Asian markets rise after heavy sell-off

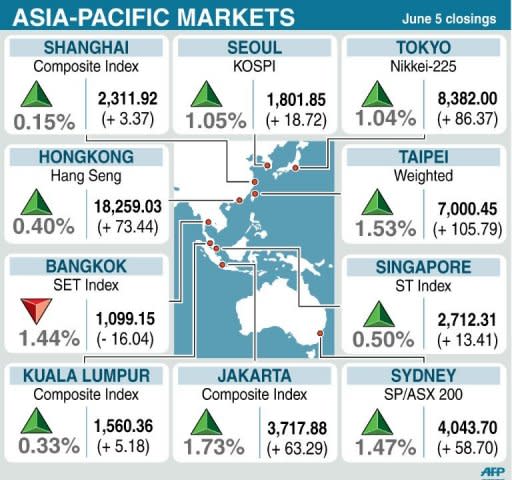

Asian markets climbed on Tuesday and the euro clawed back some of its losses as dealers took a breather from a recent heavy sell-off caused by concerns over the eurozone. With little to drive sentiment after the weekend, analysts said there was an opportunity to buy after most regional bourses fell into negative territory for the first time in 2012. Investors were also hoping that finance ministers might take steps to tackle Europe's debt crisis in a telephone conference call later in the day, they said. Tokyo finished up 1.04 percent, or 86.37 points, at 8,382.00, and Hong Kong was up 0.54 percent by the break, while Sydney ended 1.47 percent, or 58.7 points, higher at 4,043.7 after the central bank cut interest rates. Seoul closed up 1.05 percent, or 18.72 points, at 1,801.85, but Chinese shares were flat in afternoon trade. On Wall Street Monday the Dow fell 0.14 percent, the S&P 500 was flat and the Nasdaq Composite gained 0.46 percent. Despite the gains there were still signs of concern over the deteriorating global outlook. Australia cut interest rates by 25 basis points to 3.50 percent, citing fears over Europe's crisis and easing growth in key trade partner China. The cut adds to the 50 basis-point cut the Reserve Bank of Australia announced last month and puts them at a level not seen since the booming mining economy since November 2009. Markets were looking to the outcome of a conference call later in the day between the Group of Seven finance ministers to discuss Europe's crisis, in particular Spain's travails. The European Central Bank (ECB) will hold a rate-setting meeting Wednesday, with investors looking to see if it will announce any moves to kickstart the region's stuttering economy. Masaru Hamasaki, chief strategist at Toyota Asset Management, said: "Any mention by leaders of measures to stabilise the state of Europe's financial system may calm the market, and invite some buying." Spanish Prime Minister Mariano Rajoy called at the weekend for a banking union in Europe, which would be able to provide aid to lenders, especially in Spain, a move that was seeing support in France and at the ECB. However, Germany remained strongly opposed for the moment. Global markets have been hammered since the start of May as Europe's debt troubles returned after a Greek general election saw a strong showing for anti-austerity parties, while Spain's bank crisis has left the already creaking economy teetering. On currency markets the euro -- which last week hit a 23-month low versus the dollar and a near 12-year low against the yen -- regained a little ground. The common unit was changing hands at $1.2504, up from $1.2494 in New York on Monday, while it advanced to 97.904yen from 97.89 yen. The dollar was at 76.30 yen from 76.36 yen. Oil prices rose, with New York's main contract, West Texas Intermediate crude for July delivery, rising 76 cents to $84.74 a barrel and Brent North Sea crude for July up 50 cents to $99.35. Gold dipped slightly to $1,616.32 an ounce at 0700 GMT, compared with $1,622.08 late Monday. In other markets: -- Taipei rose 1.53 percent, or 105.79 points, to 7,000.45. Computer maker Acer rose by its daily limit of 7.0 percent to end at Tw$31.45, while Taiwan Semiconductor Manufacturing Co. rose 2.22 percent to Tw$78.2 -- Wellington was down 0.90 percent, or 31.20 points, to 3,420.79. Telecom fell 4.1 percent to NZ$2.435 and Air NZ shed 1.16 percent to NZ$0.85, while Fletcher Building rose 2.0 percent to NZ$6.14.