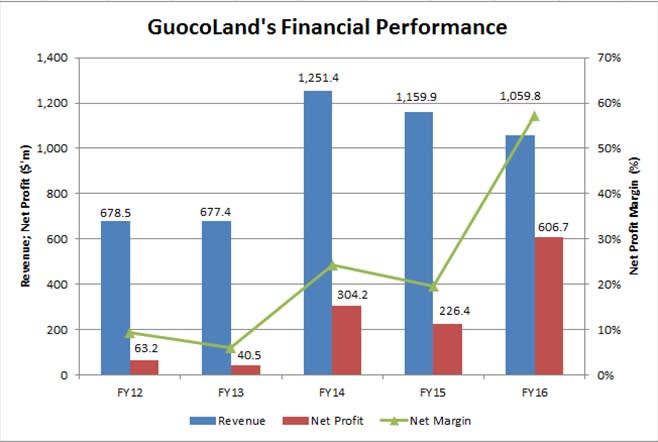

Lacklustre Earnings Cap Share Price Growth

GuocoLand’s revenue dipped slightly by $100.2 million to $1.1 billion in FY16 owing to lower revenue recognition from Goodwood Residence in Singapore and Seasons Park in China. However, the group’s revenue has actually been growing at a compounded annual growth rate of 11.8 percent over the last five years since FY12. In addition to that, net profit of $606.7 million in FY16 more than doubled from FY15 or surged more than nine times if compared to FY12’s results, primarily because of a gain from the disposal of the Dongzhimen project.

Source: GuocoLand’s Annual Reports

From GuocoLand’s latest 9M17 results, the group’s revenue continued to slide by 16.5 percent coming in at $705.8 million mainly due to lower revenue from Malaysia’s residential projects and the lack of revenue from the sale of an office block in Shanghai Guoson Centre in the previous corresponding period. Coupled with the absence of the one-time gain with regard to the disposal of Dongzhimen project in FY16, 9M17 net profit plunged by 80.2 percent to $112.3 million.

In line with the drop in activity and profitability in the current financial period, GuocoLand’s share price performance since this year paled in comparison with the rallies seen in the rest of its peers.

Deep Discount To Value

At current market price of $1.96 as at 14 August 2017, GuocoLand’s share price offers a 33.6 percent discount to its net asset value of $2.95 per share. The fair value of the group’s investment properties are determined by external independent property valuers annually, who have recognized expertise and experience in the location and property being valued. The fair values are estimated based on valuation techniques including the direct comparison method, discounted cash flow methods and residual land method.

It is noteworthy that assets held in GuocoLand’s portfolio are mostly premium developments located in the prime areas of Singapore. The group’s flagship development, Tanjong Pagar Centre (TPC), is a multi-billion integrated development located in the Central Business District (CBD) comprising five key components – commercial, residential, hospitality, retail and an urban park – rolled into one. As at March 2017, TPC’s office and retail components have achieved healthy commitment levels of around 90 percent, which serve to provide stable recurring income to sustain the group’s profitability and growth. Another of GuocoLand’s commercial properties worth mentioning would be 20 Collyer Quay, a 24-storey office building located in Raffles Place and overseeing Marina Bay, which has been enjoying consistently high occupancy rates with reputable tenants.

Looking at GuocoLand’s residential assets, one could not help but notice that the group owns Leedon Residence (one of the largest freehold residential developments in Singapore’s prime District 10 with a 4.9 hectare site), Goodwood Residence (a 210-unit freehold development sitting on a 2.5 hectare site within the prime Orchard-Scotts area), Sims Urban Oasis (a city-fringe condominium strategically located just 15 minutes’ drive away from the CBD), as well as the Martin Modern luxury condominium situated in the well-desired area of District 9.

Last but not least, let us not forget that GuocoLand still possesses a number of quality assets overseas, ranging from integrated development Shanghai Guoson Centre and Changfeng Residence in China, to another integrated development Damansara City located just at the fringe of Kuala Lumpur city centre, Malaysia.

Prudent Capital Management

We like it that management has been able to maintain a healthy financial position through prudent capital management. At the end of FY16, the group’s loans and borrowings have contracted by $1.4 billion to $3.8 billion, while cash and cash equivalents have risen by $0.8 billion to $1.4 billion. This has led to GuocoLand’s net debt falling significantly by more than 48 percent in FY16 to $2.4 billion and as a result, net debt dropped below total equity for the first time in the last five years. Its healthy gearing ratio allows the group to have the adequate financial headroom to take advantage on any investment opportunities as and when they arrive.

Source: GuocoLand’s FY16 Annual Report

That said, GuocoLand’s loans and borrowings climbed 15.8 percent to $4.4 billion in the nine months ended 31 March 2017 while cash and cash equivalents declined 31.4 percent to $980 million, primarily due to the land acquisitions of a residential site at Martin Place in Singapore and four land plots in Chongqing, China, as well as acquisitions of a 27 percent equity stake in Eco World International. Consequently, net debt jumped 43.9 percent to $3.5 billion which is approximately 1.1 times the group’s total equity of $3.3 billion. Nonetheless, we believe that the higher gearing ratio is still manageable given that GuocoLand’s gearing ratio has been hovering at around 1.5 times for the last five years, and taking into account the potential which an enlarged land bank may bring to the group.

A Possibly Long Wait For The Patient Investors

GuocoLand paid out a first and final cash dividend of $0.05 per share and a special cash dividend of $0.04 in FY16, bringing the total dividend for the year to $0.09 per share. Assuming that the group continues to pay out a dividend of $0.05 every year and given current market share price of $1.96 per share, investor may look forward to a dividend yield of around 2.6 percent which is probably not too shabby in our opinion. Nevertheless, considering that there is no clear catalyst in sight, the wait to realise GuocoLand’s intrinsic value could be a rather long one, and thus an investment only suitable for the patient investors.