Supreme Court Turns Back Stealth Attack On Wealth Tax — For Now

The Supreme Court issued a narrow 7-2ruling on June 20 rejecting a sweeping constitutional argument that a wealthy Washington state couple brought before them that was viewed as a stalking horse aimed at preemptively striking down a future tax on wealth.

The couple, Charles and Kathy Moore, had challenged the constitutionality of the Mandatory Repatriation Tax, which was enacted as part of Republicans’ 2017 Tax Cuts and Jobs Act. The MRT imposed a one-time retroactive tax on Americans who received “undistributed” income — meaning income not distributed to them by a company — from foreign corporations in which they held more than a 10% stake. The Moores argued that the tax was unconstitutional because the 16th Amendment only authorizes taxes on income, and that the unrealized gains they received from undistributed income in foreign corporations is not income.

The court’s decision, written by Justice Brett Kavanaugh, upheld the MRT, but did so without reaching the constitutional question of whether unrealized gains counted as income for the purposes of the 16th Amendment. Instead, the justices ruled that the gains taxed by the MRT were income for the foreign corporation because they were just income that remained undistributed to shareholders.

“So the precise and narrow question that the Court addresses today is whether Congress may attribute an entity’s realized and undistributed income to the entity’s shareholders or partners, and then tax the shareholders or partners on their portions of that income. This Court’s longstanding precedents, reflected in and reinforced by Congress’s longstanding practice, establish that the answer is yes,” the decision read.

Justices Ketanji Brown Jackson and Amy Coney Barrett each wrote their own concurring opinion, with Justice Samuel Alito joining Barrett’s concurrence.

Justices Clarence Thomas and Neil Gorsuch dissented. In an opinion written by Thomas, the justices said that unrealized investment gains should not count as income.

“Because the Moores never actually received any of their investment gains, those unrealized gains could not be taxed as ‘income’ under the Sixteenth Amendment,” Thomas wrote.

The question of what counted as income, and to who, was a key point that arose during arguments where Justice Brett Kavanaugh pointed out that the court didn’t need to adopt any new test or make any real constitutional claim.

“Leaving open whether realization was a constitutional requirement, there was realized income here to the entity and then it’s attributed to the shareholders in a manner consistent with how Congress has done that and this court has allowed?” Kavanaugh asked Solicitor General Elizabeth Prelogar, who was arguing on behalf of the government.

“That’s correct,” Prelogar replied. “We think that here the constitutional question is actually quite easy, and it doesn’t require the court to consider some of the foundational questions about the meaning of the 16th Amendment.”

That’s what the court did by sidestepping the constitutional issue. That constitutional issue, however, remains an open question that a future court could decide if Congress were to ever enact a wealth tax.

“Nothing in this opinion should be read to authorize any hypothetical congressional effort to tax both an entity and its shareholders or partners on the same undistributed income realized by the entity. Nor does this decision attempt to resolve the parties’ disagreement over whether realization is a constitutional requirement for an income tax,” Kavanaugh wrote in the decision.

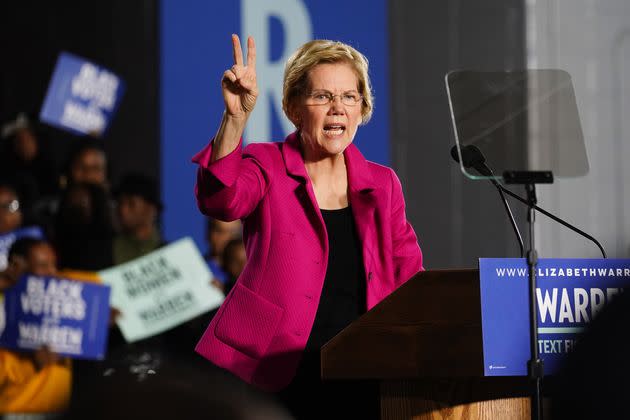

Such a wealth tax was a barely concealed focus of the case before the court. The plaintiffs received huge support from rich and powerful conservatives with the intent of using the case as a preemptive strike to take out a future wealth tax. The Moores’ lawyers, Andrew Grossman and David Rifkin Jr., made it plain in a 2021 Wall Street Journal op-ed by stating that “the couple’s constitutional challenge stands to slam shut the door on a federal wealth tax like the one Sen. Elizabeth Warren wants to enact.”

The case also featured a side-story related to recent questions about the court’s failure to abide by an ethics code. Congressional Democrats had pushed for Justice Samuel Alito to recuse from the case since he repeatedly sat for interviews with Rivkin for the Wall Street Journal’s Opinion page where the justice defended himself from criticism. Alito refused to recuse in a rare four-page letter released to the public.