WeWork faces inquiry from US regulator after botched listing

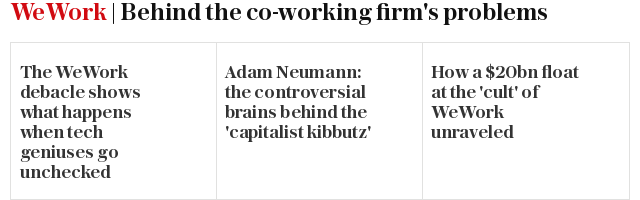

WeWork is facing an inquiry from the US markets regulator after its botched attempt to float in New York.

The Securities and Exchange Commission will scrutinise the office space company to see whether it violated the law as it pushed ahead with plans for a stock market listing this summer, according to reports.

Agents are looking closely at financial metrics disclosed by the company amid a flurry of news articles highlighting questionable accounting practices and potential conflicts of interest at the loss-making company, Bloomberg reported.

Just weeks before it was expected to trade publicly, WeWork was locked in a back-and-forth with the SEC as it tried to convince the agency that its unconventional accounting metric, “community-adjusted Ebitda” which the company claims is a snapshot of the profitability of each individual WeWork building, was legitimate.

As the agency began picking apart how it framed its losses, questions were raised over ousted chief executive Adam Neumann, who owns a stake in buildings that were leased backed to WeWork.

Corporate governance concerns were also raised when it emerged that Neumann's wife Rebekah, who is alleged to have plans to sack workers based on their “energy”, was one of the three people with the power to pick a replacement chief executive.

Early WeWork investor Stephen Langman, who occupies several key positions at the parent company We, also faced questions over investments in a fund that has leased properties to the company.

WeWork had been privately valued at $47bn (£36bn) and had hoped to secure a valuation even higher than that, but was forced to cancel its initial public offering after being forced to repeatedly scale back its valuation. Mr Neumann resigned as chief executive in September.

This week the company, which received a bail-out from major investor SoftBank, told investors it lost $1.3bn in the last three months. The SEC declined to comment on the inquiry.