It’s time Uber gave up on conquering the world

Uber made an early play for global domination. It launched in Paris, its first international city, in December 2011. Six breathless years later, Uber operates in 76 countries and more than 450 cities.

Entering those markets was supposed to be the hard part. Uber spent billions of dollars securing the so-called first-mover advantage in nearly every corner of the world. In the process it achieved a valuation of $68 billion, the highest of any startup. The faster Uber signed up customers and enlisted drivers, the thinking went, the better and more ubiquitous its service would become. These and other “network effects” would crush competitors into oblivion before they became a serious threat.

Except it hasn’t worked out like that. In spite of Uber’s best and most aggressive efforts, the company has yet to lock up a single market, and its strongest regional competitors in ride-hailing are only getting stronger. Southeast Asia’s Grab has raised $2 billion and is reportedly in talks for another $500 million. Investors have also put more money this year behind Uber’s rivals in South Korea, Latin America, and the Middle East. At home in the US, Uber has spent the better part of 2017 engulfed in scandal and lost nearly all of its top executives. It is slowly losing ground to Lyft, which raised $600 million in May.

Uber is playing a real-life game of risk, and it has arguably spread itself too thin. The company narrowed its losses in the first quarter to $708 million from $991 million in the three previous months, but has yet to outline a plan for reducing those losses further. At the first-quarter rate, Uber could exhaust its remaining $7.2 billion in cash on hand in just over 10 quarters, or two and a half years. It’s time for Uber to swallow its pride and face a hard truth: Instead of attempting to conquer the world, it should be cutting deals with competitors and making a graceful retreat in markets too tough to dominate.

The China fantasy

China was Uber’s biggest bet. For two years, Uber spent $1 billion a year attempting to break into the Middle Kingdom. The odds were always stacked against it. Plenty of US internet companies before Uber had tried and failed to establish themselves in China. It didn’t help that Uber was battling a local competitor, Didi Chuxing, that was formed by the merger of two other Chinese taxi-hailing apps, and which controlled around 80% of the app-based rides market.

By mid-2016 Uber’s losses in China had gone from exciting investors to concerning them. Bloomberg reported late that July that several institutional Uber investors were pushing for a truce and that Benchmark’s Bill Gurley had spoken with Didi president Jean Liu a few months earlier. The money Uber was spending to attract riders with cheap fares and drivers with reasonable wages was reportedly being matched unflinchingly by Didi, and the cash burn showed no signs of stopping. In August 2016, Uber agreed to staunch the bleeding. The company sold its China operations to Didi in exchange for $1 billion invested into Uber global and a 17.7% equity stake in the combined Chinese entity.

The phrase “game changer” is sorely overused in the business community, but Uber’s sale to Didi actually was one. Overnight, Uber transformed $1 billion in annual losses into a sizable stake in the company poised to become the dominant—if not the only—player in China’s ride-hailing sector. Uber didn’t win China, but its consolation prize hardly could have been better.

Russian out

A year after it ceded to Didi in China, Uber did the same in Russia. On July 13 Uber announced a merger with Yandex.Taxi, the regional leader in ride-hailing and a subsidiary of Russian search giant Yandex. The deal—which still needs regulatory approval—gives Yandex 59.3% ownership of the combined company and a Uber 36.6% stake, with the remaining 4.1% held by employees.

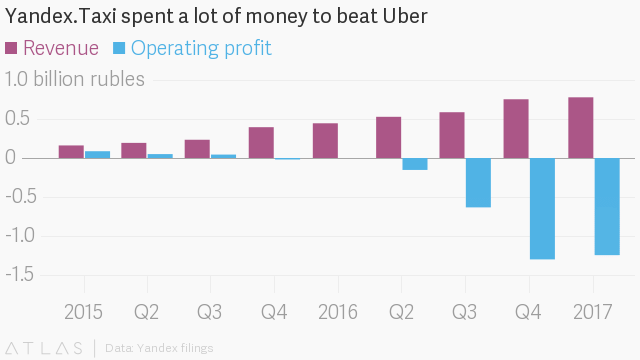

As in China, the battle for rides in Russia and five neighboring countries was a costly one. While Uber hasn’t revealed how much it spent in the region, Yandex shares are traded on Nasdaq and it has reported expenses from its taxi division in quarterly earnings for the last two years. Yandex reported an operating loss of 1.2 billion rubles (about $20 million at current conversion rates) for Yandex.Taxi in the first quarter of this year. The three months prior, that operating loss was 1.3 billion rubles ($21.7 million). The money was spent largely on promotional efforts, like boosted pay for drivers and fare discounts for riders.

