SI Research: Has Value Emerged In MM2 Asia?

Singaporeans must be familiar with “Ah Boys to Men” that first made its debut in 2012. The series of army-related movies is a local box-office hit that was the highest-grossing film that raked in four times its $3 million production budget. The film was co-produced by mm2 Asia (mm2) and renowned local film director Jack Neo.

Listed on the Singapore Exchange in 2014, mm2 has grown into an integrated film producer with businesses in the production and distribution of film, TV and online content, post-production, cinema operation, event production and concert promotion in Singapore, Malaysia, Hong Kong, Taiwan, China and the US.

At the time of writing, mm2’s share price shed roughly 53.6 percent from its peak of $0.485, which it touched in early-June last year. In addition, mm2 Asia delivered a mixed earnings performance in the latest results. We dug into mm2 to discover if value has emerged following the steep correction.

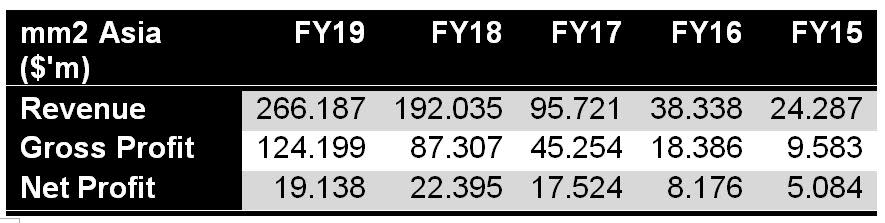

Financial Performance

Source: Shares Investment

In the latest earnings release, FY19 revenue jumped 38.6 percent to $266.2 million mainly attributed to the full-year contributions from acquired cinema businesses as the acquisition of Lotus Fivestar Cinemas and Cathay Cineplexes occurred in 2Q18 and 3Q18 respectively.

Expenses-wise, administrative expenses grew 48.7 percent to $69.9 million due to consolidation of full-year expenses from the cinema businesses. Finance costs increased by $13 million to $17.9 million with the additional borrowings and the issuance of medium-term note and convertible bonds to fund mergers and acquisitions (M&A) activities.

However, increases in administrative expenses and higher finance costs have eroded the profitability. Ultimately, net profit declined 14.5 percent to $19.1 million.

In the last five years, revenue rose at a compounded annual growth rate (CAGR) of 82 percent from $24.3 million in FY15 to $266.2 million in FY19. During the same time period, net profit also jumped to $19.1 million at a CAGR of 39.3 percent. mm2 has been producing such spectacular rate of growth as the company has been aggressively acquiring assets in the entertainment space that increases its content exposure and distribution channels.

Balance Sheet & Valuations

As at 31 March 2019, mm2 had increased its borrowings from $65.9 million to $223 million in the last 12 months. However, the current cash and bank balances stood at $18.6 million, translating to a net debt position of $204.4 million. This represents a total-debt-to-equity ratio of 104.1 percent or net-debt-to-equity ratio of 95.5 percent, making it a highly-leveraged company. However, mm2 should be able to meet its debt obligations comfortably given that it has a current ratio of 1.5 times and EBITDA-coverage ratio standing at 4.4 times.

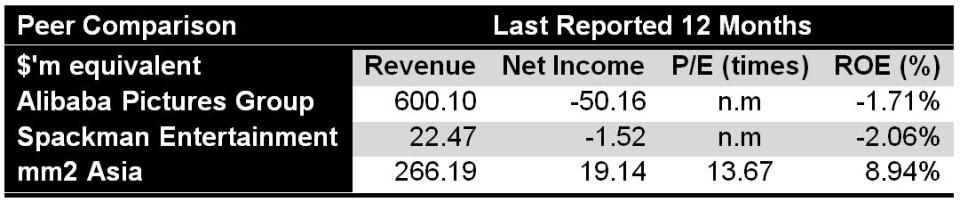

Source: Shares Investment

At the current share price of $0.225, mm2 is trading at about trailing 12 months price-to-earnings (TTM P/E) of 13.7 times. Compared to other local-listed peers, mm2 is the only profitable counter with a return-to-common-equity (ROE) of 8.9 percent.

Future Prospects

Historically, Hollywood content contributed 80 percent of total box office revenue in Singapore. However, in recent years, the Asian content are gaining traction in Singapore and neighbouring countries. There are also rising content investments in the region, for instance Turner’s Sports’ deal with ONE Championship and Netflix doubling down its investment in Asian storytellers. The rise of Asian content will be beneficial to North Asia’s (Hong Kong, Taiwan and China) core production revenue contribution.

As evident, in December 2018, a regional Chinese movies channel, SCM announced their intention to invest in and co-produce a slate of four feature films developed by mm2’s wholly-owned subsidiary mm2 Entertainment Pte. Ltd. In addition, mm2 also formed a slated financing partnership with South Korea’s largest content company CJ E&M whereby mm2 will co-finance six Southeast Asian films for the next three years through to 2021.

It is also expected that the group’s focus on North Asia will reap production of higher-margin contents, as exemplified by the fact that 32 percent of the production revenue in FY19 was derived from North Asia.

Going forward, we believe that further penetration into North Asia, expanded recurring revenue from cinema operations as well as increasing focus on Out-of-Home Entertainment Platforms (led by UnUsUaL and Vividthree) will be potentially rewarding for mm2 and its shareholders.