Tencent Leads Single Stock DLC Activity with Q3 Earnings in Focus

Tencent is expected to release their 3Q2018 earnings result on Wednesday 14 November. According to brokers, median consensus is a net profit estimates of RMB18.6 billion, representing a yearly change of +9%.

For the first four sessions following the 7 Nov launch, Tencent DLCs were the most actively traded with a total turnover of S$14 million, almost half the total turnover of the Single Stock DLCs.

SGX recently launched long and short DLCs on 10 stocks, which include six SGX-listed stocks and four HKEx-listed stocks. The DLCs offer investors a fixed leverage of 5 times the daily performance of the underlying stocks.

Daily Leverage Certificates (“DLCs”) are financial instruments issued by a third-party financial institution, in this case Societe Generale, and are traded on the SGX securities market. DLCs seek to achieve short-term investment results that correspond to the daily magnified performance of the underlying index or stock.

Tencent 3Q2018 earnings release on 14 November 2018

According to Tencent’s announcement release (click here to read more), the company is expected to announce 2018 Third Quarter Results on Wednesday, November 14, 2018. The company will also host a conference call and webcast at 8.00 p.m. HKT.

According to brokers, median consensus is a net profit estimates of RMB18.6 billion, representing a yearly change of +9%. The brokers net profit estimates range from RMB16.584 – 20.62 billion, representing a -2.8% to +20.8% yearly change. Breakdown of brokers’ estimates as of 13 Nov can be found here.

Investors will be focused on whether the mobile gaming can continue to record a substantial increase in revenue and activities amid well expected decline in PC gaming revenue. Tencent previously announced it will impose real-name registration system on all the games it produces. As such the market will be looking out for any impact on the overall profitability of Tencent’s games.

5x Long and Short Tencent DLCs

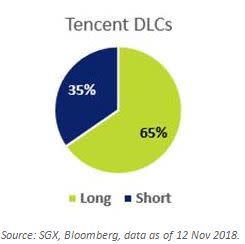

For the first four sessions following the 7 Nov launch, Tencent DLCs were the most actively traded with a total turnover of S$14 million, almost half the total turnover of the Single Stock DLCs. As seen in the pie chart below, turnover was largely on the long DLCs (65%) over the last four trading sessions.

How does it work?

The basic principle is simple – if the underlying asset moves by 1% from its closing price of the previous trading day, the value of a 5x DLC will move by 5% before cost and fees. With five times leverage on the daily performance of the underlying stock, the DLCs provide investors with the ability to make enhanced returns within a short period of time but also the risk of substantial losses if the underlying stock moves against the investor.

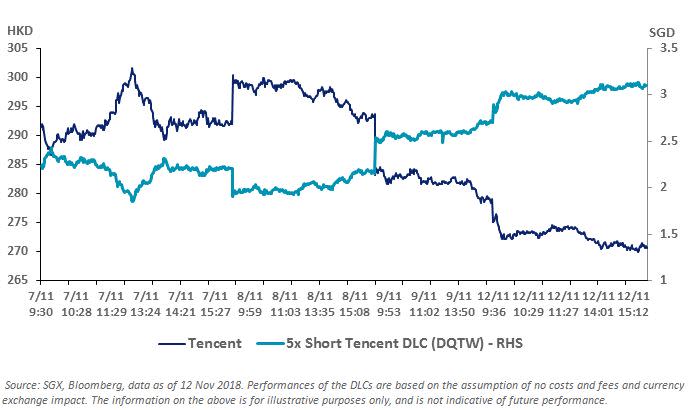

The charts below illustrates the performance of the 5x Long Tencent DLC and 5x Short Tencent DLCs over the last 4 trading sessions (7 Nov to 12 Nov 2018). The Tencent share price is down 7% as of 12 Nov 2018 market close vs 7 Nov 2018 market open. The 5x Long Tencent DLC (DANW) is down 33% over the same period from $2.16 to $1.44. Conversely, the 5x Short Tencent DLCs is up 38% from $2.24 to $3.10.

The charts below illustrates the performance of the 5x Long Tencent DLC and 5x Short Tencent DLCs over the last 4 trading sessions (7 Nov to 12 Nov 2018). Investors who are bullish on Tencent can choose to buy the Long DLC while investors who are bearish on Tencent can choose to buy the Short DLC.

Compounding effect and Trading Cost

If the trading horizon is over a few days, it is important to note that the performance of the DLC may vary from the leverage factor of the DLC due to the compounding effect. DLCs also also offer a cheaper alternative to gain exposure to the blue chip stocks. Read a previous market update here to find out more about the trading cost and the compounding effect

Range of DLCs

SGX currently list a range of index DLCs with 3x, 5x and 7x leverage based on Asian indices – the MSCI Singapore Index and Hang Seng Indices. Since 7 November 2018, DLCs on six SGX-listed stocks and four HKEx-listed stocks were listed for trading with 5x leverage. The six Singapore stocks are DBS, OCBC, UOB, SingTel, Keppel Corp and Venture. The four HKEx listed stocks are Tencent, Ping An, CNOOC and PetroChina.

Where can I find more information?

Investors can find more resources on www.sgx.com/DLC or the issuer’s website www.dlc.socgen.com. Investors should also read all listing documents provided by the issuer for other features such as the airbag mechanism, the risks and other information related to the product before trading the DLCs. The listing documents can be found under “Company Information” on the SGX website or the issuer’s website.

DLCs are Specified Investment Products

DLCs are products with features that might be more complex in nature and are only suitable for investors who possess the investment knowledge of more complex products and have a high risk tolerance. Hence, all investors need to be qualified to trade in Specified Investment Products (“SIPs”) to be able to trade DLCs. Speak to your broker to find out more on how you can qualify to trade SIPs.