Budget 2020: GST increase will not take place in 2021

SINGAPORE — The planned increase in the Goods and Services Tax (GST) will not take place in 2021, in the wake of the novel coronavirus outbreak (COVID-19).

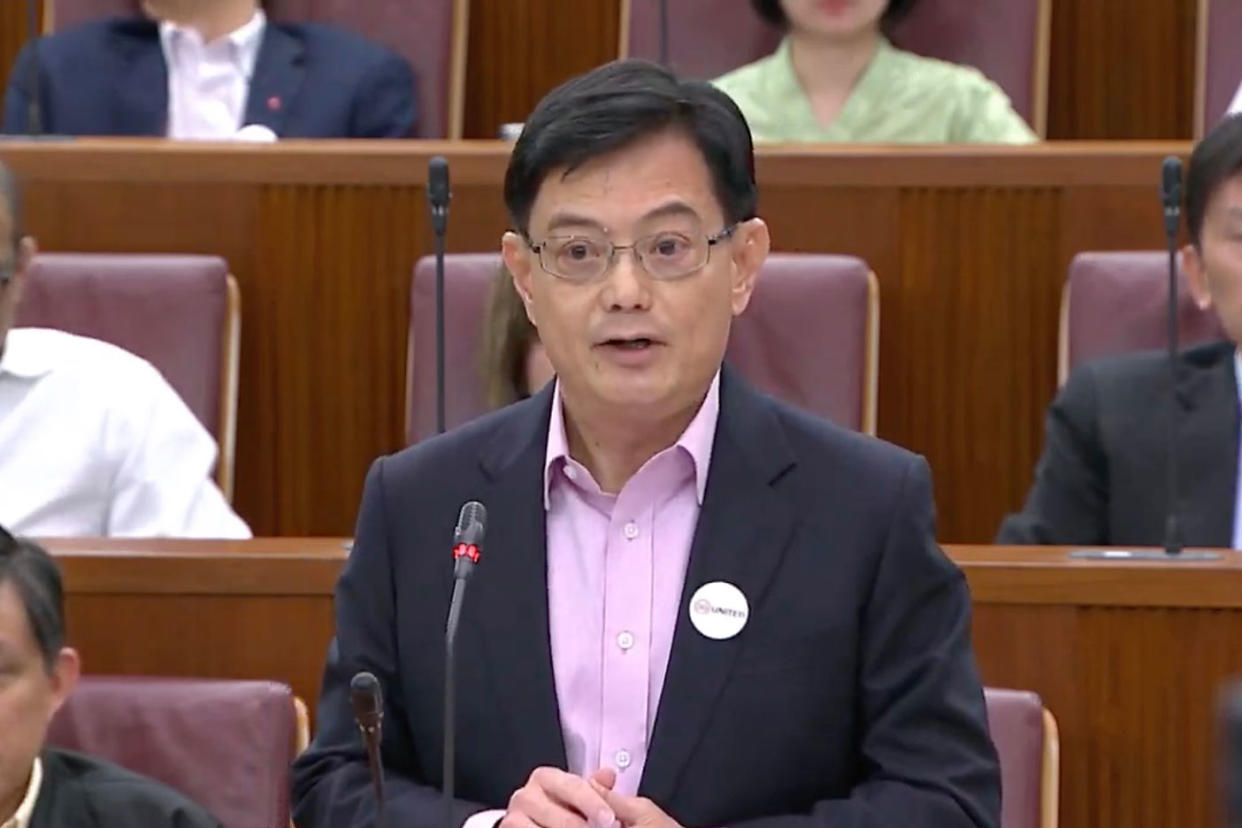

Delivering Budget 2020, Finance Minister and Deputy Prime Minister Heng Swee Keat told Parliament on Tuesday (18 February) that the hike from 7 per cent to 9 per cent will still take place by 2025. “We will not be able to put off the increase indefinitely. We will still require recurrent sources of revenue to fund our recurrent spending needs in the medium term.”

Heng assured the House that when the GST rate is raised, Singaporeans will be given sufficient lead time, and the taxes and transfers system will remain progressive. The government will also continue to absorb GST on publicly subsidised healthcare and education.

“The COVID-19 outbreak is a stark reminder of the continued importance of maintaining a sound fiscal footing to deal with surprises and unexpected scenarios. In particular, we are able to mount a decisive response to support Singaporeans and workers through uncertain times only because of good long-term planning,” said Heng.

In 2018, the 58-year-old had announced a controversial plan to increase GST by two percentage points, some time between 2021 and 2025. This was in order to raise revenue to meet recurrent spending, particularly in healthcare.

$6 billion Assurance Package

Heng said on Monday that the eventual increase will be accompanied by a $6 billion Assurance Package to cushion the increase for Singaporeans. Under the package, most Singaporean households will receive offsets to cover at least 5 years’ worth of additional GST expenses incurred.

More will be doled out to lower-income households: those living in 1 to 3-room HDB flats will receive offsets equivalent to 10 years’ worth of additional GST expenses incurred.

Every adult Singaporean will receive a cash payout of $700 to $1,600 over five years.

For example, a family of four with a combined income of $6,000 living in a 4-room HDB flat can receive a total of about $7,000 in offsets over five years, including cash of about $4,000.

The package will supplement the existing permanent GST Voucher or GSTV scheme. This defrays GST for lower to middle-income Singaporeans, and will also be enhanced once GST is raised. It will enable the government to fully offset GST for the lower half of retiree households; significantly offset GST for the upper half of retiree households; and offset about half of GST for lower-income households with no elderly persons.

Stay in the know on-the-go: Join Yahoo Singapore's Telegram channel at http://t.me/YahooSingapore

Related stories:

Budget 2020: More support for needy students and pre-schools

Budget 2020: Overall budget deficit of $10.9b expected for FY2020

Budget 2020: All vehicles to run on cleaner energy by 2040

Budget 2020: $5 billion fund for Singapore to combat rising sea levels

Budget 2020: $1.6 billion package to help Singaporeans amid economic slowdown

Budget 2020: $8.3 billion for economic transformation and growth

Budget 2020: SkillsFuture expansion to aid Singaporeans' development

Budget 2020: GST increase will not take place in 2021

Budget 2020: $5.6B packages to help alleviate economic slowdown

UPDATES: Budget 2020: Singapore prepares S$6.4 billion for coronavirus relief measures