Trading a Weak Australian Dollar

Article Summary: Using this simple Forex technical analysis technique, determine the relative strength and weakness of a currency rather than a currency pair. This is an easy way for Forex beginners to identify stronger versus weaker currencies to trade. Using this simple analysis tip, we find the Australian Dollar is weak against its other main counterparts offering us a strong trend to trade.

In our DailyFX EDU classes and webinars, we frequently talk about relative strength…not the relative strength indicator, but relative strength of currencies. This means we need to analyze them in relation to the other currencies to find out which currencies are showing relative strength and which ones are showing relative weakness.

The analysis is fairly simple and straight forward as previously laid out in “Know the Strong and the Weak Currencies.” The process can take about 15-20 minutes and doesn’t need to happen but once or twice per week.

Recent volatility has begun to kick up, but the trends in currencies can be long and strong. Current trends are no different as the Australian Dollar is an example of that.

Open a 4 hour price chart with a 200 period Simple Moving Average (SMA) as the filter. Simply take note of each currency in the pair and its relative performance versus the 200 SMA.

[If you are unsure how to apply the Simple Moving Average to a chart or how to use the SMA in trend identification. register to view this free 15 minute video course on Simple Moving Averages.]

Learn Forex: Analyzing Currency Strength

(Created using FXCM’s Marketscope 2.0 charts)

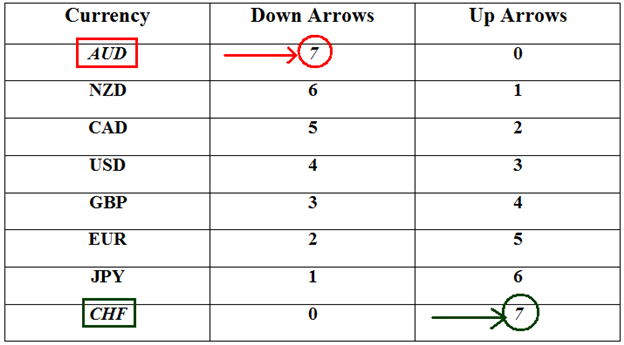

As a matter of fact, when making a note of the tally of strong versus week this afternoon, we discovered that the Aussie was down and weaker against it other 7 main currencies (USD, JPY, CAD, EUR, GBP, NZD, CHF).

This makes sense with the easing monetary policy for the Reserve Bank of Australia that has been in play for the past couple years. Additionally, the weakness from China is dragging the value of the Australian Dollar lower due to the strong trade relationship they enjoy together. The weakness is duly noted and the better opportunity out there in my opinion is to sell the Aussie.

Learn Forex: Simple Forex Analysis Currency Strength Results

Trading the Aussie can be done in several different methods. One would be trading a specific currency pair where you are selling the AUD. If you select this method, you would want to simultaneously look to buy a relatively strong currency which according to the chart above would be the CHF or JPY. This is a very common method practiced by experienced traders who would sell the AUDCHF or sell the AUDJPY pair. They would not blindly enter, but use their strategy’s buy and sell rules to enter and exit the trade.

Another way to sell the Aussie would be through a basket of currencies. There are several advantages to trading baskets with one of the most important advantages being diversification. By choosing a currency rather than a pair, you have your eggs spread across multiple buckets without being exposed solely to a specific currency pair. Diversification becomes especially important during high volatile market conditions including news events.

That way, if there is a surprise announcement by the Bank of Japan where the AUDJPY actually strengthens which is contrary to our trend analysis above, then our account is not fully exposed to the surprise news.

Trading baskets can be handled in many different ways. For example, let’s assume you normally trade a 100k position but you want to spread your trade across four Aussie pairs. Then, utilize a 25k position for each of the four pairs giving you a total exposure of 100k.

Bring a powerful basket approach to trading strong Forex trends. This simple analysis technique will help you identify a relative strong or relative weak currency to trade.

Good luck with your trading!

---Written by Jeremy Wagner, Head Trading Instructor, DailyFX Education

Follow me on Twitter at @JWagnerFXTrader.To be added to Jeremy’s e-mail distribution list, click HERE and enter in your email information.

See Jeremy’s recent articles at his DailyFX Forex Educators Bio Page.

Trading baskets can be handled several ways. The mirror platform offers a one click method to enter and exit the basket trade. Join our live Mirror Trader platform walkthrough each Wednesday at 3 pm ET and ask your questions in real time.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.