To succeed in ride-hailing, companies need to navigate the nuances of each and every market. What works in San Francisco doesn’t necessarily map onto London, Sao Paulo, Shanghai, or even New York. The only truth universally acknowledged in ride-hailing is that competition makes it a very expensive business to be in. Uber and Yandex could have spent each other into the ground. Instead they reached a pragmatic truce that allows both companies to profit from their combined success.

What’s next?

The next logical place for Uber to cut a deal is in Southeast Asia, where its turf war with Grab has intensified. On July 23 Grab confirmed a $2 billion investment—with the potential to add another $500 million—from Didi and Softbank that values the company at $6 billion. Grab operates in 36 cities and seven countries in Southeast Asia; Uber is in about 40 cities. Grab claims to have 1.1 million drivers, 50 million user downloads, and a 70% market share of private car rides. Grab is also developing a mobile payments system with the help of Kudo, an Indonesian startup it acquired in April, to open up rides to people who don’t have a credit card.

A year ago Uber seemed to have the upper hand. TechCrunch reported that its operations were profitable in Singapore and in the Philippines, and it had a substantial cash advantage over its rivals. Uber freed up additional resources by selling its China operations to Didi. But over the last 12 months Grab and another local Uber competitor, Indonesian ride-hailing startup Go-Jek, have raised more money to compete, and Uber’s advantage has withered. Go-Jek, which started in the on-demand motorbike business but expanded into cars and food delivery, also has a mobile payments service, Go-Pay.

That brings us to last week, when Japan’s SoftBank was rumored to be exploring a “multibillion-dollar stake” in Uber. The Wall Street Journal described the talks as “preliminary and one-sided,” and said any deal would “likely be on hold” until Uber replaces Travis Kalanick, its ousted chief executive. CNBC reported July 31 that those talks were dead, but not before they prompted speculation that Uber might cut a deal with Grab, brokered by SoftBank. The Japanese tech giant has already invested in Grab, Didi, India’s Ola, and Brazil’s 99, as outlined in the chart below (an asterisk indicates SoftBank led the deal). In theory, SoftBank stands to gain by pushing its portfolio companies toward more deals like the one between Uber and Didi in China, which reduce competition and anoint a single winner.

Date | Company | Deal size |

|---|---|---|

10/25/14 | Ola* | $210 million |

12/3/14 | Grab* | $250 million |

4/16/15 | Ola | $400 million |

8/19/15 | Grab | $350 million |

9/7/15 | Didi Chuxing | $3 billion |

11/18/15 | Ola | $500 million |

6/15/16 | Didi Chuxing | $7.3 billion |

9/20/16 | Grab* | $750 million |

2/27/17 | Ola* | $330 million |

4/28/17 | Didi Chuxing | $5.5 billion |

5/24/17 | 99* | $200 million |

7/24/17 | Grab* | $2.5 billion |

Uber seems unlikely to want to give up any of its remaining markets outside the US. (The company declined to comment for this story.) It doubled down on both India and Latin America last year after reaching the deal with Didi. But 2017 has thrown Uber’s corporate halls into unprecedented chaos. The company has no CEO, no chief financial officer, no chief marketing officer, no general counsel or senior vice president of engineering. Its board is deeply split over whom to appoint as CEO and, by extension, what direction the company should take. The talks with SoftBank were reportedly held by Kalanick’s close allies and weighed his possible return to power.

As things stand, Uber is in no position to conquer the world. It is too consumed by politicking and infighting; its grasp on the US is slipping; and its financial edge against international competitors is also disappearing. The company would be better off making a strategic retreat from the most contested markets—and sharing in the success of competitors like Grab—while it still can.

Sign up for the Quartz Daily Brief, our free daily newsletter with the world’s most important and interesting news.

More stories from Quartz: