U.S. Dollar Lower as Offshore Economic Data Improves

Created Using Marketscope 2.0

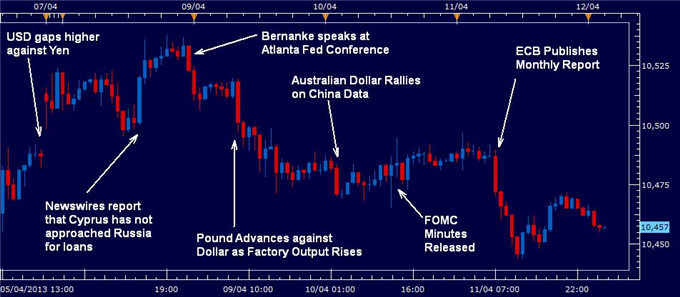

THE TAKEAWAY: The U.S Dollar after a strong start, ended the week lower as data from overseas economies showed improvements and investors sold their safe haven assets.

The U.S. Dollar had a strong start to the week as the currency - amongst others - opened higher against the Yen on the back of the Bank of Japan pledging approximately $1.4 trillion into the Japanese economy to help end deflation. These gains were reinforced as investors saw risk returning to the Euro-zone as newswires reported that Cyprus had not yet turned to Russia for loans and that it would be discussed at the next G-20 summit.

The Greenback started its decline as the Chairman of the Federal Reserve, Ben Bernanke, spoke at the Atlanta Federal Reserve Conference in Georgia. In his speech, Bernanke outlined the improvements in U.S. Banks which showed better results in their most recent set of stress tests whilst also reiterating that QE by Central Banks was ‘mutually constructive.’ This gave comfort to investors seeking higher return in riskier investments as they took their funds out of the so called ‘safe haven’ currency.

Strong factory data out of the U.K. saw the Dollar fall further against the Pound and as China announced a surprise trade deficit with an increase in imports, the strong Australian Dollar forced the Greenback lower still. As the FOMC released their Minutes from their March meeting, the Dollar remained stubbornly stagnant as the S&P500 rose with some committee members anticipating that asset purchases could slow and potentially stop by year end. Finally the ECB’s monthly report released late in the week saw an economic recovery projected for the second half of this year with the Central Bank willing to remain accommodative for as long as needed. The Euro rallied against its American partner as investors regained confidence in the Euro-zone and were prepared to seek returns through other instruments than the safe haven asset.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.